Right. XRP. Let’s talk about it, shall we? It had a little wobble this summer – dipped below $2 after flirting with $3.50. Painful if you bought the peak, obviously. But honestly, if you’re timing the market with crypto, you deserve a bit of pain. It’s like expecting a free lunch in a casino. Still, there are a few souls out there, the early adopters, who are currently looking at their screens with a sort of smug satisfaction. I’m not jealous. Much.

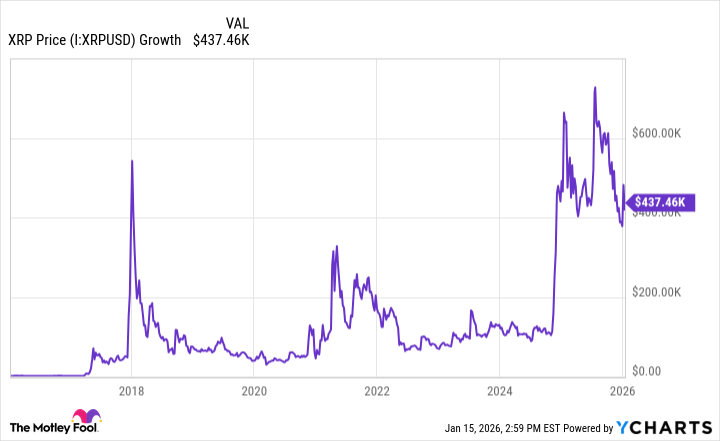

Because, let’s be real, ten years ago, XRP was basically pocket change. January 2016. A grand – a whole thousand dollars – would get you… well, a lot of XRP. Enough to be currently looking at a portfolio worth… are you ready for this?… $437,460. Yes, you read that correctly. I’m starting to question my life choices, frankly. I invested that much in a sourdough starter once. Don’t ask.

It’s a remarkable story, I’ll give it that. A truly exceptional decade for anyone who happened to be in the right place at the right time. But history, as I’ve learned – and believe me, I’ve spent a lot of time sifting through the wreckage of past booms and busts – rarely repeats itself exactly. Especially not in crypto. The laws of physics are one thing, the whims of Twitter are quite another.

XRP rose nearly 44,000% in a decade

The recent 40% drop from its July high isn’t a blip. It’s a reminder. A very expensive reminder for some. The thing is, the technology itself – the stuff about facilitating faster, cheaper international payments for banks – is…fine. Perfectly useful. But usefulness doesn’t automatically equate to a skyrocketing valuation. I’ve seen plenty of perfectly useful companies languish. It’s the hype, isn’t it? That intoxicating, irrational exuberance. And we all know how well that usually ends.

I’m not saying XRP is going to vanish overnight. Banks aren’t exactly rushing to abandon useful tools. But I suspect that the easy money has been made. The days of 44,000% gains are, shall we say, behind us. And frankly, that’s probably a good thing. A little bit of reality in a market built on dreams and algorithms? I’ll take it. Now, if you’ll excuse me, I need to go check on that sourdough starter. It’s probably worth more than my car at this point.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-19 05:12