Markets

What to know:

- XRP has catapulted to nearly $2.40, fueled by an avalanche of institutional trading and a vanishing supply on exchanges. Where did all the tokens go? To a secret crypto party, perhaps?

- Spot XRP ETFs in the U.S. have gobbled up $48 million in inflows, pushing cumulative totals past the jaw-dropping $1 billion since they burst onto the scene in November. A financial buffet!

- The rally is bolstered by a shift in market sentiment, akin to a sudden change in weather when someone opens an umbrella-thanks to a friendlier U.S. regulatory environment and recent SEC gossip.

On Tuesday, XRP leaped to nearly $2.40, extending its early-2026 rally as traders pointed to heavy institutional volumes and a tightening pool of tokens available on exchanges-like trying to find a seat at a crowded café!

The token rose as much as 11% over 24 hours to around $2.38, breaking through a resistance band that had been tighter than grandma’s hugs for weeks. The move came on one of XRP’s strongest volume bursts since mid-December, according to CoinDesk market data-a data point that reads like a novel plot twist!

One reason is flow. Spot XRP ETFs in the U.S. posted a staggering $48 million in inflows on Monday, extending a green streak for the products that have yet to witness a single day of outflows since their Nov. 13 launch. It’s like a crypto parade, and everyone wants to join!

Several of the products hit their largest single-day trading volumes on Monday, pushing cumulative inflows beyond the $1 billion mark in less than two months. Talk about a financial phenomenon!

On-chain data shows XRP held on exchanges has dropped to multi-year lows, a sign that fewer tokens are lounging idly, waiting to be sold into rallies. Traders often see this as a setup where even modest demand can send prices soaring faster than a cat chasing a laser pointer.

