TL;DR (Too Long; Didn’t Read, darling):

- The XRP army, bless their optimistic hearts, are pinning all their hopes on a Ripple ETF. After all, what else is there to do after a lawsuit that may or may not be concluded?

- Alas, some rather cynical traders are still betting against XRP. Honestly, who can blame them? 🤷♀️

ETF Hopes on the Rise (or Are They?)

The approval of Bitcoin and Ethereum ETFs was all the rage last year, naturally leading every other altcoin to dream of their own financial parade. The rise of Trump only fueled the delusion that even the smallest cryptos would be embraced by institutional investors. One can always dream, can’t one? ✨

XRP, being the third-largest non-stablecoin cryptocurrency, is naturally at the front of the queue. Apparently, about ten financial companies are clamoring to launch these products in the United States. The enthusiasm is almost touching. 🙄

The US SEC, in its infinite wisdom, has acknowledged most of these applications. Polymarket suggests a 77% chance of approval in 2025 (but only 29% by July 31st). Such certainty! How utterly thrilling. 🗓️

Crypto analysts, in their boundless optimism, believe the (still not entirely official) closure of the SEC case will pave the way for an XRP ETF. Some even think these financial vehicles could be the next catalyst for major gains. Others, with a more refined sense of drama, suggest ignoring several glaring warnings. ⚠️

Options Market Is Bearish (Told You So)

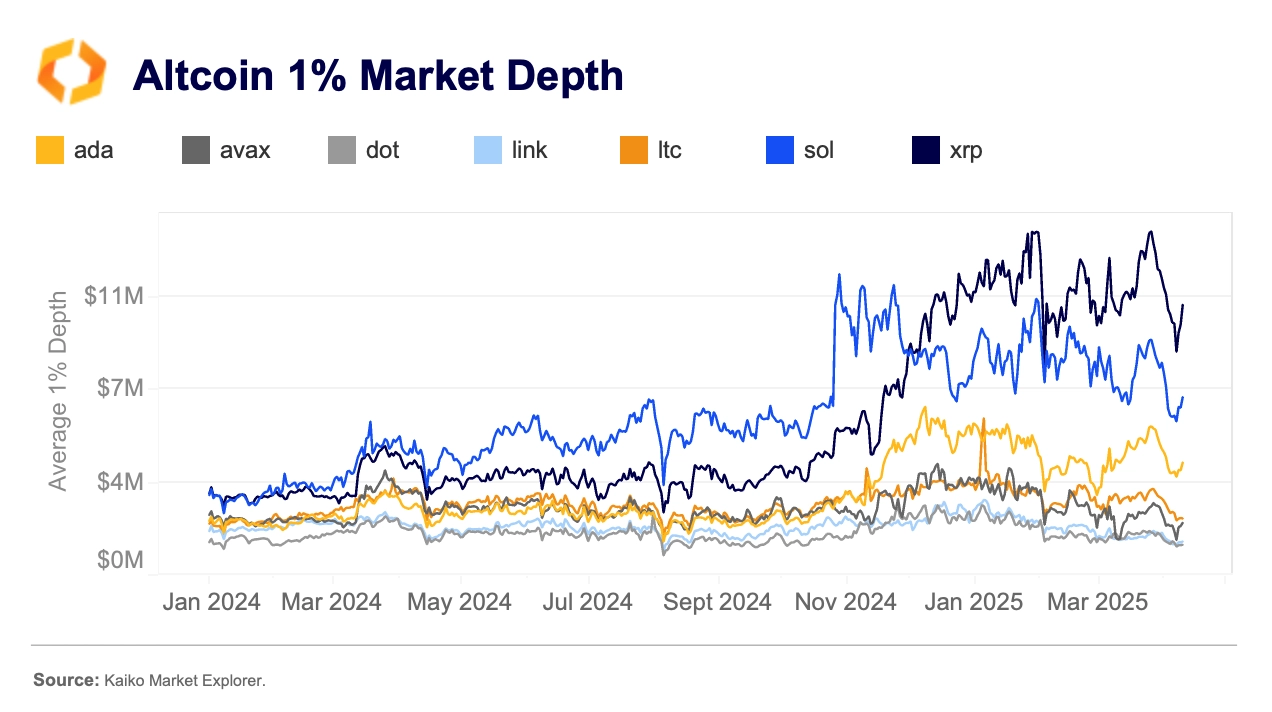

Kaiko’s report highlights the “substantial liquidity” of XRP and SOL. They have “the highest average 1% market depth.” Which is a fancy way of saying they are popular, darling. 💅

