Nvidia (NVDA) wears its $4 trillion crown like a gangster with a diamond tiepin-loud, lethal, and lording over the AI goldrush. Once just another chipmaker peddling graphics cards to basement-dwelling gamers, it’s now the house that algorithms built. Its GPUs? The velvet gloves hiding iron fists of computational power. But empires crumble when new sharks circle the blood in the water.

Broadcom (AVGO) isn’t new to the poker game. This isn’t its first rodeo, boys. A conglomerate stitched together from a hundred corporate corpses, it’s the kind of outfit that makes its bones selling picks and shovels while prospectors go broke digging in the wrong dirt. Now it’s betting its custom XPUs-AI chips tailored to specific tasks like a hitman’s bullet-can carve a slice from Nvidia’s pie. Can it pull off the hit? Let’s crack the case.

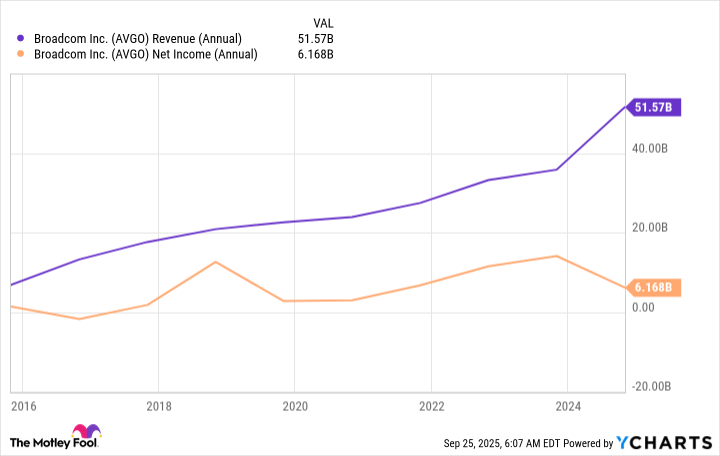

The Numbers Don’t Lie-Much

Broadcom’s market cap punched through the $1 trillion ceiling this year. That’s not luck-it’s the sound of a vault door swinging open. Its bread’s buttered in networking gear: Tomahawk switches, Jericho routers, the kind of iron that makes data centers hum like jazz clubs at midnight. But the real juice? Its XPU business, which now accounts for 65% of its AI revenue. Three unnamed clients? Big fish. Rumor has it one’s OpenAI, but in this town, rumors are cheaper than whiskey.

Broadcom’s play is simple: offer clients a bespoke suit when Nvidia’s selling off-the-rack trenchcoats. Custom chips for specific AI tasks? Cheaper than going all-in on Nvidia’s all-purpose monsters. It’s the difference between hiring a symphony and a street-corner quartet-both make music, but one won’t bleed your wallet dry.

The Heavyweight Bout

Nvidia’s GPUs are the heavyweight champs-brute force incarnate. They’ll crack any AI nut, from facial recognition to stock-market voodoo. Broadcom’s XPUs? They’re the knife fighters, quick and precise, designed for specific jobs like a lockblade in a back-alley brawl. The cloud giants? They’ll use both. Data centers will run on a cocktail of brute power and surgical strikes. Survival of the slickest, not just the strongest.

Broadcom’s recent $10 billion order for AI racks? That’s not chump change. It’s the sound of a new player buying drinks at the bar. But Nvidia’s not sweating. Its ecosystem’s deeper than a mobster’s pockets-CUDA software, developer tools, a whole damn universe that keeps coders chained to its GPUs. Breaking free’s harder than kicking a bourbon habit.

The Long Con

By 2030, AI infrastructure could swallow $4 trillion. Broadcom’ll feast, no doubt. Its hybrid model-enterprise software, networking iron, and custom chips-makes it a one-stop shop for Fortune 500 suits looking to hedge their bets. But surpassing Nvidia? That’s like trying to out-shoot a machine gun with a revolver. Nvidia’s got the mindshare, the tech, and the moats dug deep.

Still, this ain’t a zero-sum game. The AI boom’s big enough for both predators. Broadcom’ll carve its niche, and investors who sniff opportunity in the shadows won’t go hungry. Just don’t bet against the house that Jensen Huang built. The lights’ll stay on in Santa Clara for a long time yet. 💼

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-26 11:39