What is XRP? A Comprehensive Guide to Ripple’s Cryptocurrency

As a seasoned investor with over two decades of experience under my belt, I have seen many cryptocurrencies come and go, but none have captured my attention quite like Ripple’s XRP. Having had the privilege of witnessing the birth of the internet and the subsequent dot-com boom, I can confidently say that we are now in the midst of another revolution – the blockchain revolution.

XRP stands out from the crowd due to its cutting-edge features and growing ecosystem. As a daily user, I have come to appreciate its speed, low costs, and scalability, making it an ideal choice for cross-border payments. In my opinion, XRP is a compelling investment option for any forward-thinking individual who wants to be part of the blockchain revolution.

I’ve always believed that investing in technology is like catching a falling knife – you have to catch it at just the right time. With Donald Trump’s pro-crypto stance and his promise to provide regulatory clarity, I believe we are nearing that opportune moment for XRP. Rumors abound that BlackRock, the world’s largest asset manager with $12 trillion under management, is eyeing XRP for its portfolio. If Wall Street money flows into XRP through institutional investments and ETFs, a $50 price target for Ripple’s XRP will be achievable.

However, as with any investment, there will be volatility along the way. But remember, investing in cryptocurrencies is not about timing the market; it’s about time in the market. So buckle up, folks! The ride to $50 might be bumpy, but it’ll be worth it.

And as a final note, I’d like to leave you with this joke: Why did XRP join a band? Because it wanted to rock the blockchain! Keep calm and HODL on!

As a seasoned investor who has closely followed the evolution of the digital currency landscape, I find myself intrigued by XRP, which serves as the native cryptocurrency for the XRP Ledger – a decentralized blockchain specifically designed to streamline cross-border payments. Having witnessed firsthand the limitations and inefficiencies plaguing traditional financial systems, such as high fees and sluggish transaction times, I can appreciate Ripple Labs’ vision for solving these challenges with XRP.

The growing popularity of XRP in the blockchain and cryptocurrency world is not surprising to me, considering its potential to disrupt and improve existing payment systems. Furthermore, the bullish XRP price predictions reflect a collective optimism among investors about its future prospects. For those interested in exploring this exciting digital asset, I encourage you to delve deeper into the world of XRP and understand why it’s poised for success in today’s rapidly evolving financial landscape.

Key Features of XRP:

- Blazing-Fast Transactions: XRP transactions settle in just 3-5 seconds, making it one of the fastest cryptocurrencies.

- Low Fees: Each transaction costs mere fractions of a cent, making XRP ideal for microtransactions and large remittances alike.

- High Scalability: The XRP Ledger can handle up to 1,500 transactions per second (TPS), far outpacing many other blockchains.

- Energy Efficient: Unlike Bitcoin, XRP does not rely on energy-intensive mining, reducing its carbon footprint significantly.

XRP Use Cases:

- Cross-Border Payments: XRP acts as a bridge currency, enabling instant settlement between different fiat currencies. Financial institutions leverage Ripple’s technology, such as RippleNet, to streamline global payments.

- Liquidity Management: Banks and payment providers use XRP to eliminate the need for pre-funded accounts in foreign currencies, freeing up capital.

- Decentralized Applications: Developers are building innovative DeFi projects on the XRP Ledger, making it an emerging platform for decentralized finance.

Ripple vs. XRP: What’s the Difference?

Ripple is the company responsible for developing technologies centered around XRP, while XRP is a standalone digital asset utilized within the XRP Ledger. Although Ripple Labs significantly contributes to XRP’s acceptance, it’s crucial to note that the currency and its underlying blockchain maintain a decentralized structure.

Legal Challenges: XRP and the SEC Lawsuit

A contentious issue surrounding XRP is the ongoing legal dispute it faces with the U.S. Securities and Exchange Commission (SEC). The SEC argues that XRP was marketed as an unregistered security, creating doubts over its regulatory classification. This litigation has significantly influenced the way people perceive and use XRP in the U.S. However, with the incoming administration perceived to be pro-crypto, this situation may improve under the Trump administration.

