Behold, the specter of financial ambition haunts the corridors of Wall Street, where the humble XRP ETFs, those modern-day alchemists, have forged a pact with the devil of liquidity. In this age of madness, where numbers reign supreme and souls are bartered for dividends, the altcoin has been anointed with the holy oil of capital, its value swelling like a fevered dream.

Yet, lo! The first day of sorrow arrived, a black mark upon the ledger of progress. But fear not, for even in this abyss of despair, the XRP ETFs ascended to new heights, their weekly trading volume a testament to the fickle nature of human desire-double the previous week’s folly, a mere whisper compared to the grandeur of December’s prior triumph. Is this not the tale of our time? A tale of hubris, of fleeting glory, and of markets that dance to the tune of chaos?

XRP Funds Post $219M Trading Volume In Past Week

Behold the numbers, O ye mortals! The XRP ETFs, those harbingers of fortune, have etched their name into the annals of financial history with a weekly trade volume that rivals the delirium of a man possessed. A mere $219 million, yet it is a beacon in the dark, a flicker of hope in a world where every drop of gold is a dagger to the heart.

But lo, the past is but a shadow, and the present a cruel jester. The previous record, a feeble $213.9 million, now a relic of bygone days, as if the very fabric of time had been unraveled. What madness drives the investor’s soul, this insatiable hunger for XRP, even as the broader crypto market crumbles like a house of cards?

And thus, the XRP ETFs, that most enigmatic of beasts, stumbled upon their first day of sorrow, a net outflow of $40.8 million, a wound upon the flesh of their glory. Yet, like a phoenix, they rose from the ashes, their weekly tally a triumph of resilience, a testament to the absurdity of human endeavor.

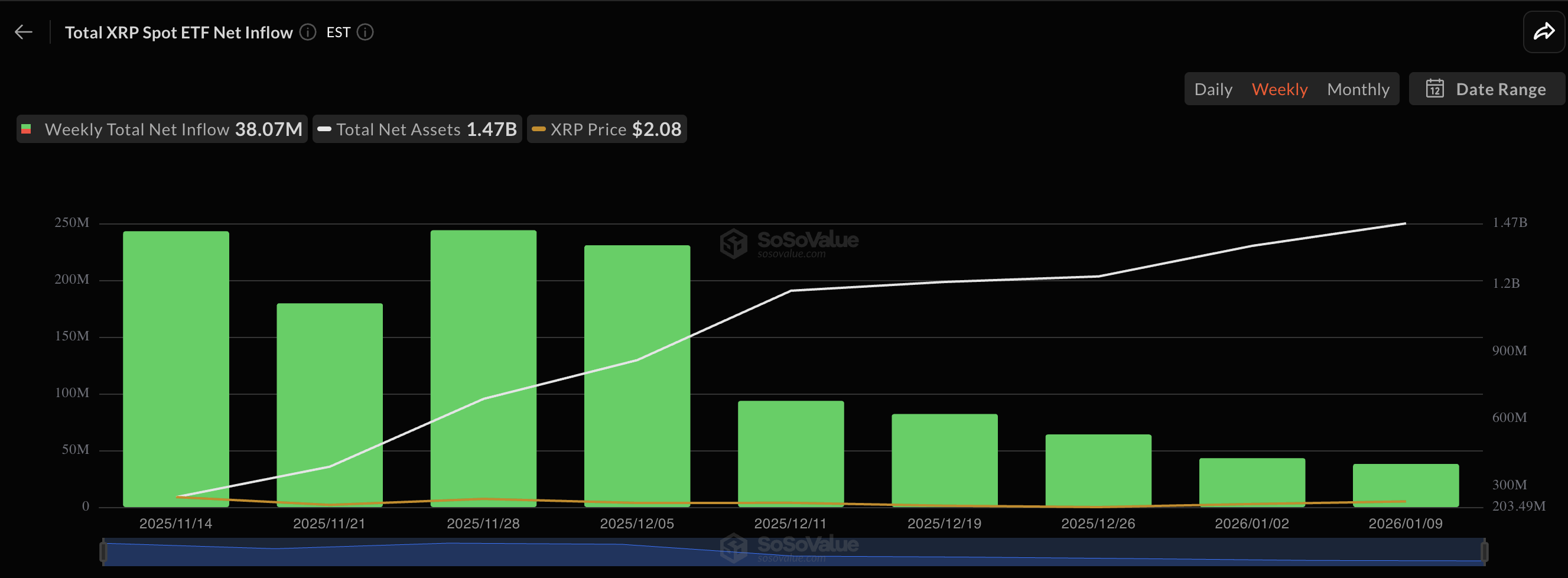

Behold, the data from SoSoValue, a oracle of truth, reveals that the XRP ETFs, those modern-day prophets, have seen an additional $38.07 million in their coffers. Yet, the chart, that cruel judge, shows a steady decline, a slow descent into the maw of oblivion. Is this not the fate of all who chase the mirage of wealth?

As of this writing, the XRP ETFs have amassed a total net asset of $1.47 billion, a sum that would make a king weep. Canary Capital’s XRPC, that paragon of virtue, leads the pack with $375.1 million, while Bitwise and Franklin Templeton follow, their AUM a testament to the greed of the masses.

XRP ETFs Shine While Crypto ETF Market Flounders

Yet, the XRP ETFs, those steadfast warriors, stand alone in their triumph, while the Bitcoin and Ether ETFs, those once-great titans, falter like the weak of heart. The combined withdrawals of $749.6 million, a wound deeper than the grave, a testament to the folly of those who placed their faith in the wrong gods.

Behold, the spot Bitcoin ETFs, those fallen angels, saw their largest single-day outflow of $486.1 million, a day of reckoning. Their weekly tally, a net outflow of over $681 million, a dirge for the hopes of the uninitiated.

And the Ethereum ETFs, that once-bright star, began with a glimmer of hope, inflows of $168.1 million on January 5, a fleeting promise. Yet, in the end, they too succumbed, their weekly tally a net withdrawal of $68.6 million, a cruel irony for those who dared to dream.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2026-01-11 20:13