Bitcoin (BTC) is wobbling above the $90,000 mark, like a tightrope walker on a windy day. Traders are biting their nails, wondering what’s next as the US Federal Reserve’s final meeting of the year looms. Some market wizards are crossing their fingers for a year-end rally, while others think a crash is just around the corner. 🤔

Key Resistance in Focus

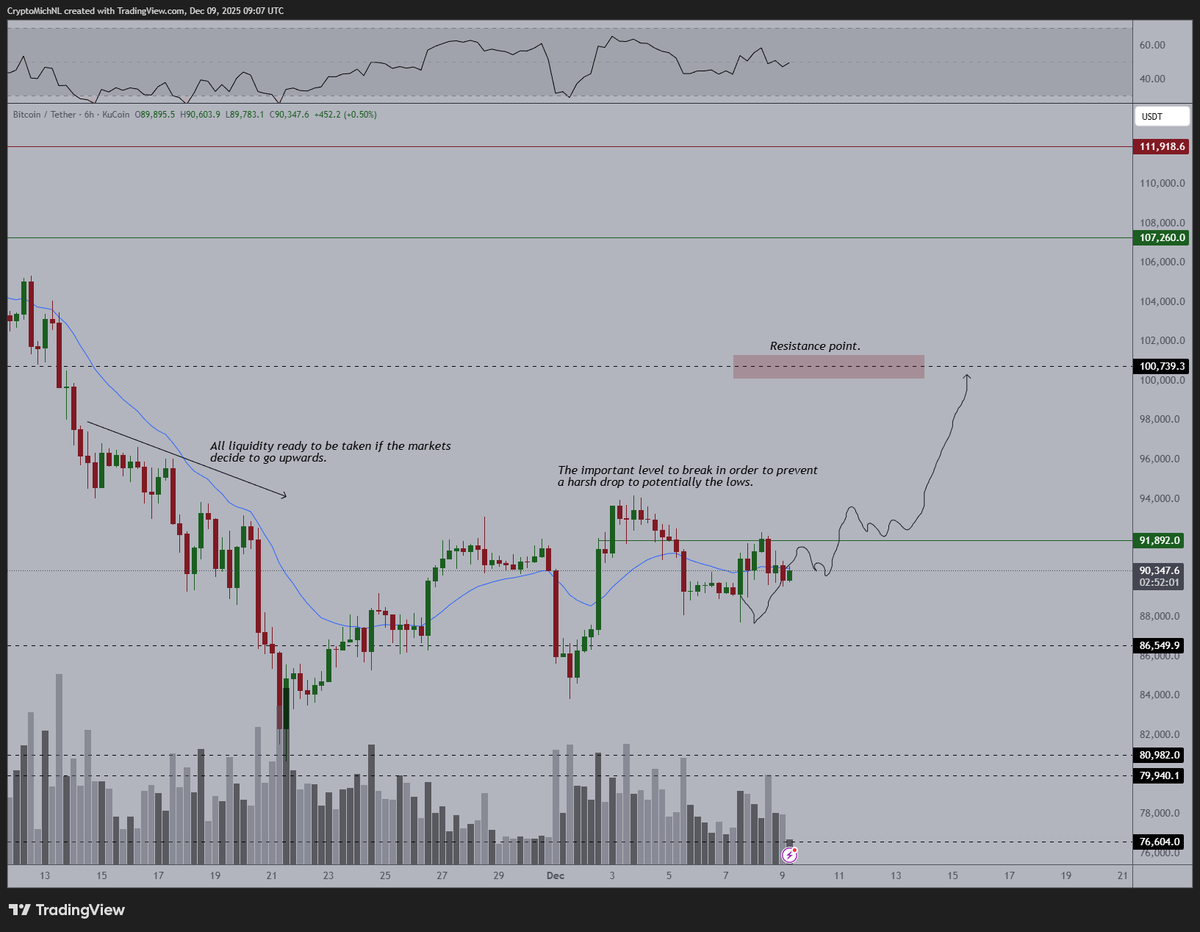

Crypto sorcerer Michaël van de Poppe says Bitcoin is still galloping along its bullish path. He’s eyeing the $91,892 mark like a hawk. Break that, and the next hurdle is $100,793. Push past that and-hold your breath-$100,000 could be in sight by December’s end. 🎯

Van de Poppe confidently declared:

“It’s all depending on the open in the US, if that’s going to be causing the standard correction, then it’s time to buy the dip.”

He also pointed out a rejection at $92,000, which doesn’t look too promising for the short term. But hey, he’s not throwing in the towel yet. If the market falls short, he’s predicting a dip to $78,000 to $82,000 before things pick back up. 🏚️➡️🏠

Despite a little slip of 2% over the last 24 hours, Bitcoin has managed to notch up a 4% gain over the past week. Right now, it’s chilling at around $90,330 with a solid $43 billion in volume. 💰

Fed Meeting Adds Uncertainty

Everyone’s eyes are now glued to the Federal Reserve’s upcoming policy meeting on December 10. Ali Martinez, the crystal ball gazer, pointed out that Bitcoin tends to throw a tantrum after most FOMC meetings this year. Out of seven meetings, six resulted in corrections, with only one fleeting rally in May. Talk about a mood swing! 😬

Market whispers suggest a 87% chance of a rate cut, but don’t hold your breath. Fed Chair Jerome Powell might just throw a curveball, leaving traders scratching their heads. Van de Poppe isn’t buying it, though:

“I wouldn’t be surprised if… Powell says ‘I don’t know whether we’ll proceed with rate cuts’ and the market does a classic sell-off.”

Some traders are bracing for either scenario, with a few predicting a final dip before a possible end-of-year rally. 🎢

Bearish Flag Pattern Raises Doubts

Ali’s chart is flashing warning signs-Bitcoin might be forming a bearish flag. If this ominous pattern holds, it could send the price tumbling to $70,000. The pattern includes a sharp drop followed by a consolidation phase, like a runner gasping for air after a sprint. If Bitcoin breaks below the trendline, things could get ugly. 💩

Other analysts, however, are glued to the short-term picture. DamiDefi notes that Bitcoin’s still stuck below a downward trendline on the 4-hour chart. He’s got a simple rule: break above $94,000, and we’re in the clear. But lose the recent lows? Well, brace for more downer vibes.

“Until $BTC clears this downtrend, you’re not buying a dip, you’re buying a downtrend,” he said.

Although the short-term crystal ball is a little foggy, on-chain data suggests that Bitcoin is still being moved off centralized exchanges. Translation: people are holding on for dear life, which could reduce the selling pressure. 📦📈

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-09 15:00