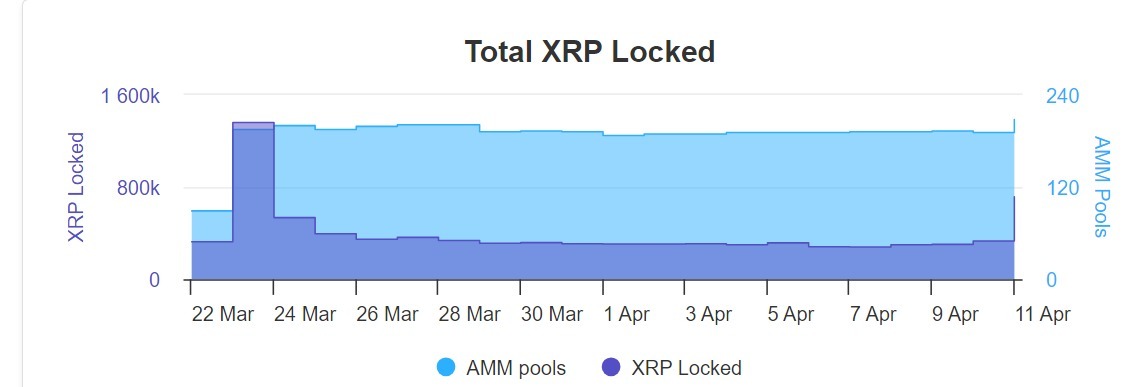

Approximately 330,000 XRP tokens were previously secured on the XRP Ledger’s newly instituted Automated Market Maker (AMM) platform. Recently, this amount has significantly increased to over 715,000 XRP tokens, equating to more than $400,000 in value. Notably, during this period, the AMM platform is undergoing essential bug repairs.

Based on information from XRPScan, the XRP explorer, there has been a significant increase in the amount of XRP held on the Automated Market Making (AMM) platform, as well as an uptick in the number of liquidity pools now available, growing from approximately 193 to 208.

Significantly, the XRP Ledger introduced a significant modification to its newly developed Automated Market Maker (AMM) engine with the release of the “fixAMMOverflowOffer” update. This enhancement was essential as it resolved a technical issue that prevented the AMM from managing sizeable trades on decentralized exchanges (DEXs) operating on the XRP Ledger.

Last month, an amendment known as the AMM update was proposed for the XRP Ledger. This change is noteworthy because it introduces a more automated process for exchanging digital assets and generates earnings by securing assets in liquidity pools. Regrettably, a defect in the initial rollout prevented the AMM from effectively handling larger swap demands.

Additional adjustments such as “fixDisallowIncomingV1” and “fixNFTokenReserve” are being developed, indicating ongoing improvements to the XRP Ledger system.

Liquidity pools, it’s worth noting, are used to settle trades, with the prices of tokens within them being determined through the use ofblockchain oracles.

Supplying liquidity to pools brings about regular income each time a trade is executed using that pool. However, this income comes hand-in-hand with the possibility of impermanent loss. Impermanent loss rears its head when price changes impact the token proportions in the pool, resulting in providers potentially missing out on greater gains if they had just kept their tokens in their personal wallets.

If the tokens lost are temporary, it’s because their proportion can be reestablished. As a result, the fee collector stands to earn the fees accumulated during this period.

Following Ripple‘s announcement about launching a stablecoin with a 1:1 value to the US dollar, which is backed by USD deposits, short-term US Treasuries, and other liquid assets, there has been an increase in the number of XRP tokens being locked.

According to a recent report from CryptoGlobee, the company projects that the total value of stablecoins in circulation will surpass $2.8 trillion by the year 2028. Notably, their own stablecoin is planned for release on both the XRP Ledger and Ethereum platforms.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-04-12 05:09