In a turn of events that would make even the most jaded financier raise an eyebrow, the XRP reserves on Binance have plummeted to a mere 2.7 billion tokens, a figure so low it could make a minimalist blush. Since the fateful day of October 6, over 300 million XRP have been spirited away from the exchange, as if the tokens themselves had grown legs and decided to take a stroll into the sunset of private wallets. 🌅

While the trading floor quivers with the sort of anxiety usually reserved for a debutante’s first ball, the sagacious analysts at CryptoQuant, led by the enigmatic Darkfrost, remain unruffled. They view this exodus not as a harbinger of doom, but as a positive trend, akin to a society hostess approving of her guests’ punctuality. Most withdrawals, it seems, are not destined for the gallows of selling, but for the safety of long-term custody. 🛡️

XRP, that stalwart of the crypto world, trades with the steady resolve of a British butler, hovering around $2.17-$2.20. The dwindling supply on exchanges only serves to bolster its long-term prospects, much like a well-tailored suit enhances one’s stature. The key level to watch, of course, is $2. Should XRP maintain its poise above this mark, the trend remains as positive as a weekend in the Cotswolds. But should it falter, one might expect a dramatic downturn, though surely not before a suitably dignified interval. 🧐

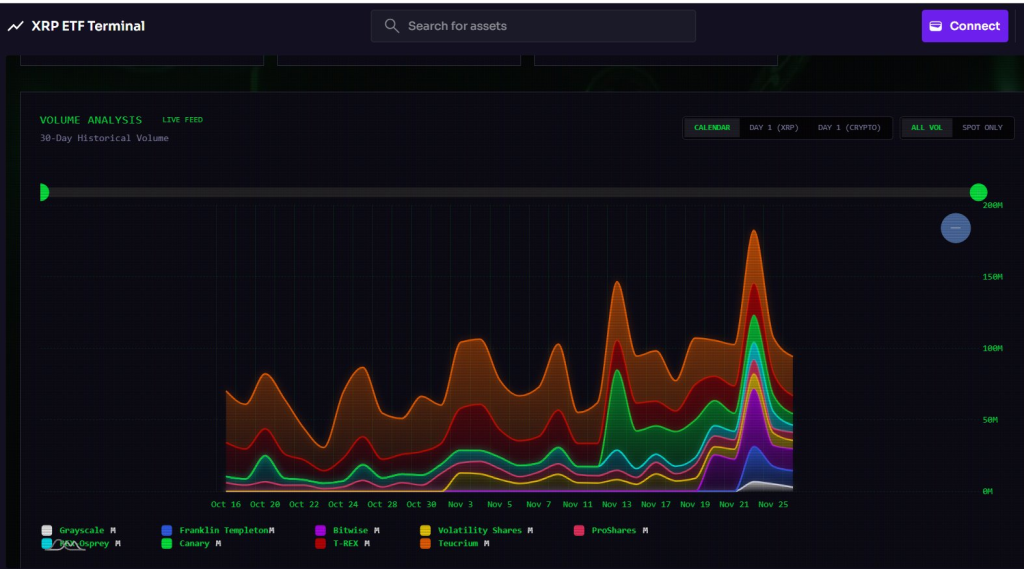

Meanwhile, the XRP ETFs-nine of them, no less-continue their quiet march, purchasing tokens with the discretion of a Mayfair auction house. Their inflows, though steady, are as subtle as a whisper in a cathedral, with reports of $73.9 million one week and $89.3 million the next. Four more ETFs are expected to join the fray, potentially giving XRP more funds than Bitcoin itself. Low-fee offerings from the likes of Franklin Templeton and Canary Capital are proving irresistible to institutional investors, who flock to them like society matrons to a debutante ball. 💼

Ripple’s RLUSD, meanwhile, is making waves in Abu Dhabi, where its ADGM approval and $1-billion market cap are laying the groundwork for a regulated payment infrastructure. One can almost hear the clinking of champagne flutes as the financial elite toast to its success. 🥂

All these developments are conspiring to lock away supply from exchanges, tightening the noose around the neck of market liquidity. Long-term holders, it seems, are in no hurry to part with their treasures, preferring to hoard them like a dragon guarding its gold. 🐉

Market Implications and Outlook

The shrinking reserves on exchanges, coupled with the relentless march of ETF inflows, paint a picture of a market in which long-term holders and institutions are absorbing XRP with the voracity of a society hostess at a buffet. Historically, such periods of consolidation and accumulation have been the prelude to dramatic price movements, much like the quiet before a grand entrance. With liquidity shifting across exchanges, institutional demand on the rise, and sell pressure on Binance waning, XRP’s market structure is tightening like a corset at a Victorian ball. This supply squeeze could well lead to a price move as explosive as a scandal in high society. 💥

While Binance weeps over its dwindling reserves, Bithumb in South Korea-a nation as active in XRP trading as a socialite at a cocktail party-reports rising holdings. It seems the global exchanges are dancing to different tunes, each with its own peculiar rhythm. 🎶

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. After all, in this world, one simply cannot afford to be out of the loop. 📰

FAQs

Why are XRP reserves on Binance dropping?

Because, darling, the tokens are fleeing to private wallets, where they can be cherished by long-term holders rather than tossed about like confetti at a third-rate party. 🏃♀️💨

Is shrinking XRP supply on exchanges good for price?

Absolutely. Less supply on exchanges means less sell pressure, which is rather like removing the temptations from a dieter’s pantry. 🍰

How do XRP ETFs affect the market?

They buy tokens with the discretion of a society matron at a charity auction, limiting price swings while steadily tightening supply. It’s all very civilized. 🎩

Why is institutional interest in XRP increasing?

More ETFs, rising OTC purchases, and the expanding use cases of RLUSD are drawing institutions like moths to a flame. After all, who can resist a good investment? 💸

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

2025-11-28 13:09