As a seasoned crypto investor with battle-scarred fingers from riding the volatile waves of the cryptocurrency market, I find myself standing at the precipice of another potential downturn – Ripple (XRP) plunging towards the sub-$2 territory. Having seen the rise and fall of numerous altcoins over the years, I’ve learned to read between the lines in technical analysis reports such as this one.

Ripple’s value (XRP) could dip below the $2 mark following a 12% decrease over the last week. Technical signs revealed in recent XRP assessments suggest an increasing bearish trend.

Recently, the value of XRP reached its highest point this year at $2.73, igniting discussions about it potentially reaching $3. However, this forecast might be postponed, and I’ll explain the reasons below.

Ripple Loses Hold on the Upside

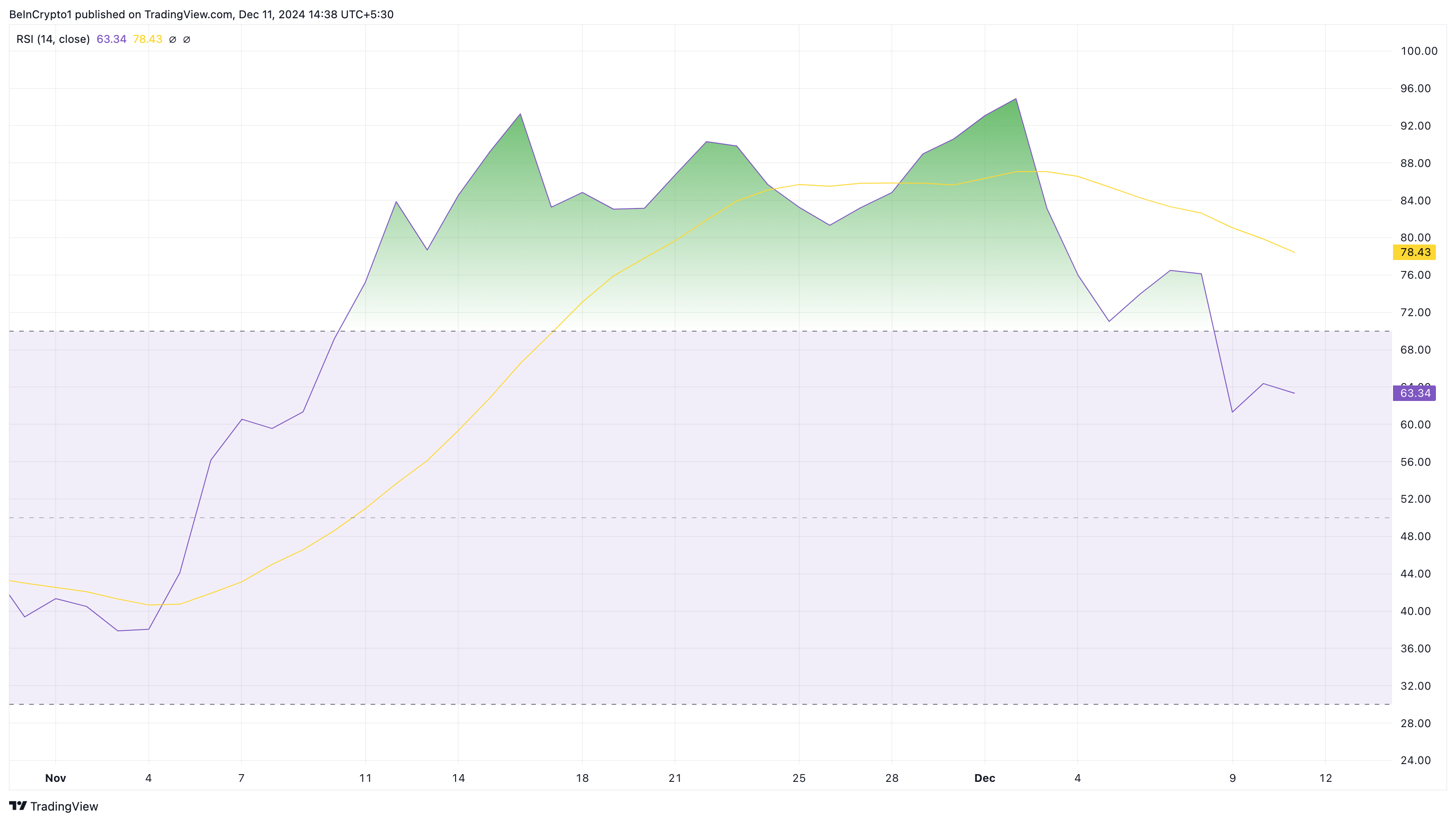

The Relative Strength Index (RSI), a tool that gauges momentum, hints that XRP’s price might decrease. This index helps identify if an asset is either overbought or oversold. When the RSI value exceeds 70.00, it indicates the asset is overbought, and conversely, when it drops below 30.00, it suggests the asset is oversold.

On December 2nd, the Relative Strength Index (RSI) on the XRP/USD daily graph reached 96.25, signaling that the asset was excessively bought, or “overbought.” This peak in value also corresponded with a temporary high for the token.

Currently, our analysis indicates that the XRP price has dipped beneath the 50.00 ‘neutral’ zone, suggesting a shift towards bearish sentiment. Additionally, the trading volume is diminishing, which could potentially lead to further drops in the XRP price, possibly falling below $2.34 in the near future.

