As an analyst, I’ve noticed a significant dip of approximately 4% in XRP‘s price over the past week, which suggests ongoing weakness. Interestingly, trading volume has decreased by around 33% within the last 24 hours to roughly $5.2 billion. However, despite this sluggish momentum, there are signs pointing towards market stabilization. This is partly due to whale activity and technical indicators that hint at potential shifts in the near future.

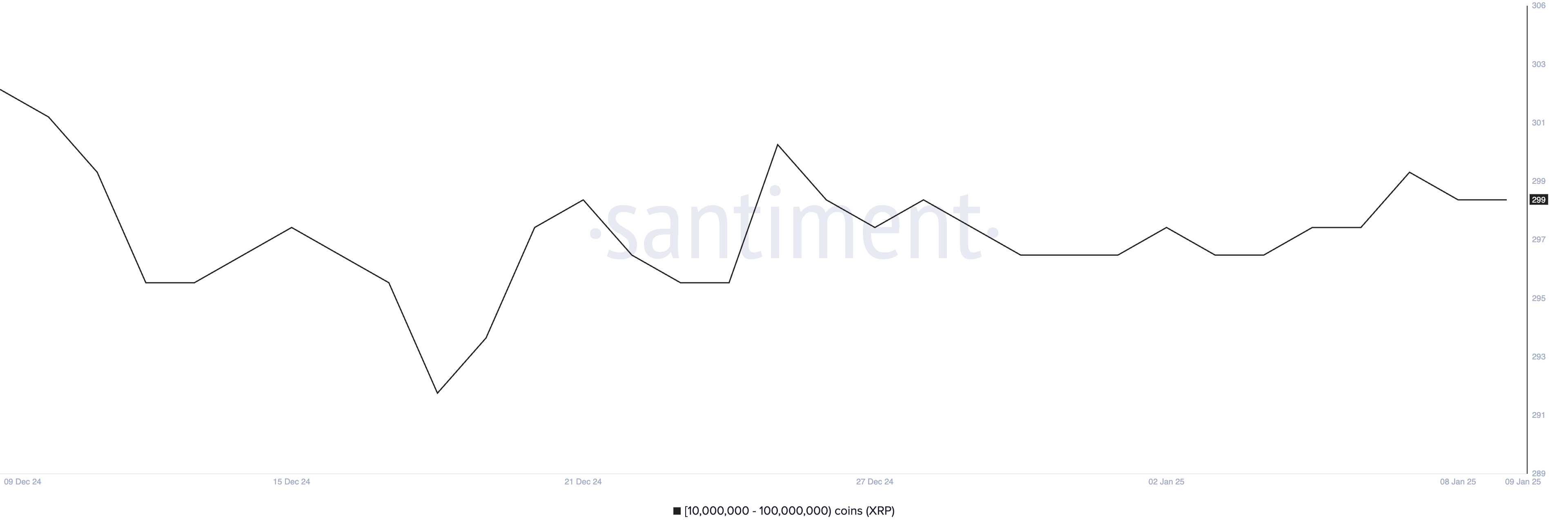

The number of whale wallets containing between 10 million and 100 million XRP has seen a slight rise, now standing at 299 as of January 8, suggesting a cautious build-up. Yet, without significant buying pressure or a positive shift in market perception, XRP continues to face potential further adjustments or extended periods of stability.

XRP Whales Stay Cautious

Analyzing the quantity of XRP holders with a balance ranging from 10 million to 100 million XRP offers valuable perspectives on the investment strategies of major players in the market. These big fish, or whales, frequently exert substantial influence over price fluctuations by either stockpiling or dispersing their assets. Their actions can sway market opinion and liquidity levels.

Following a decline to 292 on December 18, which was its lowest point for the month, the number of XRP whale accounts rebounded to 301 by December 25. Since then, it has displayed indications of stability, experiencing only small ups and downs.

