Over the last week, XRP‘s price has surged by 14%, but it appears to be in a holding pattern now, oscillating between $2.34 and $2.46 for the past six consecutive days. This prolonged phase of sideways movement indicates a balanced market opinion, where neither the bulls nor the bears are dominating the market.

The quantity of XRP holders possessing between 10 million and 100 million coins has remained consistent since December’s end, which suggests a balanced market situation. But if bullish trends intensify, XRP might surge and aim for notable upward movements, with $2.72 and $2.9 as potential upcoming milestones.

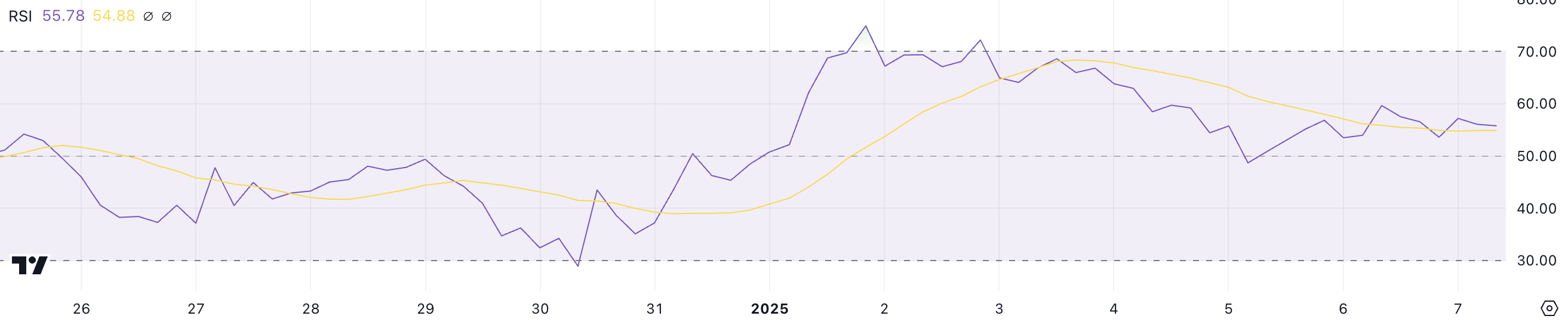

XRP RSI Is Currently Neutral

The current Relative Strength Index (RSI) for XRP is at 55.7, indicating a level of moderate market momentum. RSI is a technical analysis tool that gauges the rate and intensity of price fluctuations between 0 and 100, assisting traders in determining whether an asset might be overbought or oversold.

In simpler terms, when the RSI (Relative Strength Index) of a financial instrument like XRP exceeds 70, it often means the market is overbought and could experience a downturn or pullback. On the other hand, if the RSI falls below 30, it might signal an oversold situation, potentially leading to a price increase or rebound. As for XRP’s RSI since January 3, it has been in the neutral zone, suggesting that buying and selling forces are evenly balanced.

Right now, the Relative Strength Index (RSI) for XRP indicates a period of stability, where neither buyers (bulls) nor sellers (bears) have a clear upper hand in the market.

To continue moving upwards, the Relative Strength Index (RSI) should approach the region that indicates excessive buying, suggesting more robust purchasing power. On the other hand, if the RSI starts to decrease, this might indicate waning optimism and possibly a minor correction.

