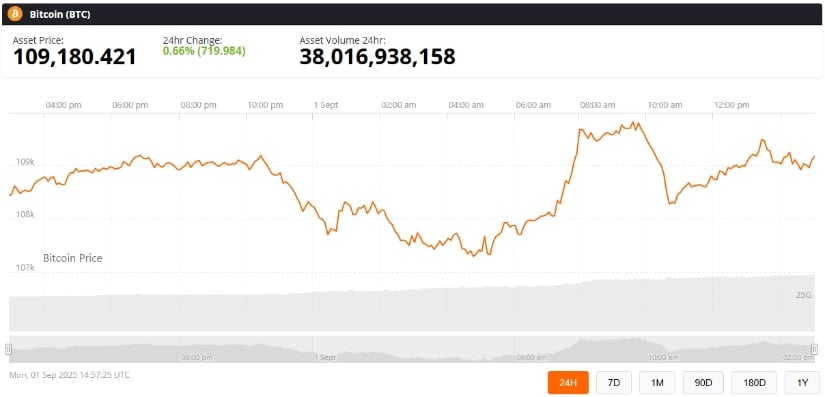

Behold the curious spectacle of Bitcoin today, perched precariously at a modest $109,180 – just a hair’s breadth below the sacred $110,985 altar. Analysts, those modern-day soothsayers armed with charts instead of crystal balls, proclaim that reclaiming this hallowed threshold is nothing less than the elixir needed for bullish enchantment. Should the stars align (and the markets behave), our metallic friend might ascend gloriously to $140,000-$200,000 before the year takes its final bow. Quite the rags-to-riches fairytale, wouldn’t you agree?

Market Overview: The Drama of Support and Resistance

Crypto oracle @Manofbitcoin upon the mysterious realm of X whispers reverence for the $110,985 support. Should the price so audaciously vault above $112,000, the bullish chorus will undoubtedly swell. Conversely, a tumble below $110,000 might provoke a malaise of corrections, the analyst laments – rather like Napoleon losing a battle to a particularly stubborn hedge.

Recent masterpieces from TradingView reveal Bitcoin flirting with the $107,200 support before sauntering back up to $109,180, like a cat testing if the windowsill is still favorable. Technical wizards highlight the 50-day Exponential Moving Average at $110,000 and the 200-day EMA near $104,000 as the stern gatekeepers of sanity. Fail to pay them homage, and deep pullbacks may follow; reclaim them, and bullish enchantment resumes.

The ever-so-temperate realms of resistance lurk at $110.8K, $111.2K, and $111.5K – the opposing forces wielding selling pressure like a Victorian suitor clutching his corset strings. On the gloomy downside, support levels at $108,600, $107,200, and $106,500 offer traders their near-term safety nets, or perhaps just traps wrapped in silk.

Trend and News Factors: The Fate Dictated by Macroeconomic Oracles

The Federal Open Market Committee’s impending declaration of a 50 basis point rate cut promises to bestow blessings upon risk assets such as our dear Bitcoin. “Lower rates make Bitcoin more attractive as an investment and an inflation hedge,” intones Steve Azoury, financial sage of Azoury Financial – as if holy scripture were being delivered between sips of Earl Grey.

