As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent developments in the world of digital assets. The move by WisdomTree to initiate the process for launching an XRP ETF is a significant step forward, particularly considering the firm’s substantial $113 billion asset base.

A global investment firm named WisdomTree, managing approximately $113 billion in assets, has begun the steps towards introducing an Exchange Traded Fund (ETF) based on Ripple‘s digital asset XRP.

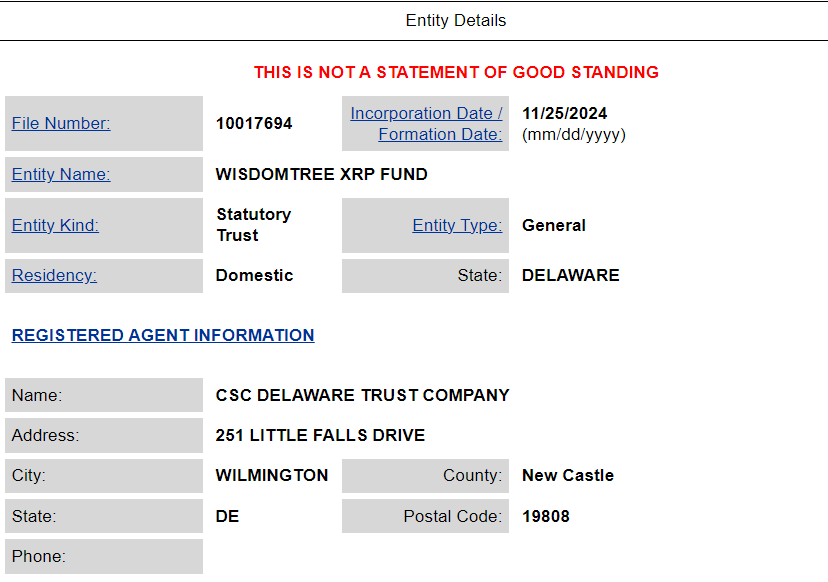

The firm recently filed for a trust entity in Delaware, a necessary precursor before submitting a formal application to the SEC.

Increasing Optimism for XRP ETF Approvals

With this action, WisdomTree now aligns with other investment firms exploring the XRP ETF sector. Notably, Bitwise submitted an application for a comparable product just last month. The trust underlines that it primarily stores most of its XRP assets in cold storage to prioritize investor safety.

In the month of October, Canary Capital too made an application to introduce a Spot Ripple (XRP) Exchange-Traded Fund (ETF). This fund aims to mirror the price changes of XRP through a standardized index, by gathering data from authorized trading platforms.

Currently, WisdomTree is the third (and possibly largest) asset management firm to submit an application for an Exchange Traded Fund (ETF) that focuses on XRP. In contrast to Bitwise and Canary Capital’s proposals, this proposed ETF aims to mirror the fluctuations in XRP’s market performance.

WisdomTree has yet to disclose an exchange listing or a ticker symbol for the fund.

According to a FOX Business journalist, Eleanor Terrett, on platform X (previously known as Twitter), she has verified with the company that this is an authentic filing. WisdomTree manages over $100 billion in assets.

Recently, after Gary Gensler’s departure from the SEC, XRP has been gaining traction and making a comeback in the bull market. In fact, it has soared by approximately 180% this month, hitting its highest price point in more than three years.

Changes in leadership at the Securities and Exchange Commission (SEC) may influence their position regarding digital assets, as evidenced by Ripple Labs’ legal battles with the SEC highlighting the importance of regulatory guidance. The departure of Gensler could potentially loosen restrictions on XRP Exchanged-Traded Funds (ETFs).

Ripple repeatedly emphasizes the possibility of XRP being embraced by institutions. Previously, the company’s CEO, Brad Garlinghouse, expressed confidence that a fund dedicated to XRP would eventually receive approval. He referred to this as an unavoidable trend in the asset category.

Beyond XRP, other digital assets such as Solana are also seeking ETF approval following the triumph of Bitcoin and Ethereum ETFs. Companies like VanEck and 21Shares have submitted applications for Solana ETFs. The Securities and Exchange Commission (SEC) has until January 6, 2025, to make a decision on these proposals.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-25 21:34