In 2025, Donald Trump put forward Paul Atkins, an advocate for cryptocurrencies, as his nominee for the Securities and Exchange Commission (SEC). This decision could potentially carry significant repercussions for Ripple’s digital token, XRP.

As a seasoned researcher with extensive experience in the financial and technological sectors, I find myself closely following the developments surrounding Ripple (XRP) and its ongoing legal battle with the Commodity Futures Trading Commission (CFTC). The recent suggestion by former CFTC Commissioner Christopher Giancarlo that Atkins may dismiss the case against Ripple has piqued my interest, hinting at a potential turning point for this innovative cryptocurrency.

Throughout my career, I have witnessed the explosive growth of various digital assets when they successfully navigate through legal hurdles, and I can’t help but see parallels between these instances and the current situation with XRP. If the case is indeed dismissed, it could unleash pent-up demand among investors and enthusiasts, leading to a potential XRP bull run that might significantly reshape the token’s market trajectory.

In 2025, I foresee a surge in interest and investment in XRP as more institutions and individuals recognize its potential value and utility. This anticipated growth could redefine the token’s market position and establish it as a leader in the ever-evolving landscape of cryptocurrencies. As someone who has closely observed the rise and fall of various digital assets, I believe that this potential bull run could prove to be a defining moment for XRP and its community.

In a positive response, Brad Garlinghouse, CEO at Ripple, praised the appointment of Paul Atkins as SEC chairman. On platform X, he stated, “An excellent selection – Paul Atkins leading the SEC will reintroduce reason to the agency. With Hester Peirce and Mark Uyeda, it’s high time we bring an end to the prohibition era in cryptocurrency, reviving economic growth, innovation, and personal choice.

Why XRP Matters to Cryptocurrency Investors

XRP distinguishes itself by facilitating seamless integration between conventional banking and blockchain innovations. With its rapid transaction speeds, minimal fees, and impressive scalability, it emerges as a preferred solution for international money transfers. Moreover, its decentralized structure encourages creativity and advancement within the cryptocurrency sector.

If you’re delving into the world of cryptocurrencies, XRP is an intriguing investment to keep tabs on. Known for its advanced characteristics and expanding network, it continues to be a significant figure in the blockchain transformation. Everyday investors worldwide have taken a liking to XRP as their preferred digital currency. The community supporting XRP is strong and enthusiastic!

XRP Price Prediction: Could $50 Be on the Horizon in 2025?

As a seasoned investor with years of experience under my belt, I firmly believe that the emergence of central bank digital currencies (CBDCs) will significantly reshape the global financial landscape. Having closely followed the development of various cryptocurrencies, I find myself particularly intrigued by Ripple’s XRP and its potential to become a key player in this new decentralized finance era.

Having witnessed firsthand the limitations and high costs associated with traditional cross-border payment systems, I can confidently say that XRP offers a superior solution due to its lightning-fast speed, minimal transaction fees, and impressive scalability. This makes it an ideal bridge between CBDCs and the broader financial system.

Given these factors, I am optimistic about XRP’s future value, and I wouldn’t be surprised to see it rally to $50 in the coming years. For those seeking to capitalize on this trend, I strongly recommend keeping a close eye on Ripple’s progress as they continue to solidify their position in the market.

In 2025, it’s possible that the price of XRP might soar up to $50, driven by Donald Trump’s supportive stance towards cryptocurrencies and his intention to bring regulatory clarity to the market. Such a policy adjustment could serve as a catalyst for Ripple Labs, opening the doors for institutional investors who have been hesitant to enter, to invest when an XRP Exchange-Traded Fund (ETF) gets approved in 2025.

