As a seasoned analyst with years of market insights under my belt, I must say that XRP‘s current situation seems rather challenging. The imbalance in the NVT ratio and the bearish MACD crossover are red flags that I can’t ignore. Historically, these indicators have often pointed to corrections, and it seems we might be heading for one again.

However, as they say, the market can remain irrational longer than you can stay solvent. XRP has shown resilience in the past, and if we look back at its previous consolidation periods, it’s not impossible that we could see a similar pattern play out. But let’s be real, I’ve seen more bullish coins go belly-up faster than a shot of cheap whiskey on a hot summer day!

So, while I can’t guarantee XRP will reach $3.00 by January 2025, I wouldn’t rule it out entirely either. Just remember to always keep your crypto wallet as tight as your dancing shoes, because the market’s an unpredictable dancefloor we’re all trying to navigate!

Due to an extended period of sideways movement, XRP hasn’t managed to break through the $3.00 barrier this year, keeping it from achieving significant growth.

Approaching January 2025, the chances seem thin for XRP reaching that significant mark, as current market trends and technical signals point towards a postponement of any major price surge.

XRP Is Facing Trouble

The Network Value to Transactions (NVT) ratio suggests that the value of XRP’s network is presently higher than its transactional value. In the past, such discrepancies have been indicative of upcoming adjustments, as excessive network valuations frequently lead to losses for investors.

These market circumstances make it difficult for recovery, as XRP’s network value may struggle without more frequent transactions. This could lead to extended periods of little change or even a decline in XRP’s value, potentially hindering its immediate growth possibilities.

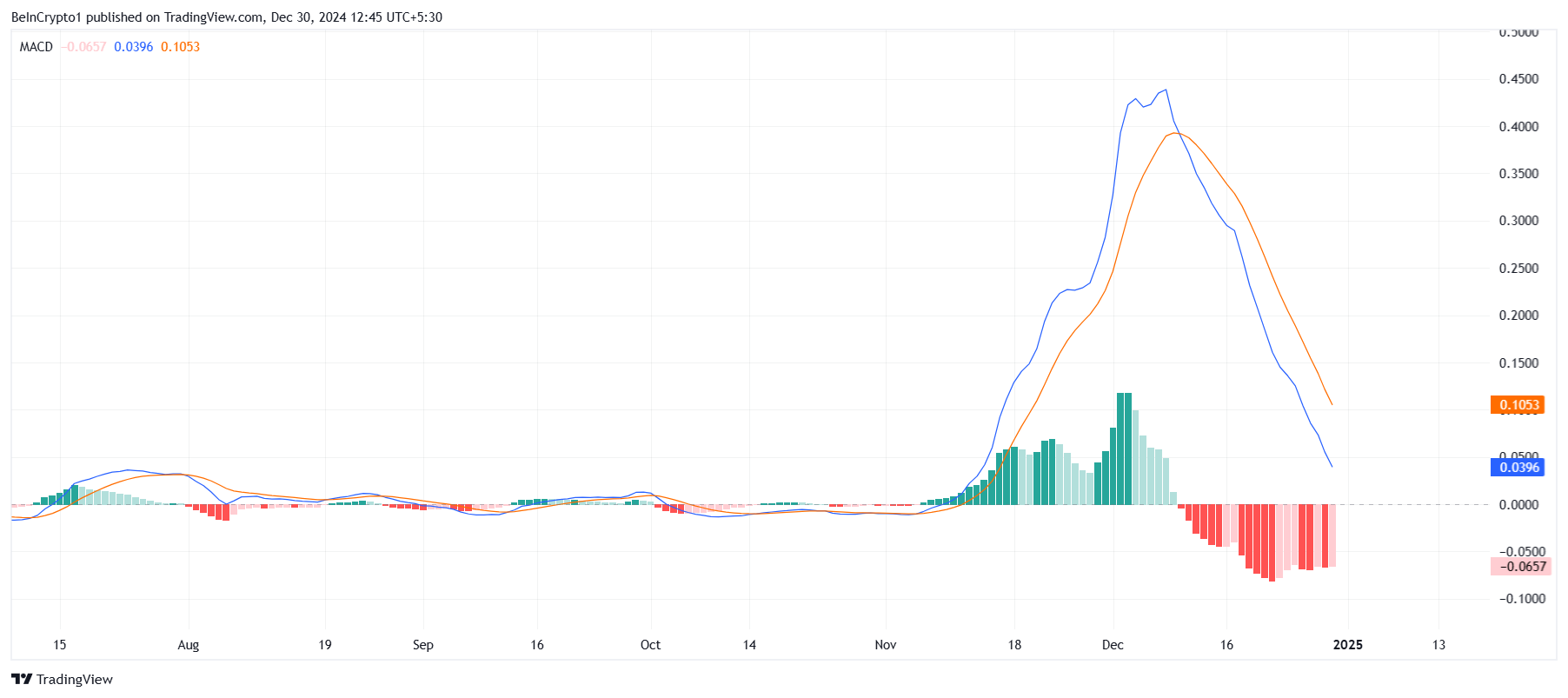

As a seasoned crypto investor who has seen multiple market cycles, I have come to rely heavily on technical analysis tools like the MACD (Moving Average Convergence Divergence) indicator. Currently, my analysis of this tool suggests a bearish outlook for the near future. The lack of a bullish crossover in sight is concerning, and I don’t anticipate any significant change as we move into 2025.

My experience tells me that the MACD’s bearish crossover often reflects broader negative market cues, and this time seems no different. The ongoing bear market has been tough on many investors, including myself, but I have learned to adapt and make informed decisions based on the data at hand.

That being said, I remain cautiously optimistic about the long-term potential of crypto as a disruptive technology. However, for now, it’s crucial to exercise patience, keep a close eye on market trends, and stay disciplined in our investing strategies.

Based on this technical indicator, it appears that the downward trend on XRP is likely to persist. As long as no reversal takes place, XRP might find it challenging to escape its current price range and may even experience additional drops if the selling pressure increases significantly.

XRP Price Prediction: Staying Afloat

For approximately a month now, XRP has been holding steady, stuck beneath the resistance at around $2.73, yet managing to stay above its support level of $2.00. This current trend appears reminiscent of a previous consolidation phase that extended for over three months, which ultimately culminated in an increase in November this year. This similarity might suggest a potential duration of roughly three months before we could see another upward movement in XRP.

Should historical patterns persist, it’s possible that XRP might not surpass $3.00 until February 2025 concludes. Over this prolonged period of consolidation, substantial selling could cause the cryptocurrency to dip down to around $1.28, potentially increasing losses for investors.

As someone who has closely followed the cryptocurrency market for several years now, I can confidently say that XRP’s trajectory could be significantly impacted by a shift in broader market sentiment. Having witnessed multiple bull and bear cycles, I have come to understand that the price movements of altcoins like XRP are often influenced by market sentiment more than anything else.

Currently, the resistance level at $2.73 seems to be holding strong for XRP, but if this barrier is breached, it could push the price up towards $3.00. This breakthrough would challenge the bearish outlook that has been dominating the market and signal a renewed bullish phase for XRP.

If this happens, it’s not unreasonable to expect XRP to reach new heights beyond its all-time high of $3.31. While I cannot predict the future with absolute certainty, based on my experience in the market, such a surge could potentially be the start of another bull run for this popular altcoin.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 11:11