As a seasoned analyst with over two decades of trading experience under my belt, I’ve seen markets ebb and flow like tides. The recent performance of XRP has caught my attention due to its intriguing mix of bullish and bearish signals.

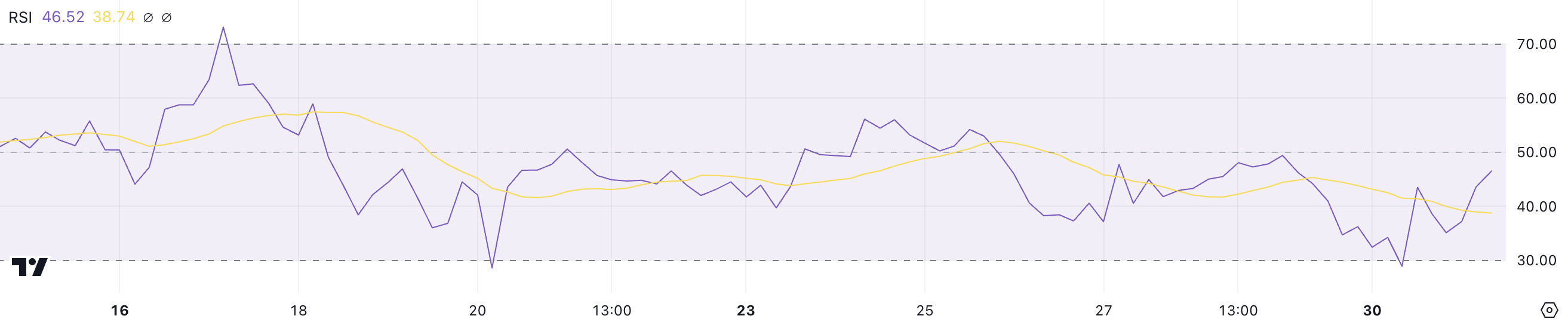

The RSI rebound from the oversold territory is a positive sign, but it remains in a neutral zone, hinting at potential consolidation or indecision among traders. This reminds me of a time when I was a young trader trying to read tea leaves – it’s always best not to jump to conclusions based on one indicator alone.

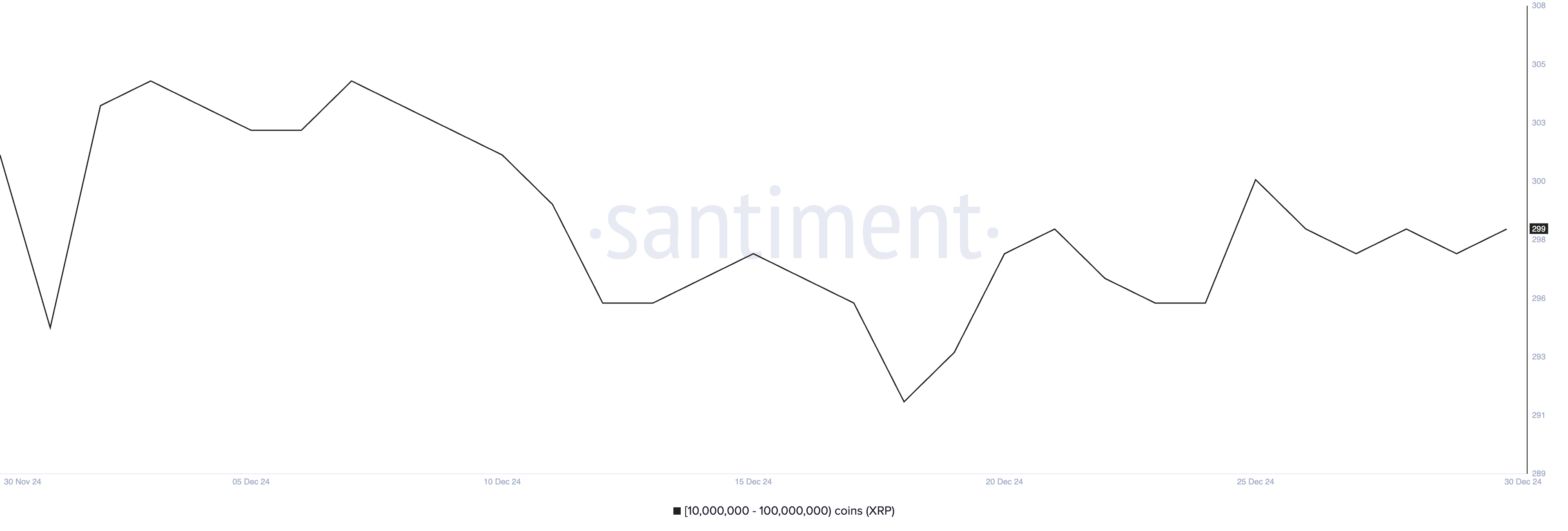

The whale activity during Christmas was intriguing – a brief accumulation phase followed by stabilization. Large investors seem cautious, neither aggressively buying nor selling, reflective of the overall market sentiment. This is similar to a game of chess I once played against a grandmaster; both of us were carefully watching our moves, not giving away too much.