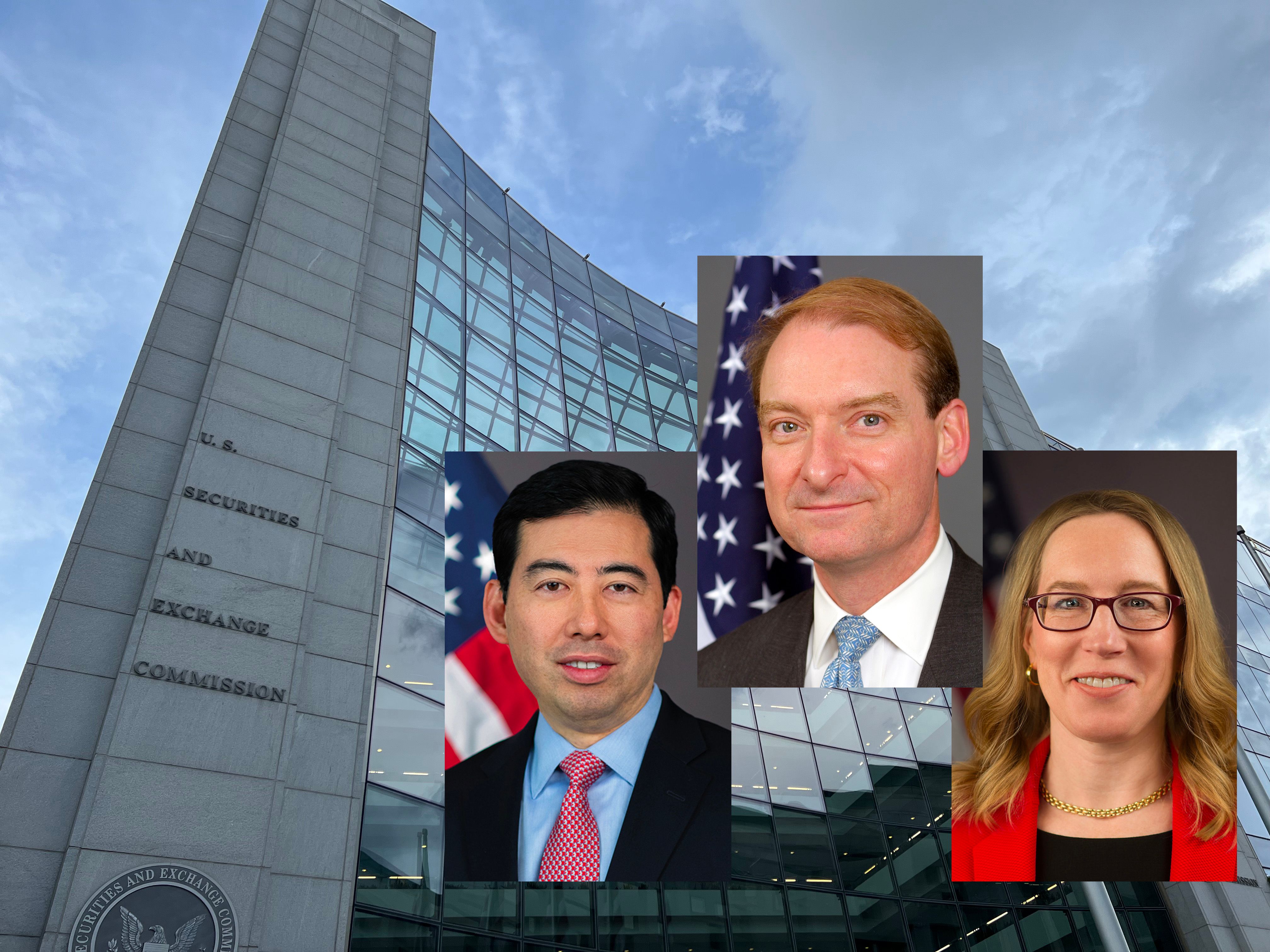

The rally also builds on a shift in general market sentiment that started late last week. Traders, like optimistic fortune tellers, have leaned into the idea that the U.S. regulatory environment is turning more constructive, particularly after SEC Commissioner Caroline Crenshaw’s departure and continued chatter about upcoming market structure legislation expected to emerge from hibernation in January.

XRP, which spent years trading beneath a cloud of legal uncertainty, has become one of the clearest beneficiaries of this newfound optimism-a classic tale of redemption!

For now, the move is also feeding on itself. Breakouts through well-watched levels tend to trigger follow-through buying from traders who were just waiting for confirmation, like a crowd waiting for the curtain to rise on their favorite show, especially in a market where Bitcoin is steadier than a seasoned tightrope walker and speculative attention is rotating toward large-cap alts.

The key question is whether XRP can maintain its position above the former resistance zone around $2.28 to $2.32. If it does, the market may start looking higher rather than treating the rally as just another whimsical spike, akin to spotting a unicorn.