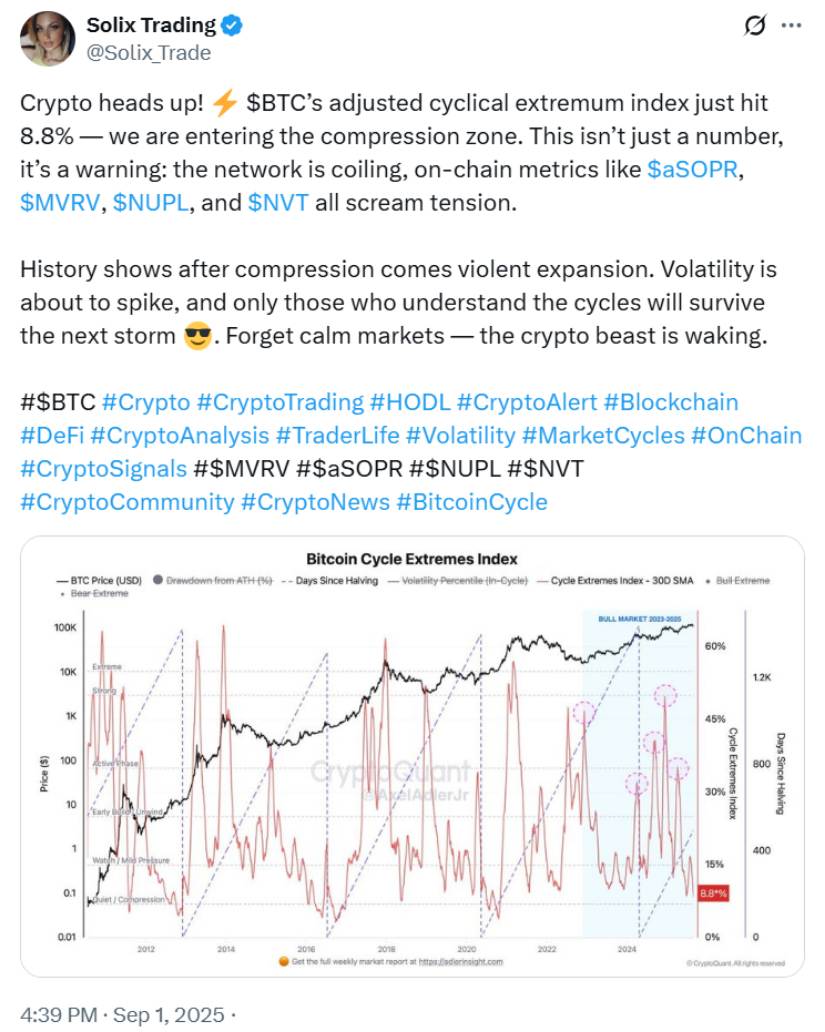

Meanwhile, the 2025 Bitcoin halving dances on the horizon, hypnotizing market sentiment like a pied piper with on-chain metrics – Network Value to Transactions and Market Value to Realized Value – all serenading us that the frenzy is far from reaching fever pitch. Long-term holders cling to their digital gold with the tenacity of a cat guarding its cream, while exchange reserves dwindle, all pointing to a bullish faith that perhaps is not entirely mad.

Technicals and On-Chain Metrics: The Bull’s Whispered Promises

Miner reserves, a quaint notion from the days of yore, linger stoically at 1.805 million BTC; a stark contrast to prior epochs where miners’ frantic sales heralded market summits. The short-term technical ensemble croons of higher lows forming, a subtle yet persuasive sign of buyer absorption, even amidst a slip or two.

The RSI curve, ever the melodramatic protagonist, now insists upon oversold conditions, hinting tantalizingly at a rally should support levels hold – a cliffhanger worthy of Wilde himself.

Looking Ahead: BTC’s Grand Performance Depends on Support

At the present modest sum of $109,180 per Bitcoin, we find ourselves at a crossroads not unlike Dorian Gray before choosing which portrait to envy. The sagacious counsel is to keep one eye nervously fixed upon $110,985 support and the near-term resistance barricade at $111.5K. Should our digital hero reclaim these positions, the stage may be set for a climactic surge to $140,000-$200,000 by year-end, propelled on wings fashioned from macroeconomic sorcery, halving prophecies, and on-chain confidence.

Investors, dear reader, would do well to pair their technical divinations with the ceaseless babble of market news – lest they be caught unawares when volatility, that mercurial beast, rears its unpredictable head. A long-term bullish posture with a dash of wit and caution appears most prudent in these enchanted yet treacherous realms.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Anime Series Hiding Clues in Background Graffiti

2025-09-02 00:01