Analysts are attributing this optimism to recent changes in laws and expected adjustments in regulations as the new Trump administration takes office.

Technical Analysis Indicates Potential Surge

On the 11th of January, XRP exited a symmetrical triangle configuration, a technical layout frequently perceived as a bullish signal for further growth. Symmetrical triangles emerge when the price fluctuates within two converging lines, indicating a balance between buyers and sellers as they hold the price within these trendlines. A break above the upper trendline of this pattern is typically interpreted as the beginning of a significant upward trend.

Experts are predicting that XRP could rise significantly, possibly reaching a price of around $4 – which would be approximately a 60% jump from its current value. This forecast is based on the triangle pattern in its price movement, where the potential target price is determined by adding the highest point of the triangle to the breakout point. The optimistic outlook is also backed up by a surge in trading activity during the breakout, suggesting robust investor interest.

Keep an eye on important support and resistance levels. Currently, the upper boundary of the triangle, serving as a potential support, is around $2.37. If price action falls below this level, it might call into question the bullish trend, possibly triggering a drop towards $2.30 – a key level also matching the 50-period exponential moving average (EMA). Conversely, maintaining an upward trajectory above this support increases the chances of reaching the $4 target, especially when accompanied by strong trading momentum.

Legal Victory Bolsters Investor Confidence

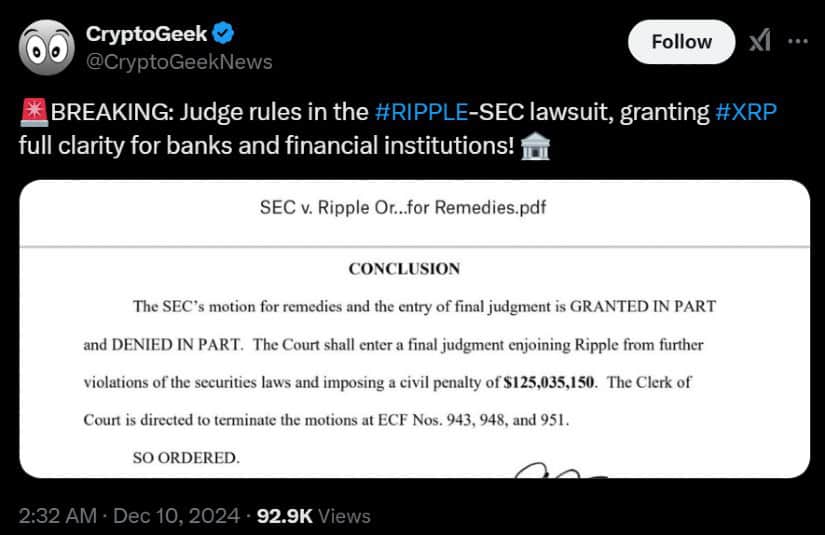

The surge in XRP’s price can be linked to a favorable court verdict that went in Ripple Labs’ favor in their ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC). On January 11, a federal judge granted a request to keep certain confidential documents under wraps. This move is generally seen as a positive sign for Ripple, boosting its standing in this significant court case.

The ongoing legal dispute between Ripple and the Securities and Exchange Commission (SEC) is being keenly followed by the cryptocurrency sector, as its resolution may establish a regulatory template for digital assets in the United States. The SEC’s assertion that XRP functions as an unregistered security has led to substantial price fluctuations, but Ripple has managed to secure a few minor triumphs, which have positively impacted investor confidence.

Impending SEC Leadership Change

The Securities and Exchange Commission (SEC) is experiencing a major change in leadership, as Chair Gary Gensler is scheduled to leave on January 20th. Known for his firm stance on cryptocurrencies, Gensler frequently pushed for more rigorous regulatory control. His exit has ignited discussions about possible adjustments in the agency’s handling of digital assets.

It’s anticipated that Paul Atkins, a previous SEC Commissioner known for his opposition to excessive regulation, will take over from Gensler. Atkins is an advocate for free markets and a more balanced approach to enforcement, which might lead to a more welcoming regulatory landscape for cryptocurrencies such as XRP. Legal analysts suggest that Atkins’ leadership could lessen legal ambiguities and motivate increased institutional involvement in the market.

Market Dynamics, an XRP ETF and Investor Sentiment

In recent months, XRP has seen impressive growth compared to numerous other cryptocurrencies. This expansion can be attributed to increased institutional investment and strategic hoarding by large investors, commonly referred to as “whales.” These entities are positioning themselves for potential regulatory approval and price increases. It’s quite probable that an XRP Exchange-Traded Fund (ETF) will be authorized in 2025, further bolstering optimistic projections about XRP’s price trajectory.

The increasing enthusiasm from investors towards XRP can be seen through the surge in its open interest, suggesting an increase in speculative actions and growing belief in its future prospects.

As a researcher delving into the dynamic world of cryptocurrencies, I find myself intrigued by the recent price movements of XRP. The market sentiment around it appears encouraging, hinting at a potentially prosperous future for this digital asset. A blend of technical indicators pointing favorably, legal triumphs, and the potential for regulatory shifts under the new SEC leadership could pave an optimistic path towards significant returns.

However, I would like to emphasize a word of caution. The cryptocurrency market is notoriously volatile, and ongoing regulatory uncertainties persist. Therefore, while the outlook may seem promising, it’s crucial for investors to exercise due diligence and prudence in their investment decisions.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-14 20:12