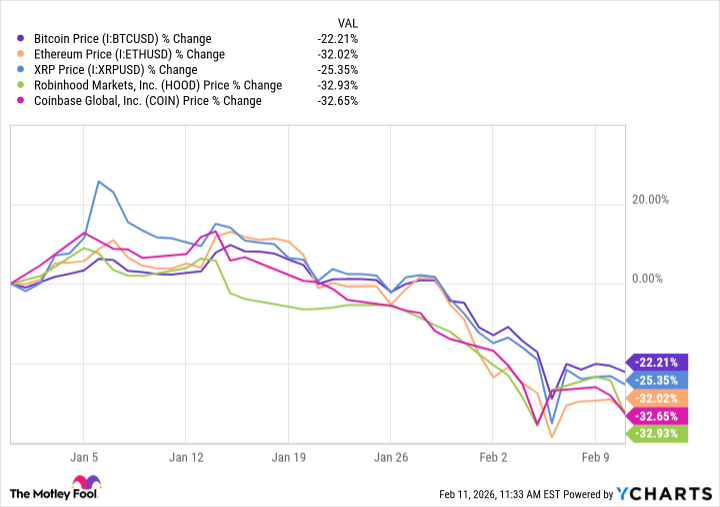

Early into 2026, capital allocation within the growth sector demonstrates a discernible shift. While certain segments of the artificial intelligence ecosystem have experienced recalibration, speculative positions within the cryptocurrency asset class are undergoing a more pronounced correction. This dynamic necessitates a rigorous reassessment of risk-adjusted return profiles.

Year-to-date, XRP has experienced a decline of approximately 25%. The question for investors is whether this represents a transient correction or the commencement of a sustained downtrend.

Current Market Conditions

The prevailing crypto market weakness extends beyond established assets such as Bitcoin and Ethereum, impacting even smaller-capitalization altcoins like XRP. This broad-based correction suggests systemic factors are at play, rather than company-specific issues.

A primary driver of this liquidity rotation is the heightened investor interest in the AI-driven infrastructure supercycle. The scale of potential monetization within this sector – encompassing technology, energy, and associated infrastructure – is drawing capital away from the more volatile cryptocurrency space.

Macroeconomic headwinds, including geopolitical instability and uncertainty surrounding Federal Reserve policy, further exacerbate the situation. Investors are exhibiting a preference for perceived safe-haven assets, notably gold, as a means of mitigating risk.

XRP: Valuation and Prospects

As of February 11, XRP trades at $1.35, representing a market capitalization of $82 billion. While Ripple has demonstrated a capacity for integrating XRP into its payments network, and challenging existing cross-border transaction infrastructure like SWIFT, these achievements must be considered within the broader market context.

The current environment highlights a potential disconnect between demonstrated utility – which XRP possesses – and prevailing market sentiment. Periods of macroeconomic uncertainty often prioritize capital preservation over speculative ventures, leading to outsized selling pressure as investors reallocate to more resilient assets.

Continued downward pressure on XRP’s price would suggest that the market perceives the token’s product-market fit as insufficient to justify a premium valuation. Investors appear to be increasingly evaluating XRP as a fintech entity, demanding consistent growth in market share and demonstrable real-world adoption.

Outlook and Risk Assessment

The likelihood of XRP commanding a significant premium appears to be diminishing. While future price appreciation is not precluded, a normalization of valuation in the near term is the more probable scenario. A continuation of the downward trend throughout 2026 is a distinct possibility.

By year-end 2026, XRP could trade at $1 or lower. At that level, a position might be considered, predicated on a long-term view of XRP as a utility or infrastructure play, rather than a purely speculative asset.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-16 07:02