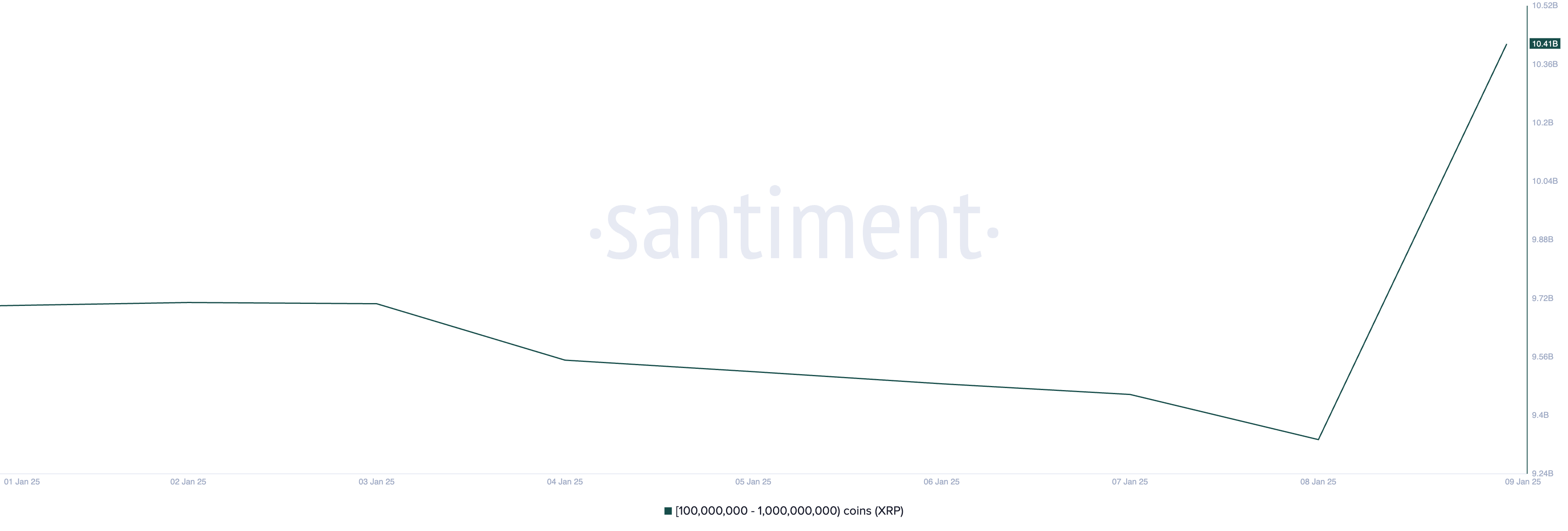

During the early hours of Thursday’s Asian session, a significant number of major XRP investors (often referred to as ‘whales’) accumulated approximately 1.08 billion tokens, equating to around $3 billion at current market prices. This action has taken their collective XRP holdings to its peak level since the month of June 2024.

Regardless, XRP’s price has been confined within a specific range, showing a strong negative sentiment or pessimism towards it.

Developments Within Ripple Fail to Excite XRP Bulls

Based on data from Santiment, it’s been reported that whale accounts with a balance between 100 million and 1 billion XRP have jointly purchased 1.08 billion XRP tokens today, which equates to approximately $3 billion. This accumulation has increased their total holdings to a record high of 10.41 billion XRP since June 2024.

The significant increase in whale holdings of Ripple is occurring alongside a series of favorable advancements within the Ripple community. Notably, these include the recent partnership with Chainlink, a meeting between Ripple CEO Brad Garlinghouse, Chief Legal Officer Stuart Alderoty, and pro-crypto President-elect Donald Trump, as well as Ripple President Monica Long’s recent statement suggesting an XRP exchange-traded fund (ETF) could be imminent.

