Cathie Wood. The name itself conjures images of a woman staring directly into the abyss of future tech, and occasionally, falling in. CEO and chief investment officer of Ark Investment Management – a firm that makes betting on long-shot technology look like a perfectly reasonable Tuesday – has been amassing Tesla (TSLA) shares like a desperate man hoarding canned goods before a nuclear winter. Which, frankly, depending on your perspective on Elon Musk’s timelines, isn’t entirely irrational.

The question isn’t *if* Wood is buying, but *why*? And, more importantly, is she seeing something the rest of us, dulled by the grey monotony of quarterly reports, are missing? Or is this just another glorious, high-stakes gamble fueled by pure, unadulterated faith – and probably a lot of caffeine?

The Numbers. Raw and Unsettling.

Wood, unlike the vast majority of the pin-striped crowd, actually *tells* us what she’s doing, day by day. It’s a public confession of sorts. A meticulously documented descent into speculative madness. Here’s the recent Tesla haul, laid bare:

| Date | Shares Bought |

|---|---|

| July 11 | 59,705 |

| July 15 | 115,380 |

| July 24 | 143,190 |

A grand total of 318,275 shares, funneled into the Ark Innovation, Ark Next Generation Internet, and Ark Autonomous Technology & Robotics ETFs. Almost a quarter of a million shares vanishing into the digital ether. It’s a power move. Or a psychotic break. Jury’s still out.

The Robotaxi Mirage

Look, Tesla makes electric cars. Good ones. Decent ones. But the ENGINE driving this buying frenzy ISN’T cars. It’s the phantom limb of the future: the robotaxi. Musk, of course, has been painting this picture for years – a world overrun by self-driving Tesla fleets, churning out cash like a digital printing press. A world where *you* are the product, being quietly and efficiently ferried around in a metal box.

Wood, bless her heart, is ALL IN on this delusion. Ark’s $2,600 price target for Tesla isn’t based on current earnings, or even plausible projections. It’s based on the ASSUMPTION that Musk can actually pull this off. It’s a valuation built on HOPE and algorithms, a terrifying combination. And let’s be honest, when you start building your forecasts on the dreams of a man who regularly promises things he can’t deliver, you’re essentially gambling with other people’s money. It’s a strange and dangerous game.

Competition is brewing, naturally. Waymo (Alphabet) is chugging along, Uber is making deals with… well, everyone. But Musk, fueled by sheer audacity and a complete disregard for conventional wisdom, insists he’ll have autonomous ride-hailing operational across HALF THE UNITED STATES by the end of the year. HALF. THE. COUNTRY. This, friends, is either breathtaking genius or a spectacular act of self-deception. Probably both.

“I think we will probably have autonomous ride-hailing in probably half the population of the U.S. by the end of the year,” Musk declared with the serene confidence of a prophet – or a man who’s spent too long in a pressurized metal tube hurtling through space. It’s exactly this kind of wild-eyed optimism that attracts investors like Wood. They don’t care about present reality; they’re chasing a future that may never arrive.

And that’s the crux of it. Wood isn’t privy to secret intel. She’s not smarter than Wall Street. She’s simply willing to believe in the impossible, to bet against the odds, to embrace the chaos. It’s a risky strategy, but one that has, at times, paid off spectacularly. The real question is: when does the music stop?

To Buy, Or Not To Buy? A Question for the Ages (And Your Therapist).

Valuing Tesla is like trying to nail Jell-O to a wall. It’s not an automaker, not really. It’s not a pure tech company either. It’s a Frankensteinian monster of car manufacturing, energy storage, artificial intelligence, robotics, and software – a mess of circuits and steel held together by the unwavering belief of its cult leader.

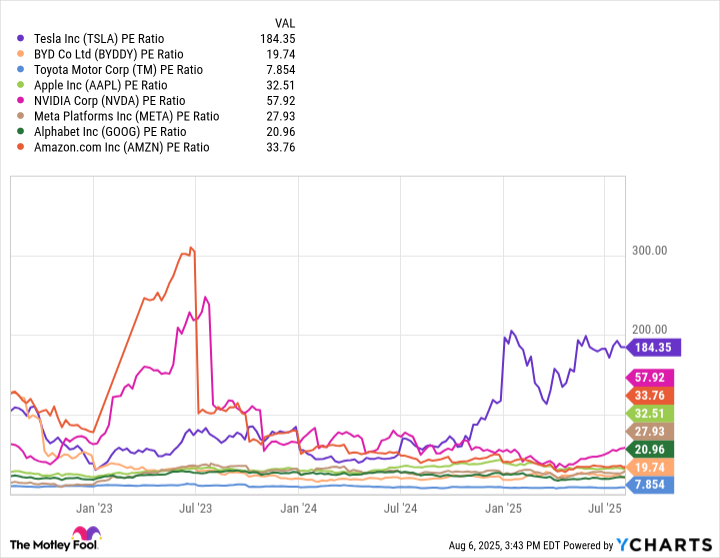

The chart doesn’t lie. Tesla trades on narrative, on hype, on the sheer force of Elon Musk’s personality. The P/E multiple expands while profitability…stagnates. It defies logic. It mocks the fundamental principles of finance. But logic has never had much sway in the realm of cult stocks.

I remain cautiously optimistic about the robotaxi business, in the VERY long run. But Musk’s timeline? Forget about it. Regulatory hurdles, technological challenges, the simple fact that he’s historically terrible at meeting deadlines… it’s a recipe for disappointment. I suspect the robotaxi rollout will be less a revolution and more a slow, grinding, chaotic evolution.

For now, I’m watching. Observing. Waiting for the inevitable correction. There will be opportunities to buy Tesla at more reasonable valuations. Maybe. Or maybe we’re all just hurtling towards a glorious, automated, slightly terrifying future. Who knows? All I know for sure is, this whole thing feels…wrong. And usually, when things feel wrong, they are. 😵

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-10 04:41