Currently, there are 297 whales in our data, which indicates a gradually increasing curiosity from major investors. Despite XRP being in a period of consolidation, this trend suggests they remain cautiously optimistic.

Over time, we’re seeing more and more whales investing in XRP, which might indicate growing trust in this cryptocurrency. This could pave the way for price consistency or even a rise in the short term. But if we don’t witness stronger buying patterns, the market may not experience significant movement upwards or downwards.

XRP CMF Is Still Negative

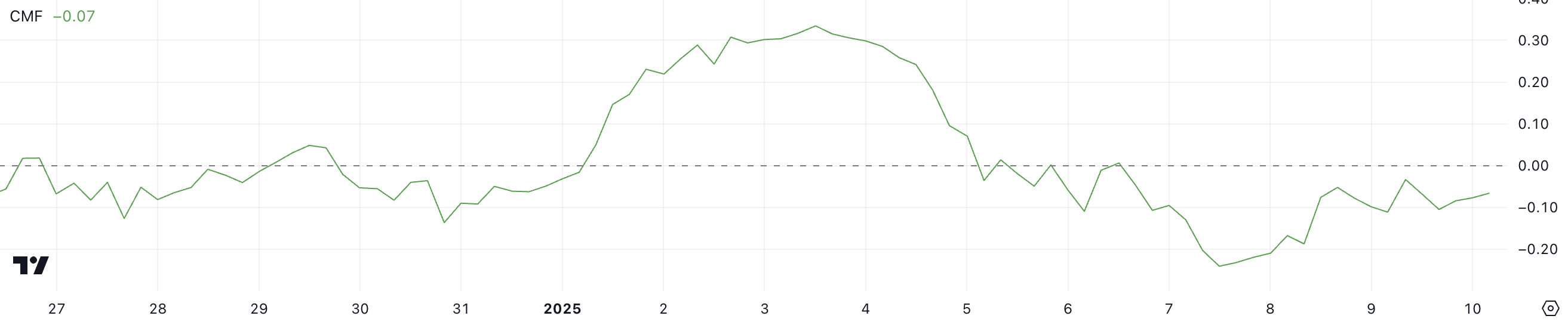

Currently, the Chaikin Money Flow (CMF) for XRP stands at -0.07, bouncing back from its recent low of -0.24 on January 7. The CMF is a technical tool that gauges the inflow or outflow of funds into an asset by analyzing price and trading volume over a defined timeframe.

In simple terms, when the figures are greater than zero, it means there’s more buying activity happening, which is a positive or bullish outlook. Conversely, numbers lower than zero showcase more selling activity, suggesting a negative or bearish sentiment.

At a level of -0.07, XRP’s Chaikin Money Flow (CMF) continues to show a predominance of selling over buying actions. Yet, the uptick from -0.24 implies that the degree of selling may be lessening, which could hint at a stabilization or a transition towards more even market dynamics.

Should the Cumulative Moving Average (CMF) keep improving and venture into positive zones, this could suggest increased buying activity and potentially trigger a price surge. Alternatively, if the CMF trend reverses and dips once more, XRP might encounter further selling pressure.

