As a seasoned analyst with over two decades of experience in the crypto markets, I’ve seen my fair share of volatility – it’s like riding a rollercoaster without the cotton candy! The recent downturn in XRP has certainly been a wild ride, but it’s important to maintain a balanced perspective.

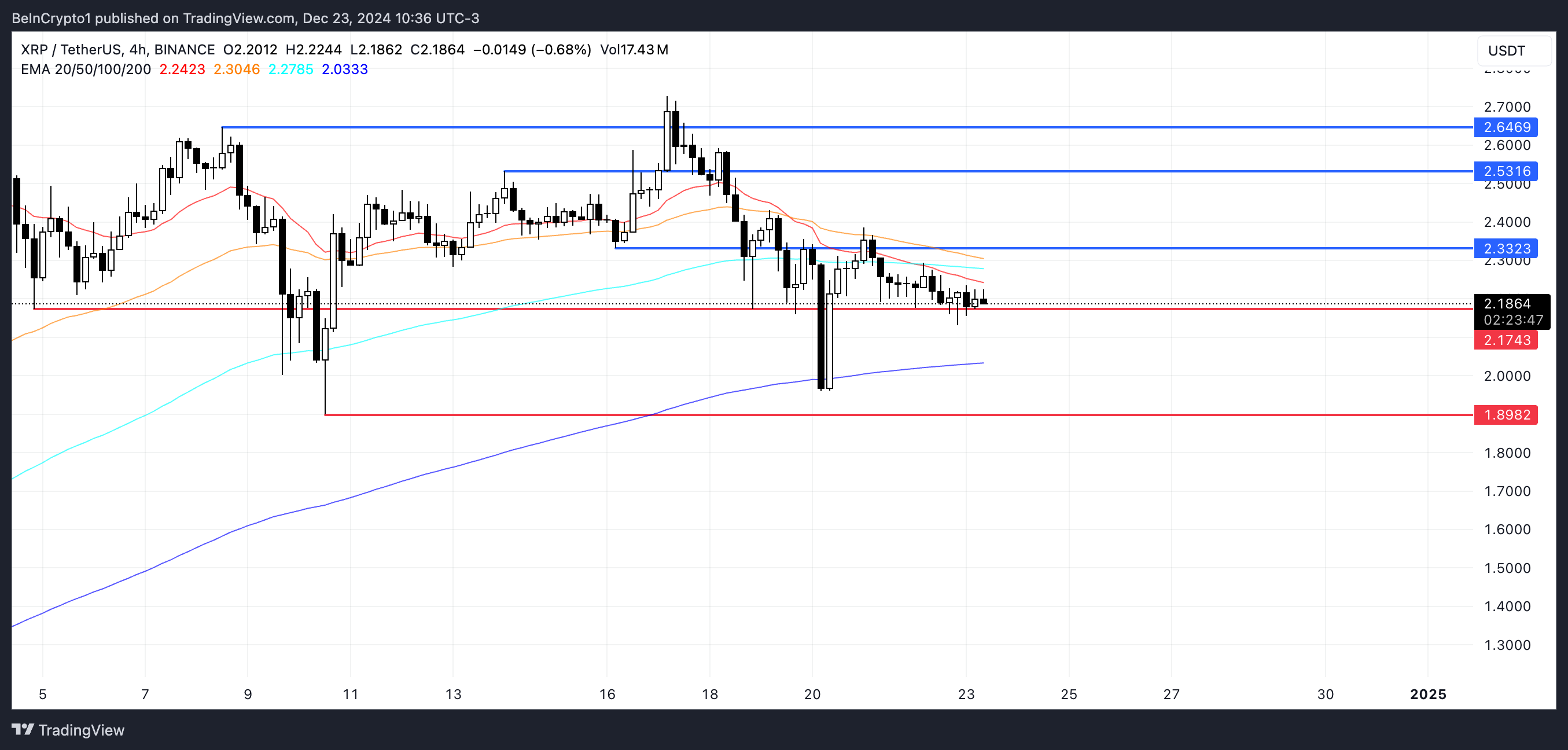

The price of XRP has experienced a significant drop, falling by over 8% in the last week, following its six-year high on December 17th. This recent fall brings XRP near a vital support level at approximately $2.17, a price point that could significantly influence its short-term direction.

Although there’s been a recent dip, technical indicators such as RSI and CMF are giving ambiguous signals, hinting at potential recovery but not yet enough to establish a clear bullish momentum. Traders are closely monitoring XRP’s performance to see if it manages to hold its current support or rebound back to its December uptrend. This crucial action will significantly influence the coin’s future direction.