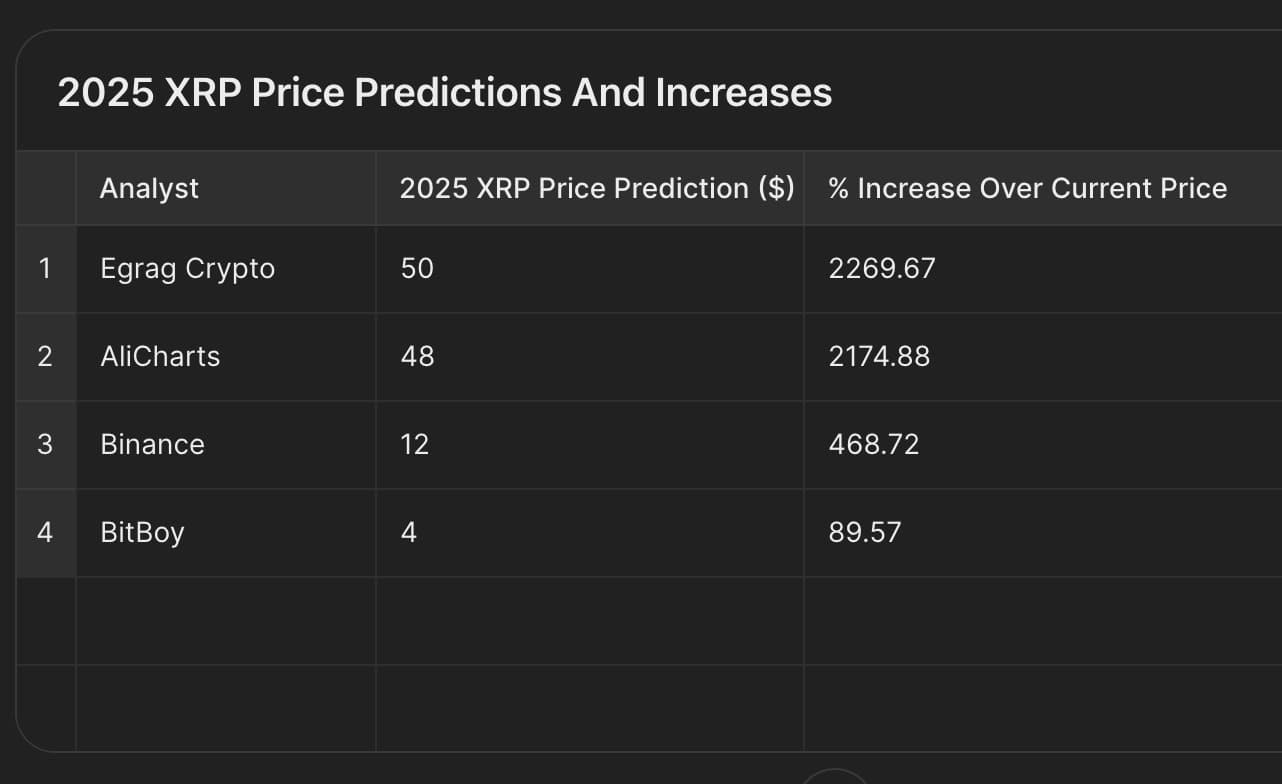

XRP Price Predictions – 2025

Speculation is growing that BlackRock, the world’s largest asset manager with a whopping $12 trillion in assets under management, could potentially add XRP to its investment portfolio. If they do, it could ignite a massive price surge. Furthermore, at least four companies such as WisdomTree and Bitwise have submitted applications for ETFs centered around XRP. The recent triumph of Bitcoin ETFs demonstrates the profound impact such financial products can have on digital currencies.

If significant investments from Wall Street institutions, including ETFs, are directed towards XRP, it’s plausible that the price of Ripple’s XRP could reach $50 per unit.

In the retrospective analysis of 2024, I find myself remarking that my focus, XRP, experienced a significant surge in productivity. This revitalization can be largely attributed to what I’ll refer to as “The Trump Pump,” an event that provided XRP with a renewed sense of momentum, effectively overcoming the negative impact of the SEC under Gary Gensler’s leadership and its perceived hostile stance towards crypto.

After the inauguration in 2025, if Trump’s crypto-friendly cabinet members such as David Sacks, appointed as the “crypto czar,” and Paul Atkins, the new head of the SEC, take office, they will have the opportunity to begin their work. There may be fluctuations in the market throughout this period, but it becomes more probable that a Bitcoin Strategic Reserve and an XRP Exchange-Traded Fund (ETF) will be approved in 2025. This is favorable news for Ripple, and particularly advantageous for XRP investors who are eagerly awaiting optimistic XRP price forecasts.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-30 07:19