As a seasoned crypto investor with battle-tested nerves, I have learned to read between the lines and decipher the subtle signs that often precede market movements. The recent dip in XRP‘s price below $2 was enough to make any investor sweat, but the quick rebound it has shown since then is a testament to its resilience and potential for growth.

On December 10th, the price of Ripple (XRP) dropped briefly below $2, leading some to think that its upward trend could be coming to an end. However, these pessimistic thoughts didn’t last long. In fact, XRP has experienced a significant recovery, rising by approximately 8% over the past 24 hours.

It’s worth noting that some lesser-known signs point towards a possible continued upward trend in XRP this year. Let me explain.

Ripple Stakeholders Send More Tokens into Circulation

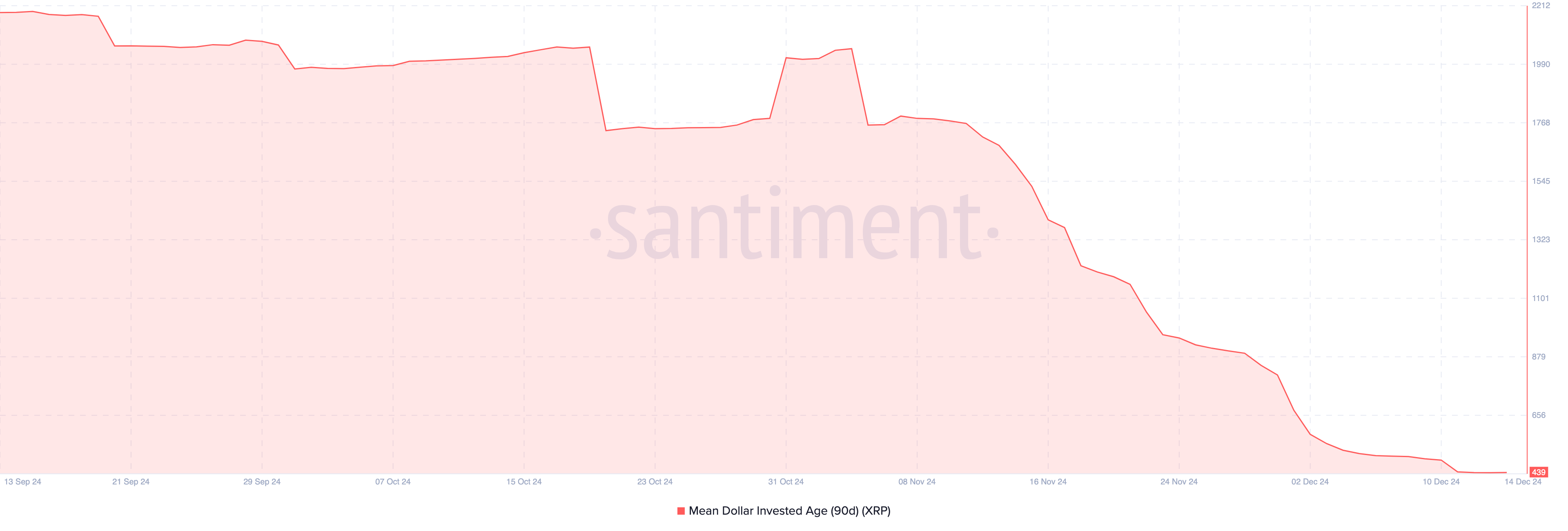

The Mean Dollar Invested Age (MDIA) is an on-chain metric that suggests XRP’s price could continue to trade higher. MDIA represents the average age of all tokens on a blockchain, weighted by their purchase value.

A growing Media Domestic Investment (MDI) suggests that significant coins have been held by major players without much movement. In the past, this lack of activity has made it challenging for an altcoin’s price to build momentum. At present, XRP’s MDI is remarkably low, suggesting a resurgence of previously inactive assets. This metric, representing the median age of exchanged tokens, implies that dormant coins are being circulated again.

As a crypto investor, I find it intriguing when the Market-Cap-to-Daily-Transaction-Value (MDIA) ratio dips low. Unlike a high MDIA suggesting stagnation, a low one is seen as a bullish signal. This decrease indicates that dormant XRP tokens have re-entered circulation, which in turn boosts trading activity and enhances liquidity.