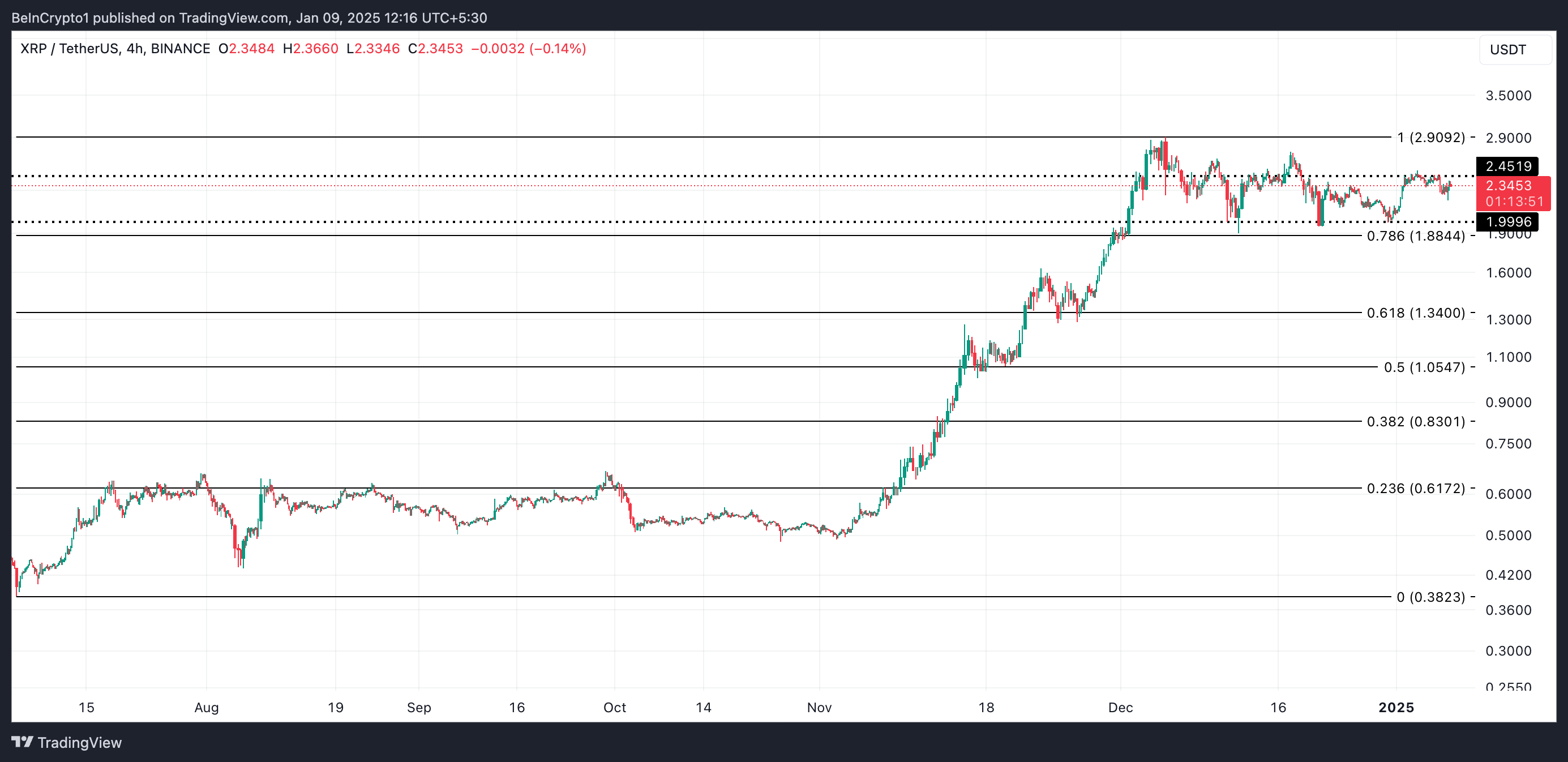

Although there was a lot of whale activity involving XRP, its response has been relatively quiet, with its price moving in a straight line rather than significantly increasing. A technical analysis conducted over a four-hour timeframe supports the pessimistic outlook that is preventing the token from breaking through to higher prices.

