Ah, XRP. The troubled soul of the cryptocurrency world. It has slumped 4% this week, dragged down by the ever-so-merciless market forces. As of now, it’s hanging onto life at $2.31, like a lifeboat in a storm.

But wait, what’s this? A glimmer of hope? Despite the doom and gloom across the market, some on-chain data suggests a near-term rebound. Oh, the sweet taste of optimism.

Could XRP Be Ready for a Wild Ride?

According to the ever-diligent Coinglass, XRP’s liquidation heatmap is flashing like a neon sign at $2.48. Liquidity clusters, they call them. Well, isn’t that just a fancy way of saying “there’s some serious trading action happening here”? Traders use heatmaps like psychics use tarot cards—finding those magic price zones where a bunch of leveraged positions are bound to be wiped out.

the market loves drama. And who doesn’t?

For XRP, that glowing cluster at $2.48 might just be the sweet spot where traders rush to buy or close out short positions. Who knows? It could be the spark for a short-term rally. Or it could be another cruel trick played by the crypto gods. Place your bets!

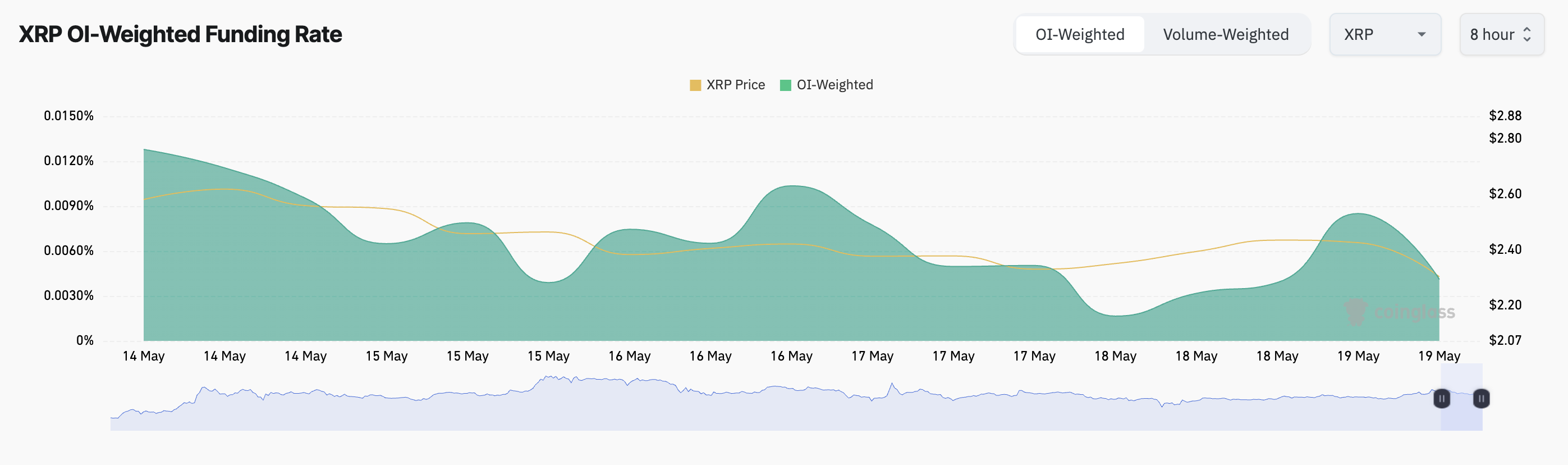

But wait, there’s more! Despite all the chaos, XRP’s funding rate is holding steady at a healthy 0.0041%. A positive funding rate means traders are still hungry for long positions. In other words, they’re betting that the price will go up, probably hoping for a miracle. Or perhaps just some decent returns after the bloodbath of the last week.

The funding rate is like a periodic handshake between traders in perpetual futures contracts. If it’s positive, the longs are winning, and everyone’s feeling good. But let’s be real, who knows how long that feeling lasts in this crazy world of crypto?

The Bulls Are Stirring, Or Are They?

Over on the daily chart, XRP’s Directional Movement Index (DMI) is showing some encouraging signs. The positive directional index (+DI) is now above the negative directional index (-DI), like a champion fighting off its nemesis. This could mean that the demand for XRP is growing, and the bulls are gearing up for a potential charge.

In DMI language, the +DI means that the bulls are in control, pushing the price up. The -DI, on the other hand, is like the bear that refuses to go away. But for now, the bulls are ahead. If this trend continues, we might just see XRP surge to $2.50. Or maybe it’ll just get stuck in a rut. Who knows?

But, of course, there’s the flip side. If the price keeps dropping, we could be looking at a sad, slow descent to $2.29 and possibly even $2.11. A real gut punch. The market’s a cruel mistress.

Read More

2025-05-20 00:11