As a seasoned researcher with over two decades of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The recent surge in XRP‘s price has caught my attention, but as with any investment, it’s essential to consider both sides of the coin.

Over the last month, XRP has seen a remarkable surge of 424%, moving it nearer to its record peak price of $3.31. This substantial rise has sparked considerable interest, suggesting that there may be more growth on the horizon.

Yet, as XRP approaches its all-time high, there are increasingly apparent bearish signs that might complicate its journey towards setting fresh records.

XRP Is Facing Challenges

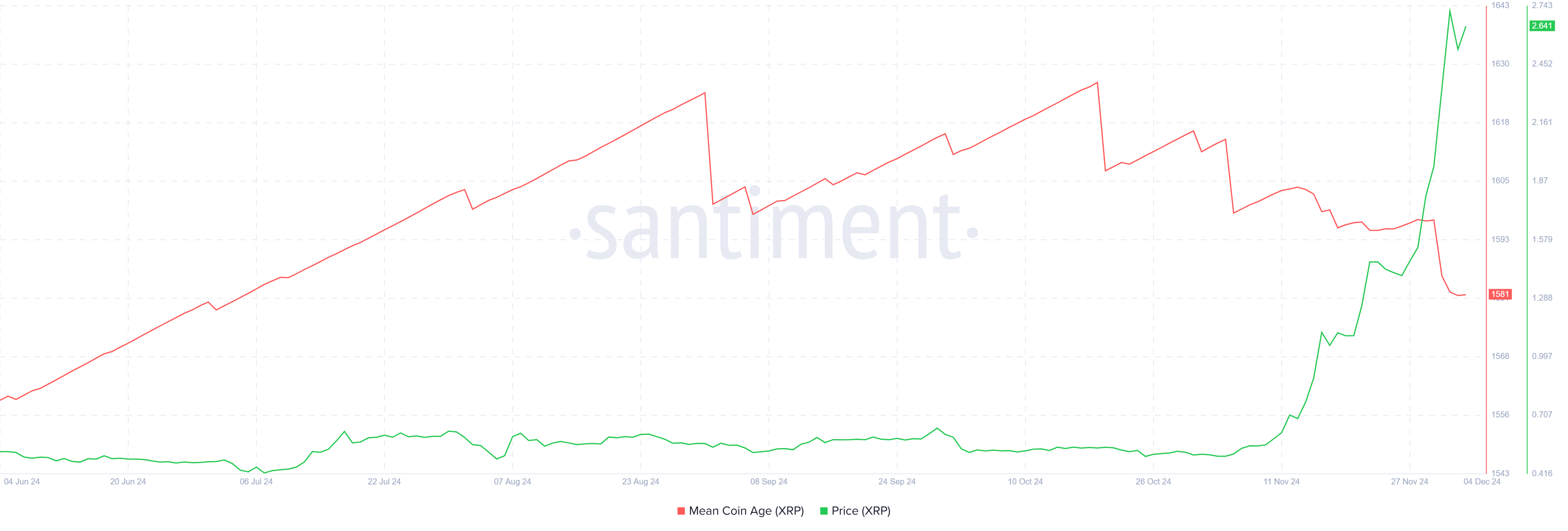

The recent trend in XRP’s market mood shows some worrying patterns, notably with the Mean Coin Age metric, which has persistently dropped. A falling Mean Coin Age usually signals that investors are shifting their XRP holdings instead of keeping them for long-term investment. This indecision is often interpreted as a bearish sign, suggesting that investors might be getting ready to sell off their positions.

A rising average age of coins tends to indicate robust holding patterns, suggesting investors believe the asset will grow in value. But the current trend in XRP suggests a change in attitude, with more people trading instead of holding onto it. If this pattern persists, it might hint that XRP could be approaching a price ceiling as more traders look to cash out their gains.

