As a seasoned crypto investor with a knack for spotting potential and navigating market trends, I find myself intrigued by Grayscale’s latest moves. The launch of the Grayscale XRP Trust, MakerDAO Trust, Bittensor Trust, and Sui Trust within a matter of weeks is a testament to their commitment to expanding their crypto portfolio.

On September 12th, Grayscale Investments – the world’s biggest cryptoasset manager, under Digital Currency Group (DCG), unveiled their newest cryptocurrency investment offering: the Grayscale XRP Trust. This product enables investors to invest in XRP, the digital token that operates the XRP Ledger. As per a statement from the company, this trust is now open for daily subscriptions and can be accessed by accredited individual and institutional investors.

The XRP Ledger is a decentralized, peer-to-peer network designed for simplifying and speeding up cross-border financial transactions while making them more cost-effective. Rayhaneh Sharif-Askary, Grayscale’s Head of Product & Research, underscored the importance of XRP’s application, suggesting it could transform conventional financial systems. As per the press release, XRP’s ability to process cross-border payments in mere seconds could potentially address the constraints faced by legacy systems.

In a manner similar to their existing single-focus investment trusts, Grayscale’s latest XRP Trust centers solely on XRP as its primary asset. By launching this new product, Grayscale is broadening the variety of cryptocurrency investments they offer, with over 20 distinct crypto assets already included in their portfolio.

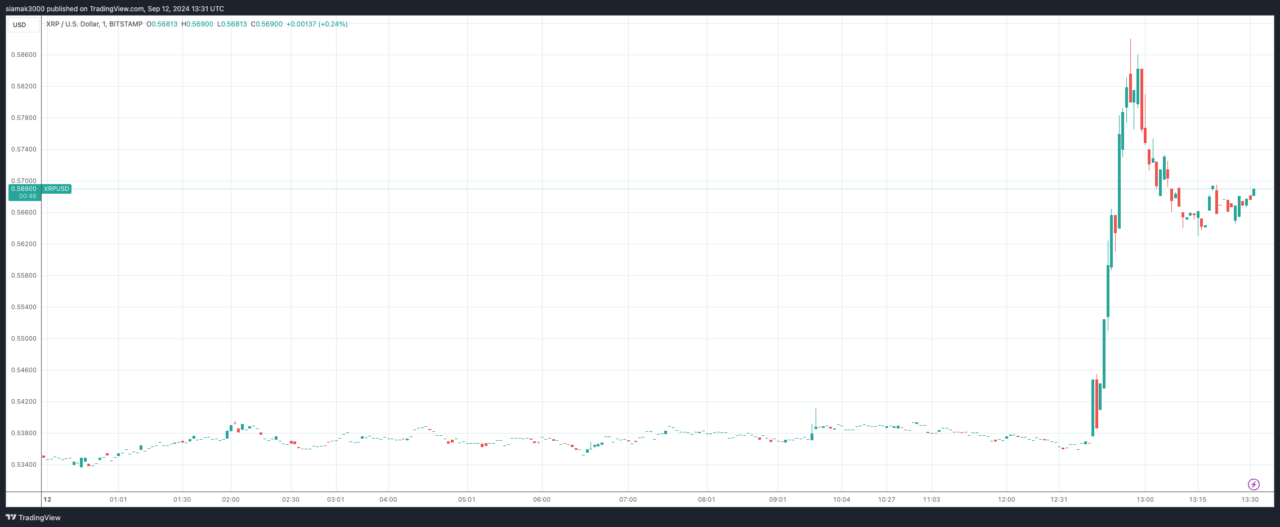

At the time of writing, XRP is trading at $0.5674, up 6.6% in the past 24-hour period.

On August 13, Grayscale introduced the Grayscale MakerDAO Trust, a product designed to let investors directly invest in MKR, the token that holds utility and governance functions within MakerDAO – a decentralized organization managing the Maker Protocol, a financial platform based on Ethereum blockchain that’s part of the broader decentralized finance (DeFi) sector. The MakerDAO system significantly contributes to DeFi, featuring an on-chain credit protocol, stablecoins, and integration with real-world assets.

The MKR token is significant in the Maker Protocol as it serves dual purposes: facilitating governance and ensuring system balance. As a governance token, MKR empowers its owners to shape critical decisions regarding the Maker Protocol’s functioning. These decisions might involve setting risk thresholds, deciding on acceptable collateral types, or modifying the fees related to DAI generation, the stablecoin overseen by the protocol.

On August 7th, Grayscale launched two new investment trusts: the Grayscale Bittorrent Trust and the Grayscale Sui Trust. The primary aim of the Grayscale Bittorrent Trust is to invest in the native token of Bittorrent, TAO. On the other hand, the Grayscale Sui Trust is designed specifically for investing in the SUI token that belongs to the Sui protocol.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-09-12 16:41