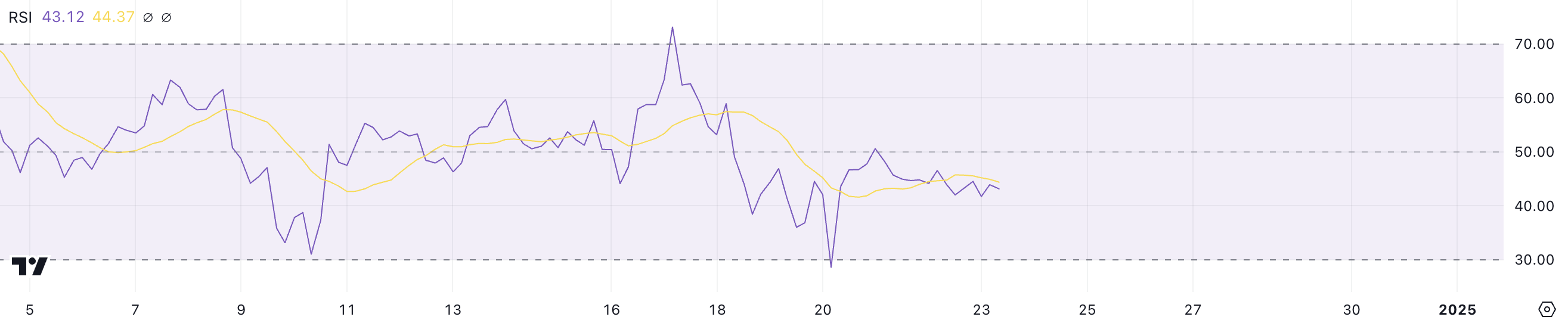

XRP RSI Is Currently Neutral

The Relative Strength Index (RSI) for XRP has spiked to 43.12, rising steeply from a level under 20 only three days prior. This substantial jump hints at a marked change in the asset’s momentum direction. When the RSI falls below 20, it usually signals that an asset is heavily oversold, which could imply excessive pessimism or selling among investors.

43.12’s bounce back indicates a surge in purchasing enthusiasm, implying that traders might be taking advantage of reduced prices, viewing them as potential opportunities.

The Relative Strength Index (RSI) is a tool that helps determine the pace and intensity of recent price fluctuations. It spans from 0 to 100, with significant levels often at 30 and 70. When readings drop below 30, this suggests an overly rapid decrease in prices, which might mean they’re due for a turnaround or rebound.

In other words, when readings exceed 70, it indicates that the asset might be overbought, which means prices have risen too much and could potentially experience a decline. On the other hand, the RSI of XRP at 43.12 falls within a neutral zone, neither indicating it’s oversold nor overbought.

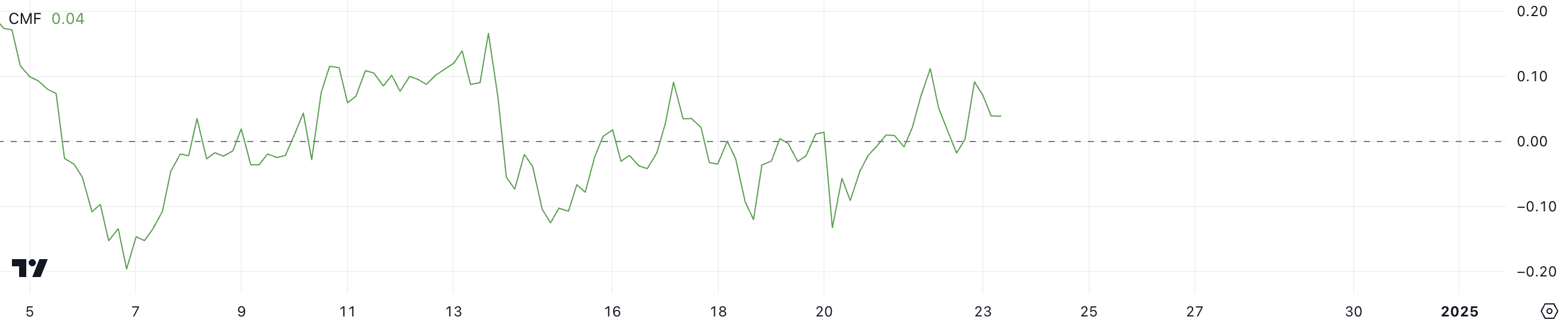

XRP CMF Is Positive, But Not That Strong

For XRP, the Chaikin Money Flow (CMF) stands at 0.04, which indicates a moderate level of buying pressure slightly prevailing over selling pressure. This follows a peak of 0.11 from the previous day, suggesting increased accumulation during that period, and a significant improvement from -0.13 on December 20, when there was more selling activity.

The transition from lower (negative) to higher (positive) figures shows a change in market attitude, as more money is being directed towards buyers recently. Nevertheless, the decline from 0.11 to 0.04 indicates that while there’s still interest in buying, it seems to be decreasing slightly, which may suggest a temporary period of stabilization or consolidation for XRP in the near future.

The Chande Momentum Oscillator (CMF) is a tool used to gauge the intensity of buying or selling activity by examining both price and volume over a defined timeframe. This indicator measures values between -1 and +1; positive figures indicate predominant buying pressure, while negative numbers signal dominant selling pressure. When the CMF exceeds 0, it usually means that more funds are being invested in the asset, signaling accumulation. Conversely, when the CMF falls below 0, it often indicates that the asset is being distributed.

As an analyst, I find myself observing that XRP’s Current Market Force (CMF) stands at 0.04, slightly tipping the scale towards more buying activity than selling. This slight tilt suggests ongoing buyer interest, yet the drop from 0.11 might hint at a lessening of bullish momentum. Consequently, this could lead to a period of sideways movement or require increased volume to maintain any upward trend.

XRP Price Prediction: Can XRP Price Go Below $2?

In simpler terms, for XRP’s current price to remain steady, it’s crucial that the support level at $2.17 holds firm. If it doesn’t, there’s a possibility of a substantial drop in price, with the next potential support found at $1.89. This could mean a 13% decrease, implying that the market mood might turn negative and potentially cause more selling.

Prices such as $2.17 frequently function as both psychological and technical hurdles which investors tend to safeguard, aiming to halt any further price drops.

If XRP’s price manages to reclaim the upward momentum it showed back in early December, leading to record highs not seen for six years, the perspective might significantly brighten.

As a crypto investor, I’m optimistic that a resurgence of bullish energy might propel XRP towards the near-term resistance level of $2.33. If this upward trend solidifies, further potential targets at $2.53 and $2.66 could potentially materialize.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-23 23:11