Sui outperforms bitcoin and ether as Mysten Labs promotes privacy tech

27 minutes ago

XRP’s 9% surge leads crypto as bitcoin climbs to 6-week high near $95,000

9 hours ago

A few Republicans have crypto’s destiny in their hands at the SEC, CFTC

9 hours ago

Famed Coinbase backer Fred Wilson predicts 2026 UX pivot for crypto

11 hours ago

Filecoin surges 6%, outperforms wider crypto markets

12 hours ago

Sui outperforms bitcoin and ether as Mysten Labs promotes privacy tech

27 minutes ago

A few Republicans have crypto’s destiny in their hands at the SEC, CFTC

9 hours ago

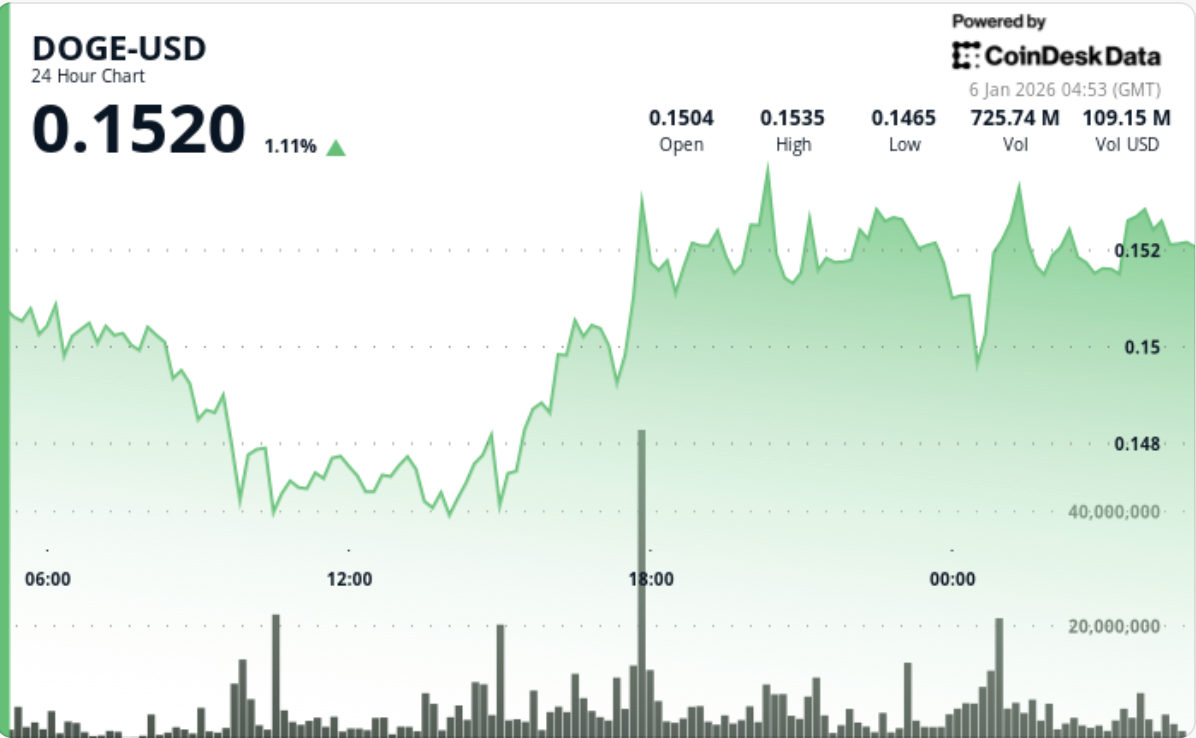

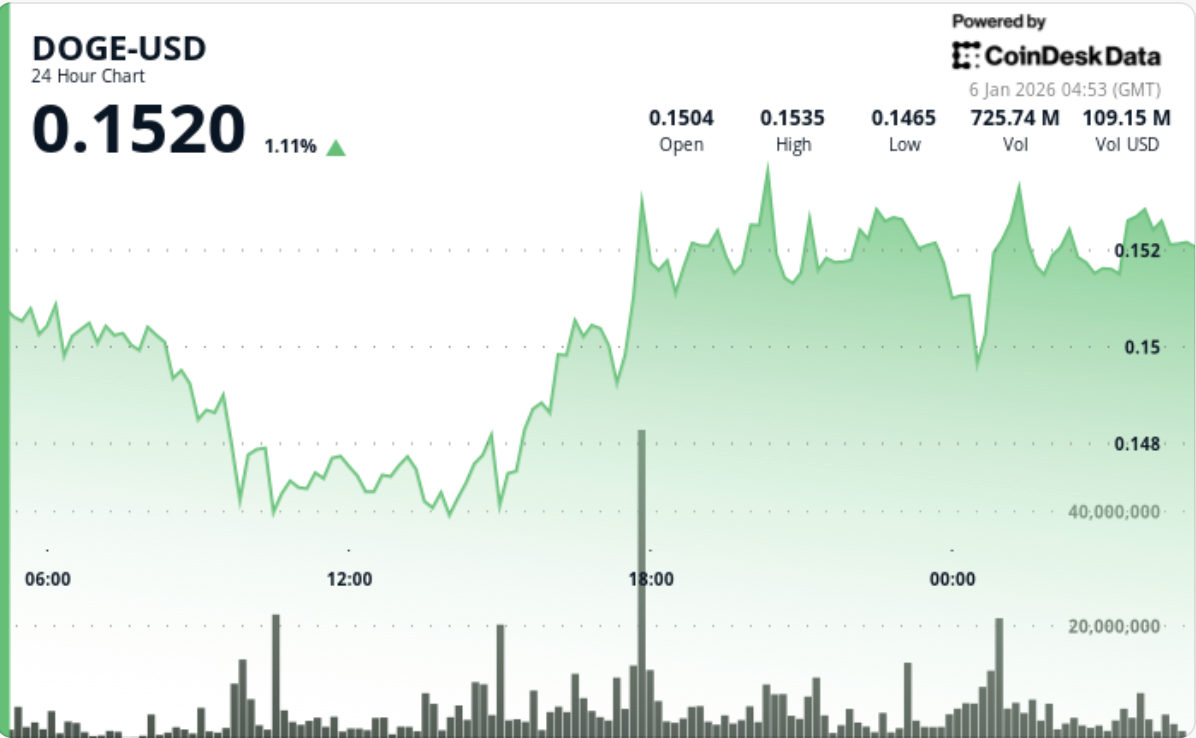

Dogecoin 2x ETF tops early 2026 leaderboard as DOGE prints V-shaped rebound

32 minutes ago

Famed Coinbase backer Fred Wilson predicts 2026 UX pivot for crypto

11 hours ago

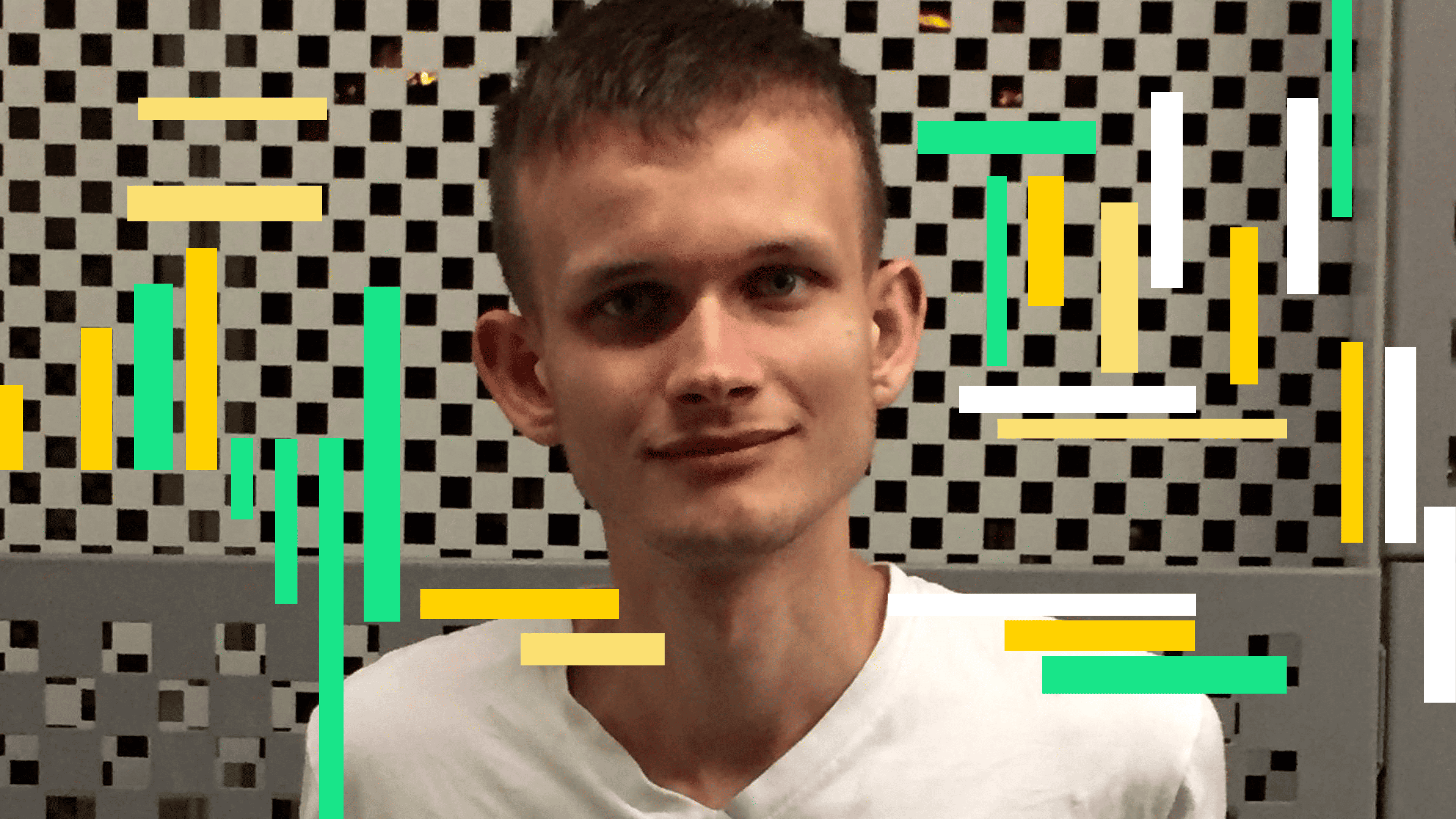

Ethereum can move beyond Bitcoin-style limits as new scaling tools mature: Vitalik Buterin

15 hours ago

Tom Lee calls for new bitcoin record in January, while warning of a volatile 2026

12 hours ago

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-01-06 08:37