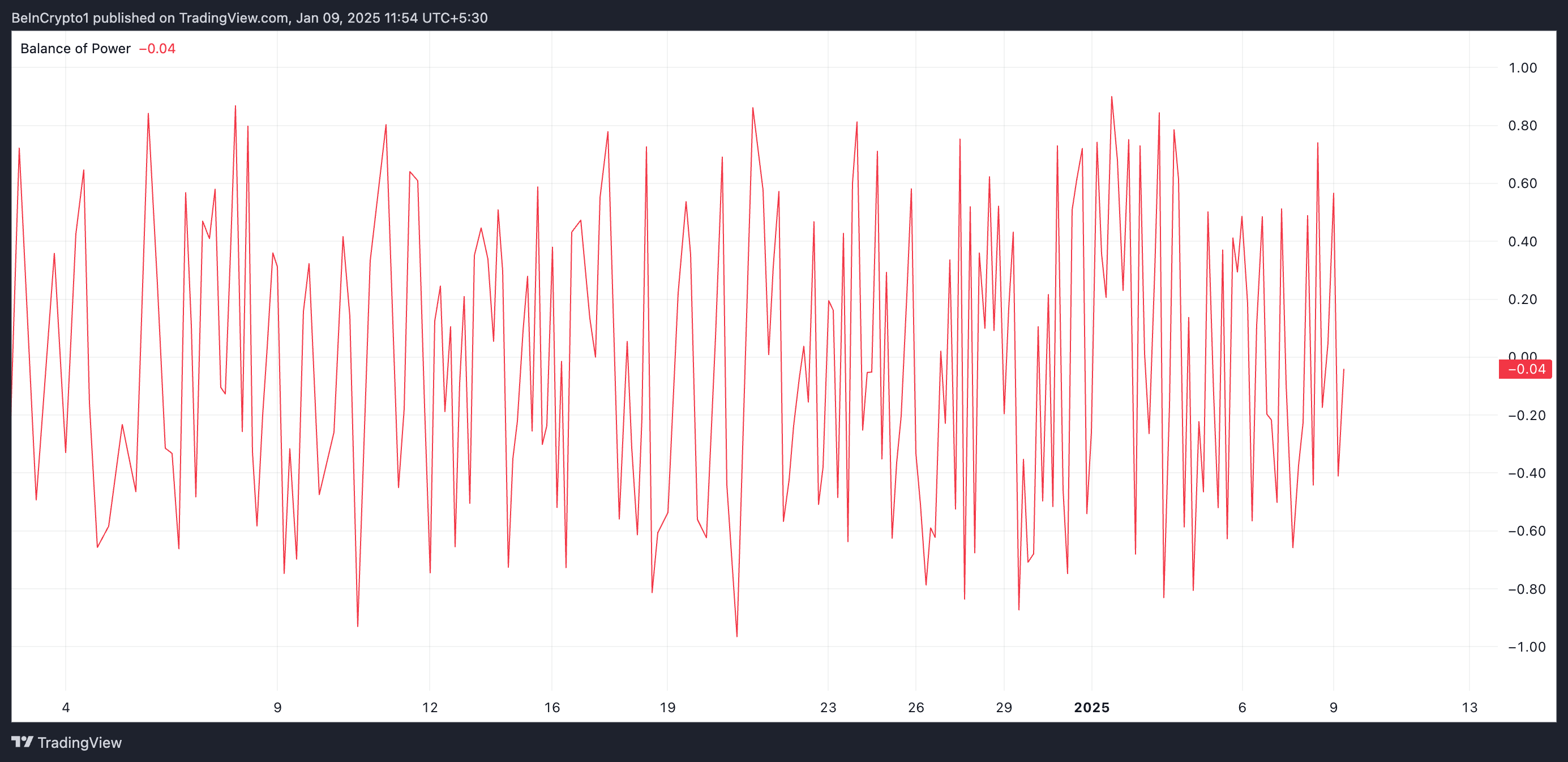

Initially, the current Balance of Power (BoP) stands at negative 0.04, indicating that sellers are currently more dominant than buyers based on recent price trends and movement analysis over a given timeframe.

If its value goes below zero, it suggests that sellers have more influence over the market, implying a pessimistic outlook and potential for prices to fall.