XRP’s market depth exploded in late 2024, driven by the hopes of regulatory changes. How delightfully naive! It surpassed SOL and doubled that of ADA, ranking third among the ETF hopefuls. 🎉

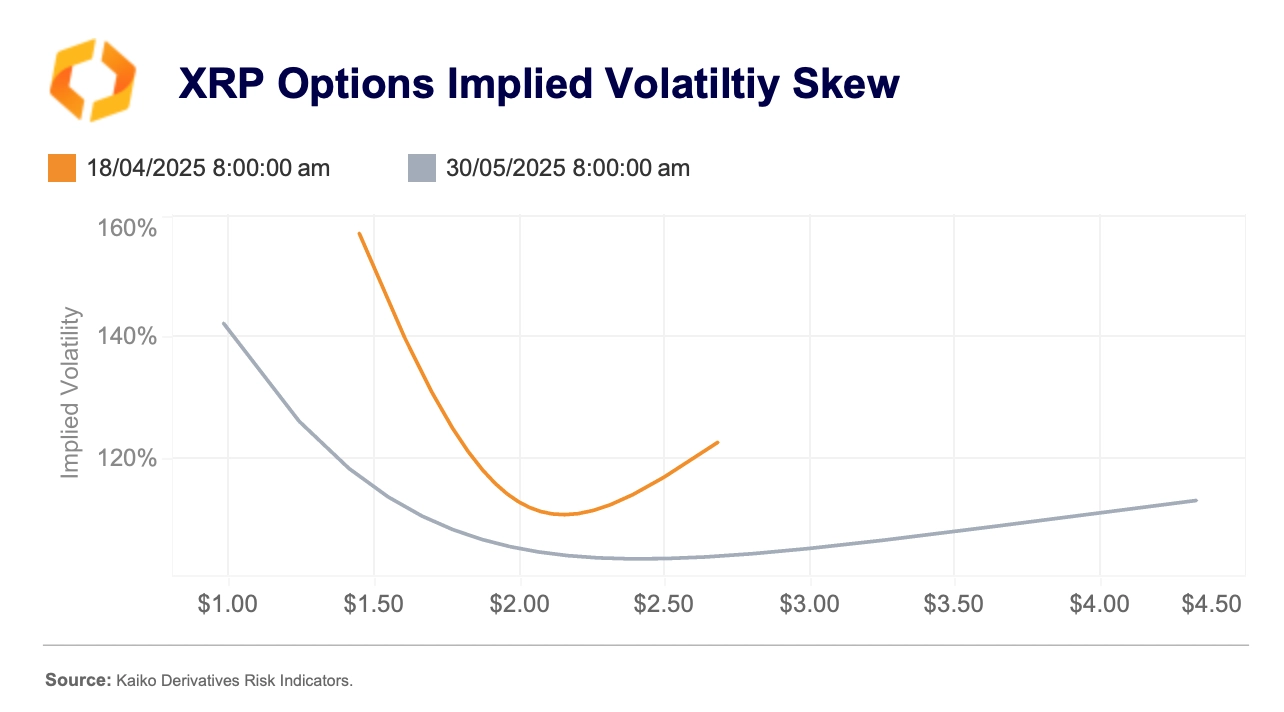

Despite the XRP ETF anticipation and Ripple’s developments, which include a $1.2 billion prime broker acquisition, the options market on Deribit is “skewed bearish.” As if anyone is surprised. 🐻

Kaiko said the volatility smile for the April 18 expiration is “heavily to the left,” signaling “demand for downside protection.” In other words, people are expecting the worst. ⛈️

However, the report explains this bearish outlook is “likely linked to broader market uncertainty due to macroeconomic concerns.” Because, of course, it’s never just about XRP, is it? 🌍

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-04-17 17:08