As an analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The current state of XRP is one that requires careful observation and a nuanced understanding of both technical indicators and broader market dynamics.

As a crypto investor, I find myself in possession of a substantial XRP holding, currently occupying the fourth spot among cryptocurrencies by market capitalization, boasting a whopping $130 billion valuation. Despite this formidable standing, XRP has experienced a 10.4% downslide over the last week, indicative of a consolidation phase following its remarkable surge in November and December. This consolidation is likely a pause before potential further growth.

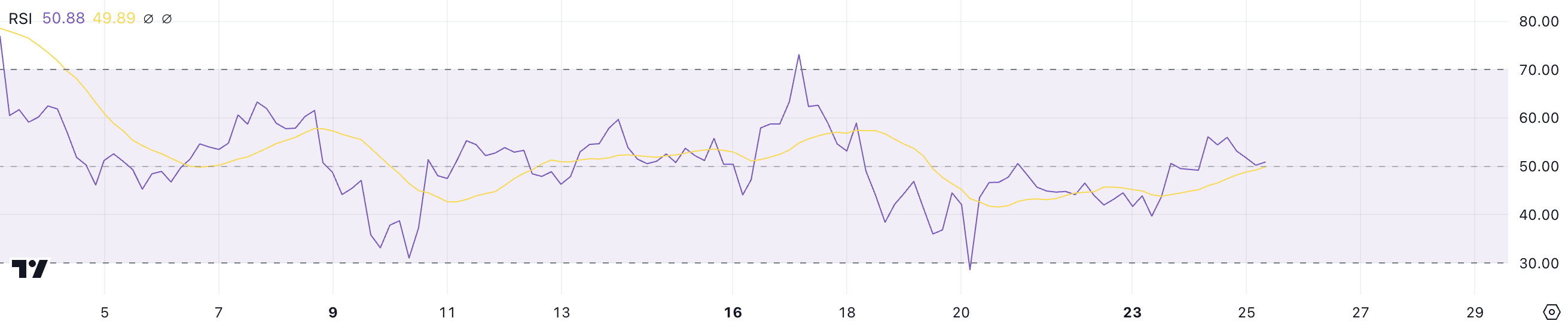

Technical markers such as a balanced Relative Strength Index (RSI) and tightly grouped Exponential Moving Averages (EMA), imply an absence of strong trend direction, hinting at a market that’s waiting for some definitive movement or decision.

XRP RSI Has Been Neutral For 3 Days

Right now, the RSI of XRP stands at 50.88, suggesting a neutral stance as we’ve seen since December 20th. This means that the market is evenly matched, with neither the buyers nor the sellers having a clear upper hand.

After an impressive surge in November and December, XRP’s price is currently in a stage of stabilization. Over the last few days, its Relative Strength Index (RSI) has fluctuated between 40 and 55. This narrow band indicates that the coin is going through a time of decreased price swings, as traders are waiting for a more definitive sign about its future direction.

The Relative Strength Index (RSI) is a tool used to measure the rate and strength of price changes, ranging from 0 to 100. When the RSI value exceeds 70, it usually signals that the market is overbought, potentially leading to a correction. Conversely, an RSI value below 30 indicates the market might be oversold, which could signal an upcoming rebound.

Currently, XRP’s Relative Strength Index (RSI) stands at 50.88, placing it squarely in the neutral zone. This means there’s neither intense buying nor selling activity occurring, indicating a balance. In the immediate future, this steady RSI pattern might lead to continued consolidation of XRP prices unless a significant event triggers to disrupt the current equilibrium.

