As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I must say that the recent downturn in XRP‘s price is something I’ve seen before – more than once! The decrease in exchange outflows and the bearish sentiment are clear signs that investors are no longer as eager to HODL XRP.

As a researcher, I’ve noticed an intriguing trend with Ripple (XRP) prices recently. Over the past 30 days, we saw an impressive surge of approximately 350%. However, following this rise, the price has since dipped from its peak of $2.80. This downturn might be linked to a reduction in XRP exchange outflows, as the latest data suggests.

If this trend persists, XRP could lose more of its recent gains.

Ripple Investors No Longer HODLing in Numbers

On December 4th, the amount of XRP withdrawn from exchange platforms totaled approximately 980.65 million units. Currently, that figure has dropped to around 44.17 million, suggesting a decrease of about 936.48 million tokens. This measurement monitors the quantity of tokens removed from exchanges.

If supply remains low (meaning more people are holding onto their cryptocurrency rather than selling), this suggests strong buyer interest and can potentially cause the price of the cryptocurrency to rise. Conversely, an increase in supply (more sellers) might indicate waning bullishness and could potentially lead to a decrease in the cryptocurrency’s price.

Based on today’s price of approximately $2.33 for XRP, the value of the outflows from the exchange in the past 24 hours amounts to about $2 billion. If this outflow trend persists and less XRP is being traded, it could potentially lead to a decrease in XRP’s price as well.

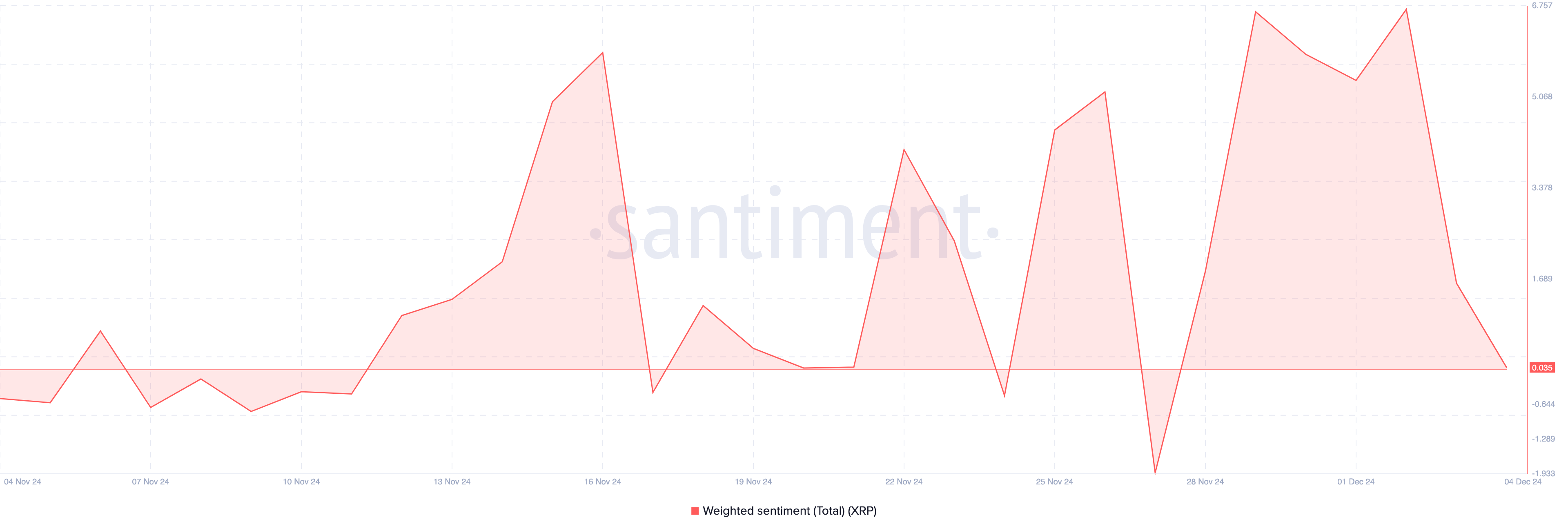

In addition, Santiment indicates that the sentiment towards XRP has noticeably decreased, going from 6.75 to 0.035. Weighted Sentiment is a tool used to measure market opinion, showing whether investors are generally optimistic (bullish) or negative (bearish) about a cryptocurrency.

A rising sentiment indicates growing bullishness and enthusiasm around the token, while a decline points to bearish sentiment, signaling reduced confidence or negativity in the market. If this trend persists, it could dampen demand for XRP, potentially leading to a price decline as market interest wanes.

XRP Price Prediction: Time to Drop Below $2?

Looking at a day-by-day perspective, XRP has displayed three successive red candles, suggesting increased selling activity for this altcoin. Upon closer examination, it’s clear that the trading volume associated with this cryptocurrency is dwindling.

Essentially, the high volume indicates that there’s been more activity in selling compared to buying. If this trend persists, it could lead to a further decrease in XRP’s price. However, if the data holds and the outflow from XRP exchanges decreases, the value might dip down to around $1.90.

If the market takes a pessimistic turn, the value of this altcoin may fall as low as $1.46. But if there’s an uptick in outflows from the exchange once more, it could potentially boost the price back up to around $2.90.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

2024-12-05 22:55