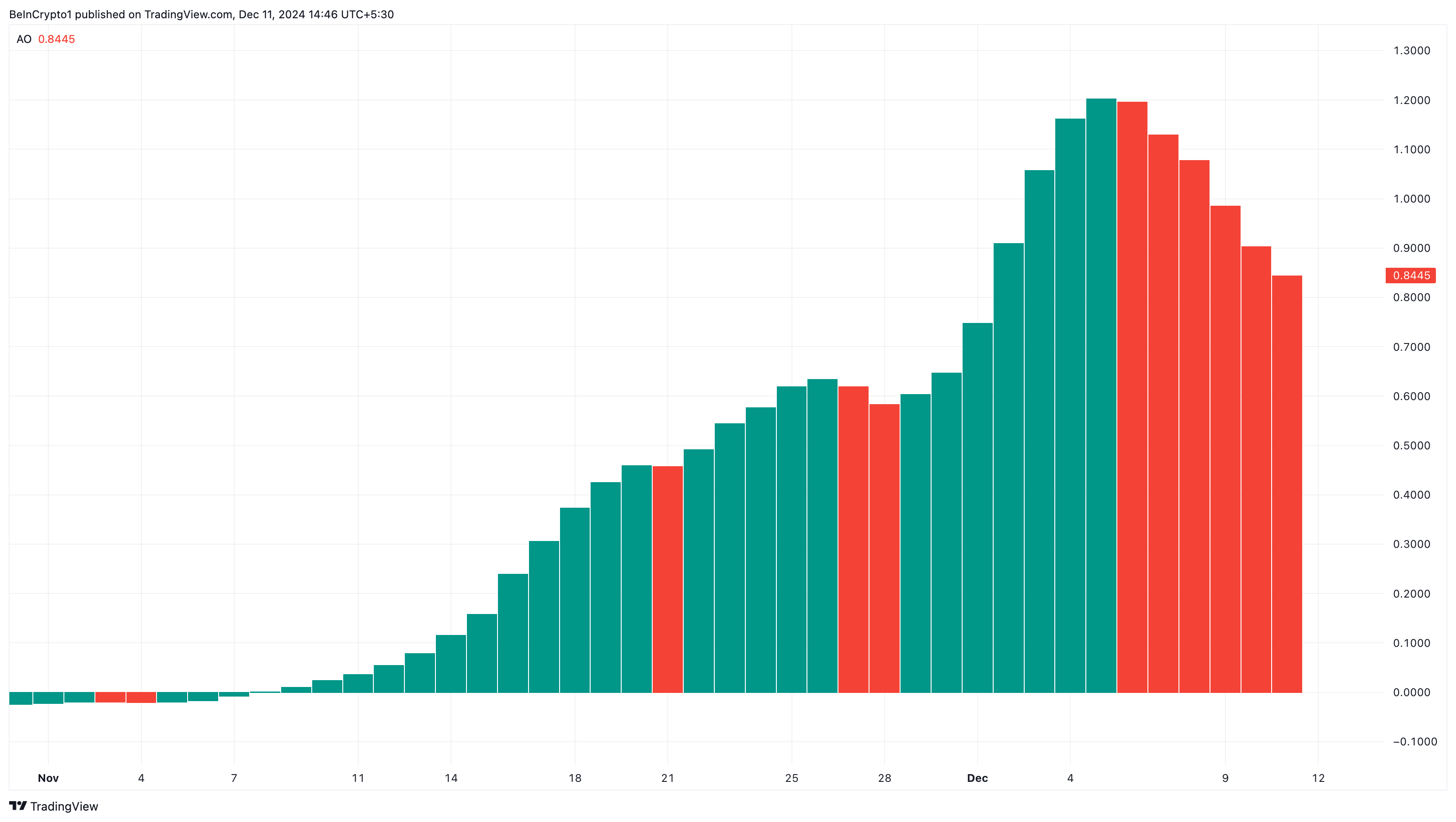

Instead of just the Relative Strength Index (RSI), the Awesome Oscillator (AO) is another tool hinting that XRP could drop beneath its present level. This oscillator measures the market’s momentum by comparing recent price movements with past patterns.

This tool employs a horizontal line at its core, with price fluctuations depicted on both sides. The comparison of two distinct moving averages is used to determine whether the trend is rising (bullish) or falling (bearish). When the AO shows a positive value, it signifies a bullish momentum, while a negative reading indicates a bearish trend.

Currently, the Average Outlook (AO) is optimistic. Yet, it’s displayed red bars on its histogram, which could imply that the bullish energy surrounding the altcoin might be diminishing.

XRP Price Prediction: Lower Lows

On the 4-hour timeframe, XRP is showing a head-and-shoulders configuration. This is a well-known pattern that typically signals a shift from bullish to bearish trends. It includes three peaks: first, a smaller one called the left shoulder, then a larger peak, referred to as the head, and finally, a smaller peak again, known as the right shoulder.

A “neckline” is drawn by connecting the lowest points of the two troughs. The slope of the neckline can be either upward or downward. However, a downward slope typically indicates a more reliable reversal.

Looking at the chart, it appears that XRP’s price has fallen below the neckline at $2.40, suggesting a lack of strong demand. If this downward trend continues without interruption, there’s a possibility that the token could drop to around $1.87. On the flip side, if buying interest rises significantly, XRP could potentially surge towards $2.90.

Read More

2024-12-11 15:12