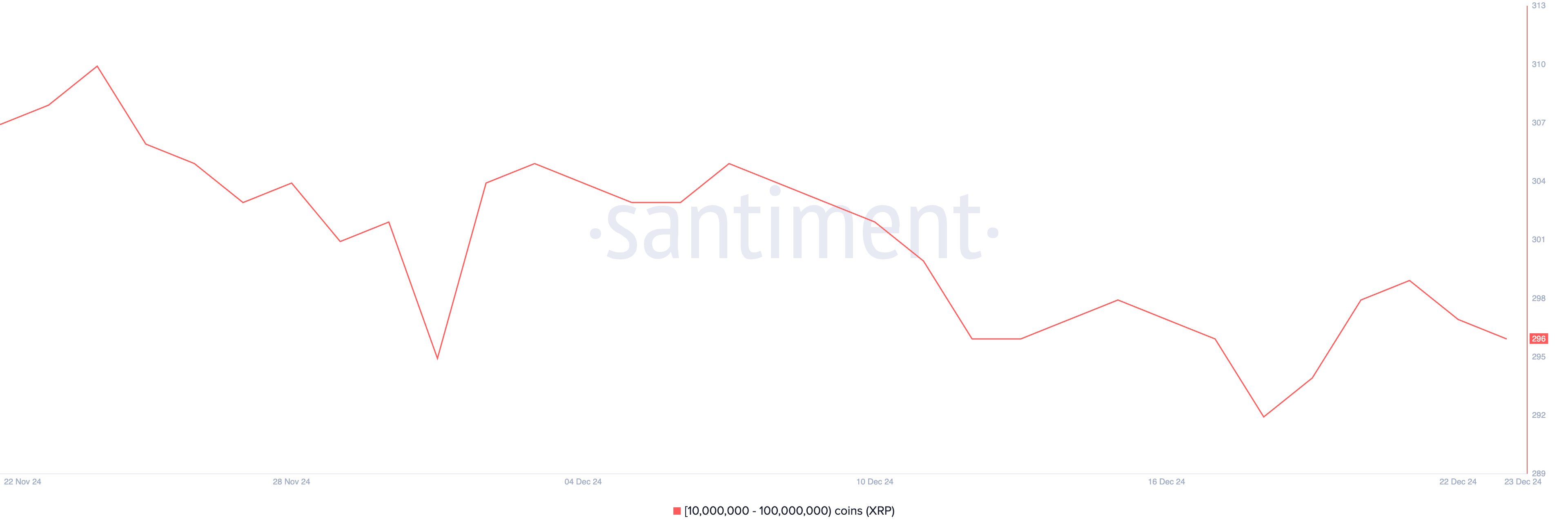

XRP Whales Stopped the Accumulation

On November 24th, the number of large XRP holders (with between 10 million and 100 million XRP) peaked at 310, indicating substantial accumulation among these major investors. However, since then, this count has been decreasing, possibly suggesting a drop in large-scale investment or distribution actions.

During the span of December 18th through December 21st, the number of whales (large investors) increased from 292 to 299, hinting at a surge of interest during that time frame. Yet, since then, the count has dipped slightly, now at 296, which might suggest some uncertainty or selling among significant stakeholders, possibly due to profit-taking or hesitation.

Monitoring whale behavior is essential as these massive entities carry substantial weight in financial markets, capable of impacting trends drastically thanks to their immense assets and potential trades.

Lately, we’ve observed a decrease in the number of whale wallets after a temporary increase. This trend might imply conflicting opinions among large investors. In the near future, this could mean that some whales continue to hold onto their investments while others are selling off, which may result in XRP prices stabilizing or experiencing slight downward pressure.

XRP Price Prediction: Can XRP Fall Below $2 In December?

At the moment, the value of XRP is moving inside a confined area. The upper limit for now seems to be around $2.33, while $2.17 serves as the lower boundary.

Should the backing at $2.17 not hold up, the XRP price might experience a larger retreat, possibly dipping down to around $1.89.

If XRP manages to surpass the resistance level of $2.33, it might open up opportunities for increased growth, potentially reaching towards $2.53 and even $2.64 in the future.

At present, the EMA lines don’t suggest a clear direction, as they are tightly grouped together, signaling a phase of consolidation. This absence of a strong trend implies that XRP’s price fluctuations may primarily hinge on whether it manages to breach this range. Therefore, keeping an eye on these levels is particularly important in the near future due to their potential impact on XRP’s short-term price action.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2024-12-25 18:31