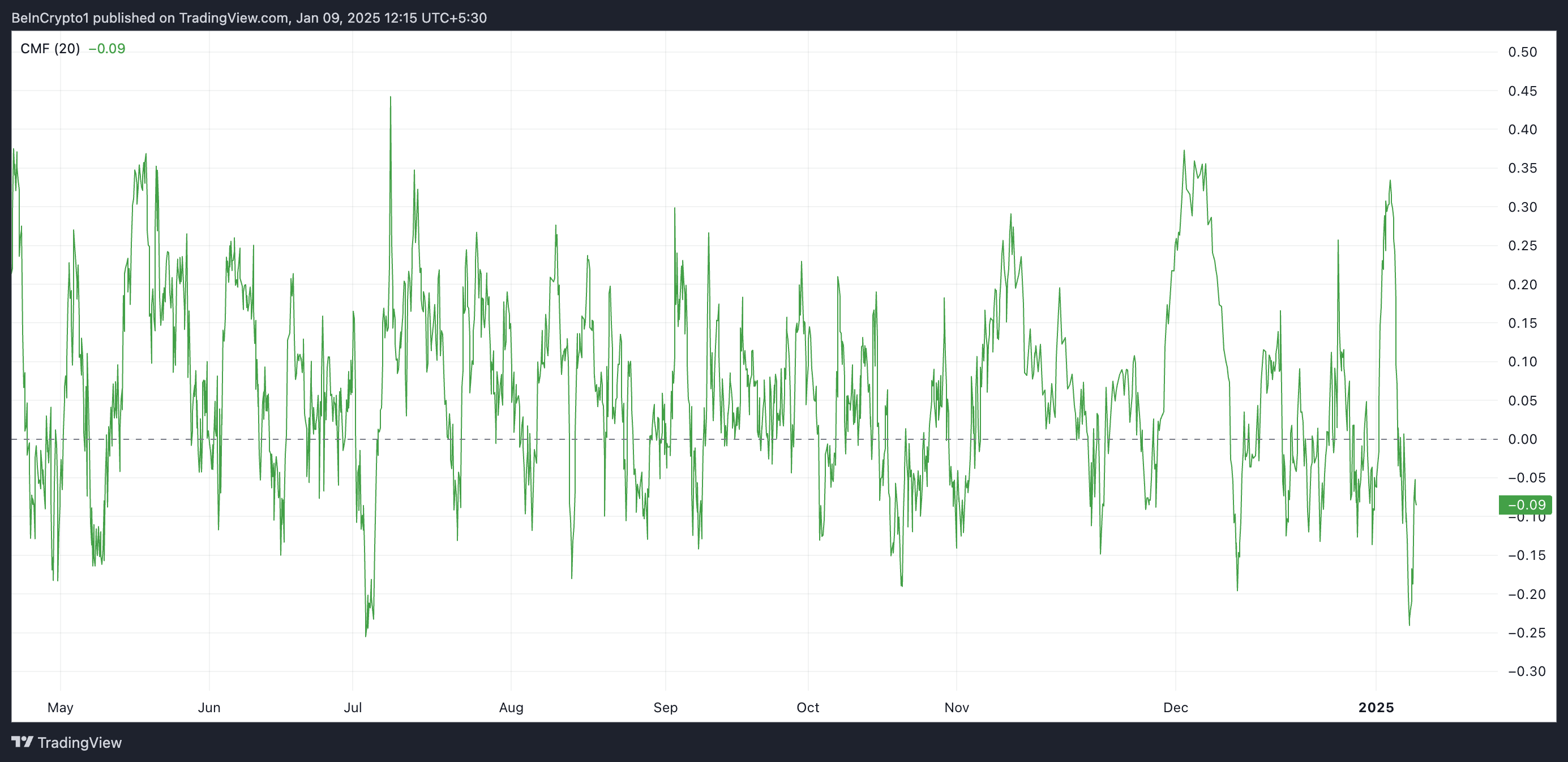

Adding to the bearish perspective, the Chaikin Money Flow (CMF) for XRP indicates a downward trend. At present, this indicator that measures the inflow and outflow of funds in the asset stands at -0.09.

When a financial asset’s Crowd Momentum Factor (CMF) shows a negative value, it means that there’s more demand to sell than buy, suggesting a prevailing pessimistic sentiment or downward trend in the market.

XRP Price Prediction: Key Levels To Watch

Based on the Fibonacci Retracement analysis by XRP, if the current downward trend intensifies, the value of XRP could potentially drop to a support level of $1.99. If this support is not strong enough to withstand the pressure, the price could further decrease towards $1.88.

If the number of whale investors continues growing and boosting XRP purchases significantly, it could cause the price to potentially reach $2.45, contradicting this pessimistic prediction.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-01-09 13:50