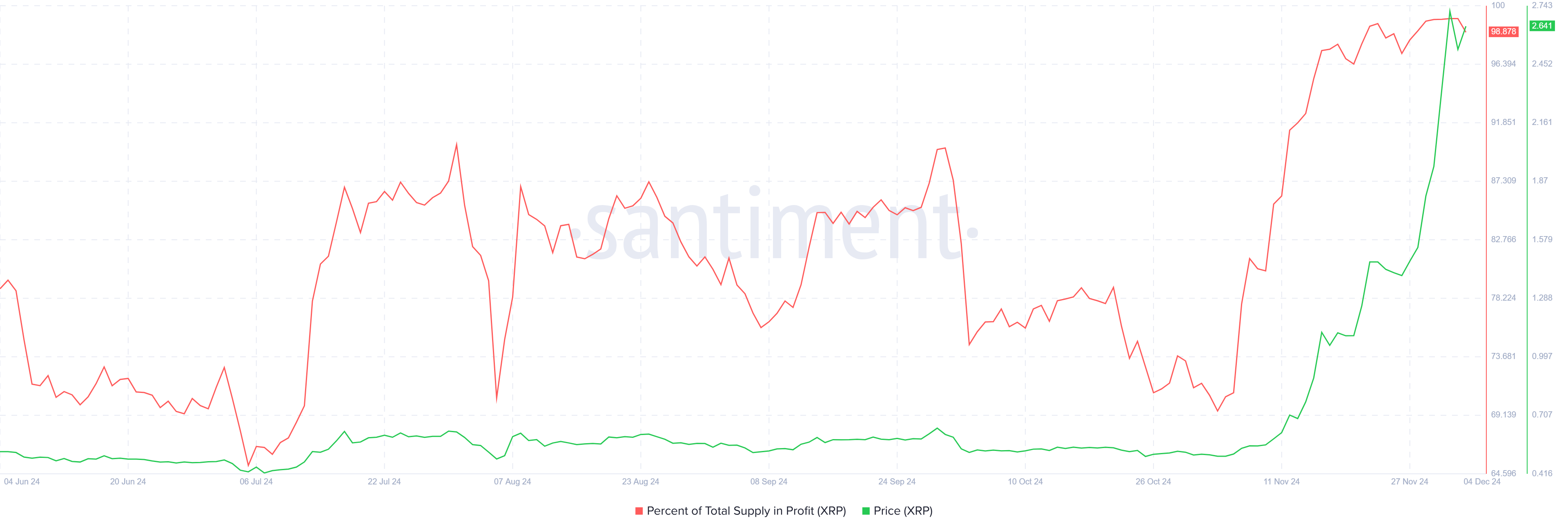

As an analyst, I’m observing that the broader movement of XRP appears favorable, but there are indications of impending saturation. At present, more than 98% of its total supply is in profit, a pattern historically associated with markets approaching their peak.

When more than 95% of the market’s supply is profitable, it can frequently indicate that the market might be nearing the end of its bullish trend. Previously, such high rates of profitability have often signaled market peaks, where prices start to decline following a prolonged period of growth.

A substantial portion of XRP being held at a profit suggests numerous owners are currently profiting, potentially triggering a surge in selling. This increased supply, coupled with pessimistic market feelings, implies the upward trend could be nearing its peak, possibly due to an over-saturation.

XRP Price Prediction: Aiming For ATH

The current price of XRP is approximately 25% shy of hitting a fresh record high around $3.31. This latest price spike has sparked enthusiasm about potential future gains, yet the journey to this new peak might not be smooth sailing. Barriers at crucial points could hinder XRP’s climb, prompting investors to watch for indications of a breakthrough or shift in direction.

Should negative influences persist, like decreasing Average Coin Age and selling pressure from investors, it’s possible that XRP might find it difficult to surpass its All-Time High (ATH). In such a scenario, the digital asset could experience a downturn, attempting to hold at the support level of $2.00 and potentially undoing its recent progress.

If the positive trend persists for XRP, it might exceed its all-time high (ATH) and establish a new maximum price point. It’s essential to keep an eye on the $2.00 support level, as it could help mitigate any abrupt price declines. As long as XRP maintains itself above this level, reaching a new ATH remains possible.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-04 16:23