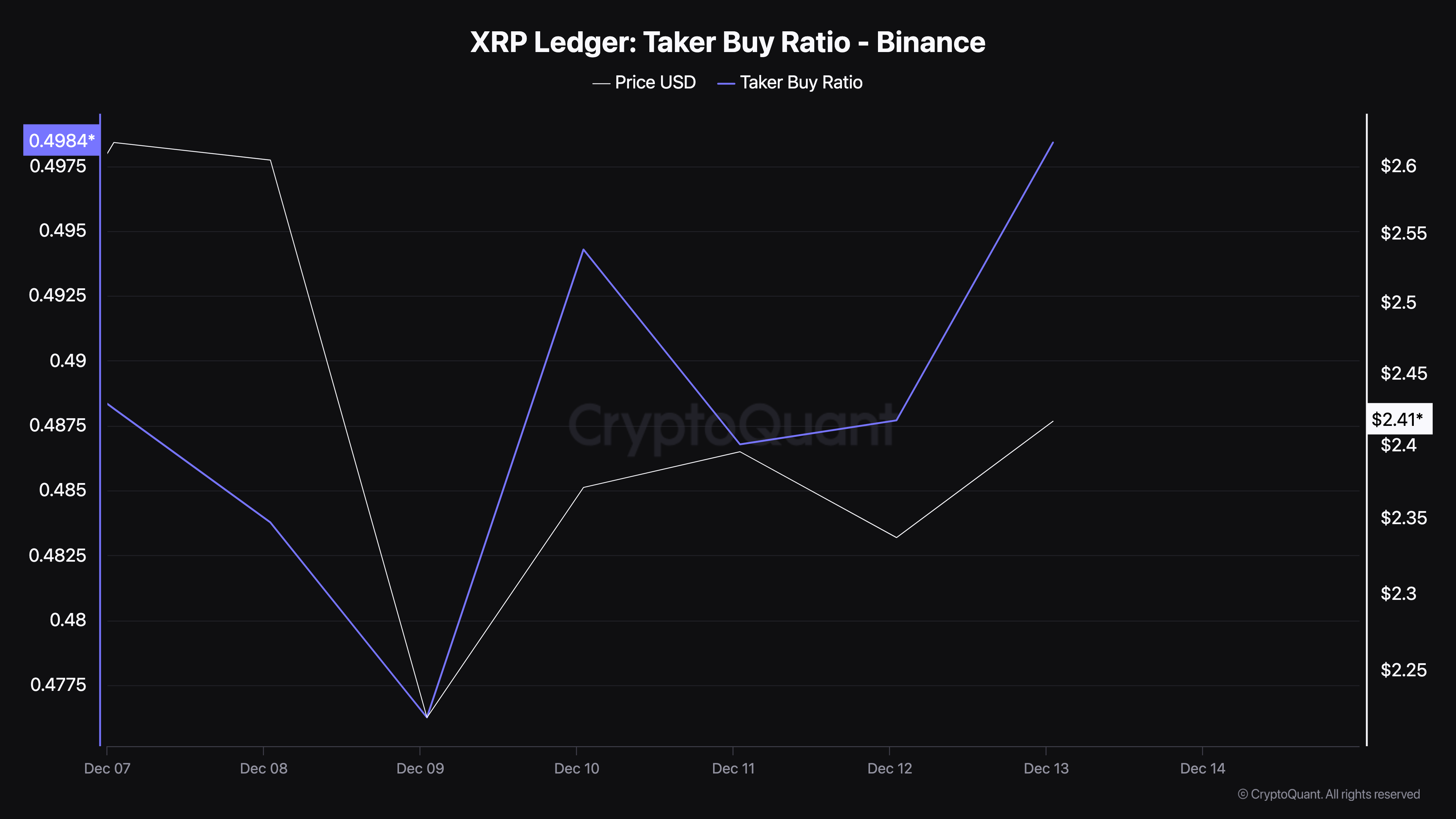

Beyond Media and Traditional Digital Assets, the Ratio of Orders Filled (Taker Buy Ratio) hints at possible additional increases in the value of XRP. This metric quantifies the percentage of buy orders executed against the overall number of transactions in the derivative trading market.

When the Taker-Buy Ratio surpasses 0.5, it indicates an increase in bullish sentiment, suggesting that buyers are starting to dominate the market. As per CryptoQuant’s data, this ratio has risen to 0.55, signaling a substantial boost in buying pressure surrounding XRP.

If the current pattern persists, it might suggest robust market confidence, which could propel XRP to unprecedented pricing heights in upcoming trading periods. Conversely, falling beneath that threshold suggests pessimism among traders, necessitating vigilance.

XRP Price Prediction: Bulls Are in Control Again

In the context of a 4-hour timeframe on December 12, the value of XRP dipped momentarily below both its 20 and 50 Exponential Moving Averages (EMA). The EMA serves as a tool for identifying trends in the market.

When the cost dips beneath these markers, it usually points towards a bearish phase, whereas climbing beyond them suggests a bullish surge. The latest drop in price for XRP seems to hint at a possible additional correction.

Currently, the bulls are once again in charge, causing the price to rise above those levels. This change suggests a resurgence of bullish energy, hinting at a possible increase in XRP’s value to around $2.90 in the near future.

If the demand for purchasing increases significantly, there’s a potential for the price to reach around $3.50. Conversely, should the number of inactive tokens entering circulation decrease noticeably, it could lead to a drop in price, potentially taking it down to $1.93.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-14 13:11