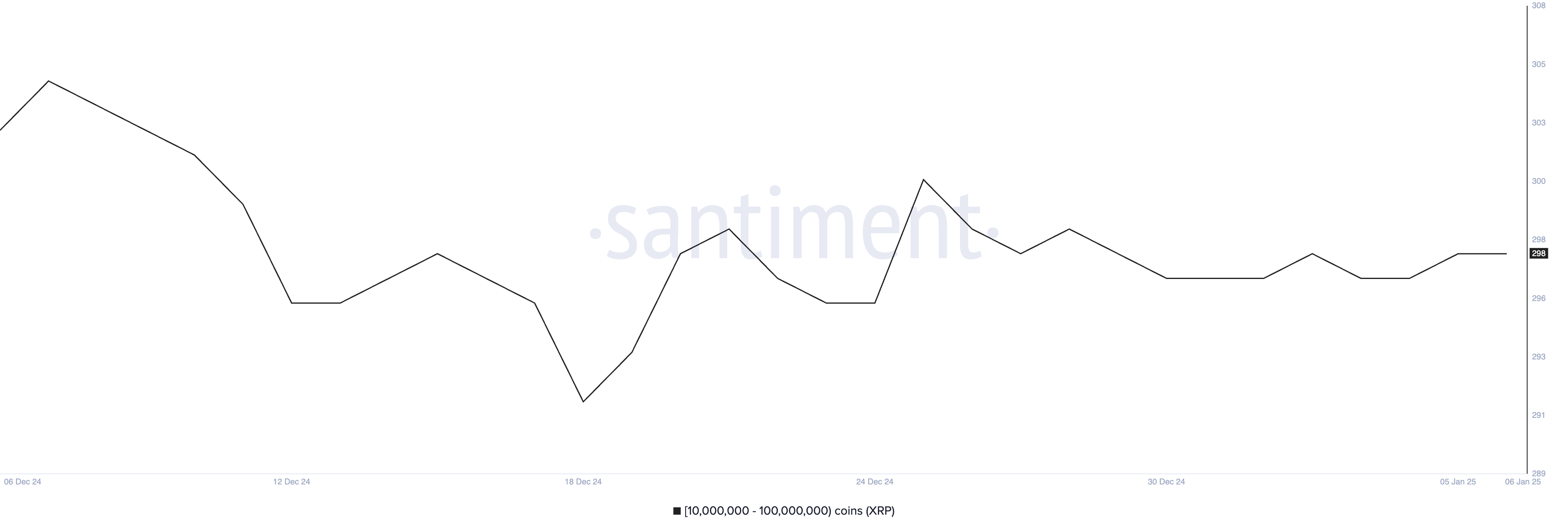

XRP Whales Has Been Stable Since the End of December 2024

As an analyst, I’ve noticed some notable volatility in the number of XRP whales holding between 10 million and 100 million coins. Reaching a peak of 305 whales on December 7, the count has since dropped dramatically to a monthly low of 292 on December 18.

After that incident, there’s been a slight improvement and it’s remained relatively stable at approximately 298 since December 27. Keeping tabs on whale behavior is essential as they, being major players, can substantially impact market patterns by either buying or selling in large quantities.

Over the last fortnight, the consistent increase in whale populations might be pointing towards a phase of market stabilization. This could imply that significant investors are not showing excessive buying or selling activity, suggesting a balanced outlook.

In simpler terms, the stability in XRP’s price right now might suggest less price fluctuation in the immediate future, since big investors (whales) aren’t making significant moves that would normally cause price swings. But if we see these whales becoming more active again, either buying or selling a lot of XRP, it could indicate the start of a new trend.

XRP Price Prediction: Can It Rise 20%?

Over the last six consecutive days, XRP’s value has been confined to a limited fluctuation, oscillating between a ceiling at approximately $2.53 and a floor around $2.33. This price pattern suggests that the market is uncertain about its direction, as it waits for a significant push in either direction.

As a researcher, I’ve identified potential support for XRP at the $2.33 level. If this support is breached in future price movements, it may signal a continued downtrend. The next significant levels of potential resistance that could halt or reverse this trend are at $2.13 and $1.96 respectively. Therefore, if the support at $2.33 fails to hold, XRP might experience further downside towards these levels.

For the XRP chart, the EMA lines suggest a state of indecision, as they’re not clearly pointing to an upward or downward trend currently. Yet, should bullish strength reappear, the XRP value might challenge the resistance level around $2.53.

If we see a strong move beyond the current price point, it might lead to additional growth, potentially reaching $2.72 and even $2.90. This would represent an approximate increase of 20.3%. The direction this will go depends on who, between buyers and sellers, takes charge in the upcoming period.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-08 02:06