XRP Price Prediction: Resistance at $2.35 Is Fundamental

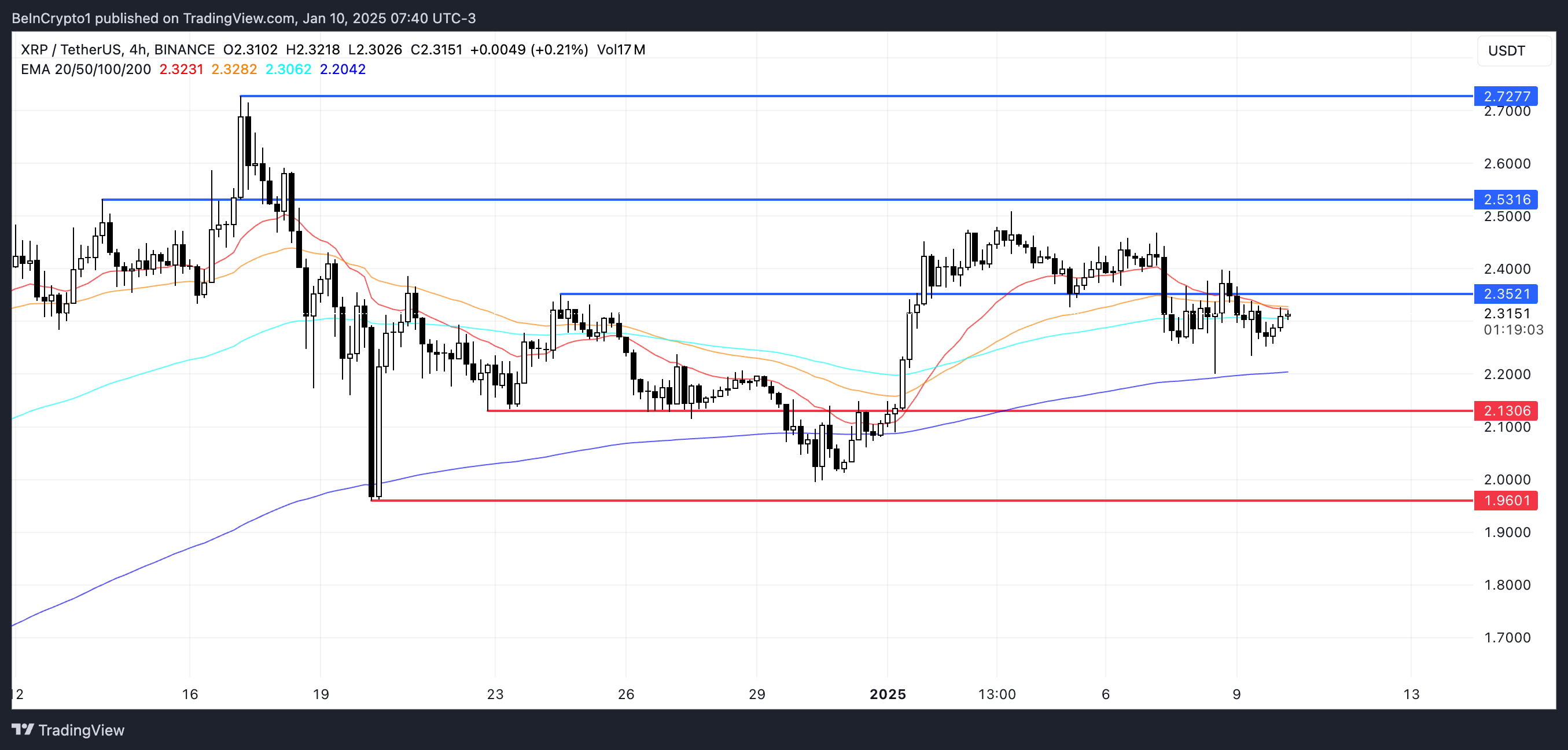

At the moment, XRP’s Exponential Moving Averages (EMA) indicate a state of ambiguity, as they are not providing a definitive signal about its direction. This vagueness reflects a market equilibrium, where both optimistic and pessimistic scenarios might unfold. This uncertainty aligns with whale activity statistics and the Chaikin Money Flow (CMF), which suggest that both bullish and bearish outcomes could play out.

Should an upward trend emerge and XRP successfully surpasses its resistance at around $2.35, this could pave the way for additional growth. The continued bullish force might propel the price towards approximately $2.53 and potentially even $2.72, presenting a possible 17.6% profit opportunity.

Instead, if the trend continues downward, the XRP price might be tested against the support of $2.13. If this support doesn’t keep it up, there could be more pressure towards a fall, possibly reaching as low as $1.96, which is its lowest point since mid-December.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-01-11 02:54