In terms of price prediction, XRP is currently trading in a narrow range between $2.13 and $1.96. If the resistance at $2.13 breaks, it could signal a bullish phase, potentially targeting $2.33 or even $2.53. However, a potential death cross on its EMA lines suggests a bearish shift that could push the price down to $1.89 and further if not managed well.

In essence, XRP’s current state is akin to a game of cat and mouse – the bulls are chasing the resistance level, while the bears are lurking at support. For now, it seems we must all wait and see who makes the first move. And just as I once learned in poker, sometimes the best play is to stay patient and watch the river unfold.

To lighten the mood, let me share a joke: Why did the trader cross the road? Because he heard there was a good deal on the other side of the market!

Over the last week, XRP’s price has dropped approximately 6%, but it has shown signs of recovery by gaining around 3% in the past day, suggesting possible stabilization. The Relative Strength Index (RSI) has climbed to 46.5, signifying a move out of oversold territory, while whale activity has remained consistent following a temporary accumulation phase over Christmas.

The data indicates a somewhat guarded outlook in the market, as XRP trades within the range of $2.13 resistance and $1.96 support. Whether XRP will continue its upward trend or experience additional drops hinges on either breaching significant resistance points or avoiding a possible ‘death cross’ on its Exponential Moving Averages (EMA).

XRP RSI Recovered From an Oversold Zone

The RSI value for XRP has risen to 46.5, bouncing back from an oversold state of 30 it reached between December 30 and December 31. This recovery implies that the selling pressure may have lessened, with the price now attempting to find balance.

A Reading of RSI (Relative Strength Index) at 46.5 suggests that the market momentum leans slightly bearish, yet it’s trending towards a region that could indicate uncertainty or indecision among traders. As XRP price strives to hold its value above $2, this momentum shift may hint at a possible wavering in conviction.

The Relative Strength Index (RSI) is a tool that calculates the rate at which prices are changing between 0 and 100, based on the size of those changes. A reading above 70 signals overbought conditions, which might hint at an upcoming price decrease, while a reading below 30 points to oversold conditions and could indicate a potential price increase.

As a seasoned trader with over a decade of experience under my belt, I have learned to read the market trends like a book. Currently, with XRP’s RSI at 46.5, it appears to be in a neutral zone for me. This means that it’s neither displaying strong upward nor downward momentum. In my experience, such a reading often indicates a consolidation phase, where the coin may stay near its current levels unless there is a significant change in buying or selling pressure. I always keep a close eye on these situations as they can lead to exciting opportunities for both short-term and long-term gains. However, it’s essential to remember that the market is unpredictable, and anything can happen, so it’s crucial to have a well-thought-out trading strategy in place.

Whales Accumulated XRP During Christmas

Over the past few days, the count of XRP holders, who possess between 10 million and 100 million XRP, has held steady. There was a temporary surge in these whale numbers from 296 to 301 between December 24th and 25th, hinting at a short-term accumulation period.

Since December 26, the number has remained fairly stable between 298 and 299, suggesting a prolonged phase of stability in whale activity. This consistent pattern implies that big investors appear to be neither buying or selling XRP aggressively at this time.

Monitoring the behavior of whales (large financial investors) is essential as they frequently exert considerable influence over market trends. Their purchases typically spark rising trends, whereas their sales tend to cause falling trends.

As an analyst, I’m observing a steady trend in the number of whales, which seems to indicate a cautious stance among significant investors. In simpler terms, their sentiment appears neutral at the moment. Given this short-term outlook, it’s plausible that the XRP price could maintain its current range with limited fluctuations, unless the behavior of these whale investors shows clear signs of accumulation or distribution, which could potentially disrupt this stability.

XRP Price Prediction: Will It Stay Above $2?

At the moment, the value of XRP is moving between tight boundaries, with a ceiling around $2.13 and a floor at $1.96. It’s attempting to hold steady above the $2 mark.

If the resistance at 2.13 is breached and surpassed, XRP’s price may continue to rise, possibly aiming for 2.33. In the event of further reinforcement of the uptrend, the price might ascend even higher, reaching a potential level of 2.53, indicating a more powerful bullish trend.

On the other hand, the EMA lines seem to signal caution, suggesting that a ‘death cross’ might materialize shortly, which typically indicates a change in market trend towards bearishness.

With my extensive background in cryptocurrency trading and analysis, I have witnessed many market fluctuations firsthand. If the bearish setup materializes for XRP, it could spell trouble for investors who are holding onto their XRP at the current $1.96 price level. In such a scenario, the critical support at $1.89 may not hold up, leading to a potential drop in price down to $1.63. This decline would represent a significant setback and could negatively impact the overall health of my portfolio. As always, it’s crucial to stay vigilant and adaptable in this ever-changing market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-31 17:44