Oh, how the wheel of fortune spins! 🎢 As Bitcoin waltzes through the ballroom of fluctuating markets, the question on every investor’s tongue is, “Will history repeat itself?”

Recall 2018, when Bitcoin stumbled under the weight of Trump’s first term, losing a staggering 72% of its value. Economic uncertainty and tighter regulations had the cryptocurrency dancing the melancholic waltz. And now, with Trump back at the helm and fresh tariffs stirring the global pot, might Bitcoin find itself in a familiar tango? 🕺

Yet, 2025 introduces a new dance partner to the scene: Bitcoin ETFs. The ballroom has filled with the sound of institutional footsteps, as giants like BlackRock pirouette with spot ETFs, drawing in hefty inflows. 💃

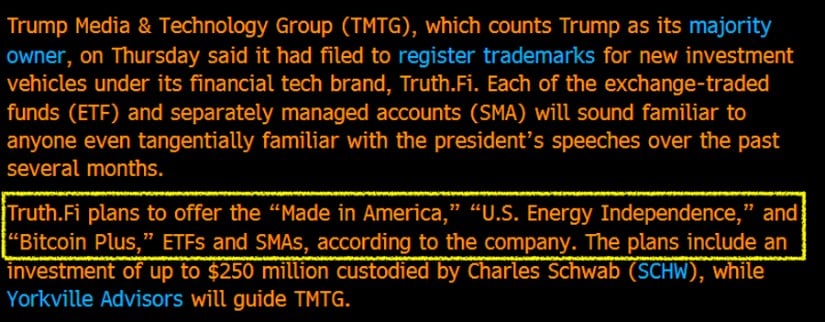

Enter the Trump Media Group, announcing a grand entrance with multiple spot Bitcoin ETFs. Can this new wave of institutional capital counterbalance the economic pressures of renewed trade wars? Will Bitcoin’s fate be swayed by the tunes of institutional demand? 🎶

Trade Tensions Tango, Markets React

The return of trade skirmishes between the U.S. and China has set off a chain reaction in financial markets. Trump’s latest 10% tariff on Chinese imports has given the U.S. dollar a boost, sending it skyward to a level unseen since the disco era. 🕺 Traditional safe havens like gold have responded in kind, hitting record highs. 💰

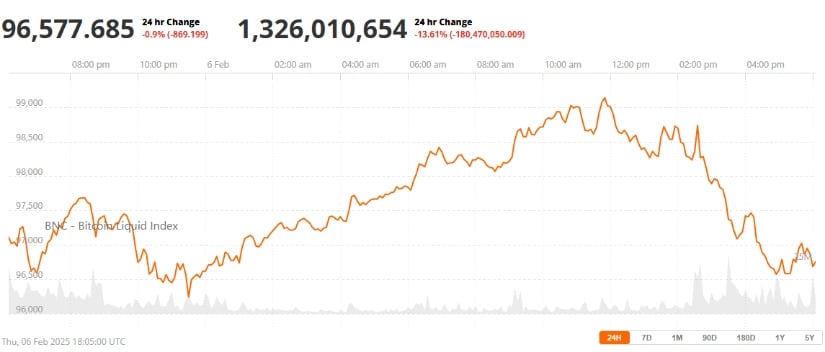

Meanwhile, Bitcoin, often likened to gold as a digital vault of value, struggles to keep its safe-haven crown. The cryptocurrency has lost over 6% of its market share, reminiscent of its 2018 decline. But fear not, dear reader, for Bitcoin has shown the resilience of a seasoned dancer, consistently holding above the $98,000 mark. If Bitcoin can maintain this poise, analysts predict a potential rally, much like the encore of a triumphant ballet. 🩰

Exchange Balances Suggest Accumulation

A bright spot in Bitcoin’s narrative is the dwindling supply of BTC on exchanges. Over the last half-year, exchange balances have dipped 13%, reaching a six-year low. This suggests that investors are tucking their holdings into self-custody, akin to stashing away precious jewels. 🪙

A notable withdrawal of 17,000 BTC on February 5, including a hefty 15,000 BTC from Coinbase, signals growing confidence among the whales. Such accumulation trends often foretell the anticipation of higher prices, much like a gambler’s intuition before the roll of the dice. 🎲

Bitcoin ETFs: The Twist That Turns Heads?

The biggest twist in 2025’s plot is the Trump Media Group’s launch of multiple Bitcoin ETFs. The announcement on February 6 sent Bitcoin’s price spinning from $95,000 to $98,500 in a whirlwind hour. Trading volumes exploded, with Coinbase reporting a 150% increase, reaching $1.2 billion in 24-hour volume. 🌋

Since the debut of U.S.-based spot Bitcoin ETFs in early 2024, institutional demand has soared, with total inflows exceeding $40 billion. The ETFs have attracted an additional $2.5 billion in the past fortnight, a testament to the growing investor confidence. 📈

The ETF-driven momentum also lifted other cryptocurrencies, with Ethereum, Cardano, and Solana seeing 5-8% price jumps. On-chain data confirmed growing market participation, as active Bitcoin addresses spiked following the ETF launch. 💫

Bitcoin’s 2025 Price Outlook

As we peer into the crystal ball, Bitcoin’s path will be guided by key economic indicators. The upcoming Consumer Price Index (CPI) report in January is a pivotal moment—rising inflation could delay Federal Reserve rate cuts, potentially putting pressure on risk assets like Bitcoin. 💬

Renowned analyst Bob Loukas remains optimistic. He envisions that once Bitcoin surmounts $106,000, it will enter a new bullish cycle. Loukas anticipates Bitcoin to hit rock bottom by late February, setting the stage for a significant uptrend. 🚀

At present, Bitcoin grapples with breaking past the $110,000 resistance level. According to Bravenewcoin data, Bitcoin is trading at $98,262, down over 9% from its recent peak. Loukas describes this phase as an “eat-each-other” cycle, where new investor influx is scarce. He suggests that Bitcoin may reign supreme in the upcoming cycle, leaving some altcoins in the dust. 🍂

Despite recent trade-related market turbulence, Bitcoin’s dominance has surged, reinforcing its position as a favored asset during economic uncertainty. As global trade disputes continue to unfold, institutional investors may increasingly view Bitcoin as a hedge against financial instability. 💪

Will 2025 Be Different?

Though echoes of 2018 linger, Bitcoin’s current market milieu is markedly different. Bitcoin may encounter significant downside volatility as 49,700 BTC ($5 billion worth), dormant for six to twelve months, has suddenly moved, according to CryptoQuant. 🏃♂️

Bitcoin: $5 Billion in Dormant Bitcoin moves according to CryptoQuant.

Analyst “XBTManager” cautions that this could herald a potential sell-off, increasing panic among retail investors and adding to selling pressure. However, they also noted that such movements sometimes indicate market manipulation, as prices often rebound swiftly. 🔄

This warning comes amid a 7% dip in Bitcoin’s price earlier this week, plummeting from nearly $98,000 to just above $91,000. Several altcoins saw losses of up to 20%, and over $2 billion in leveraged trading positions were liquidated within 24 hours. The decline was fueled by concerns over Trump’s new tariffs on Canada, China, and Mexico, though market fears eased slightly after the administration delayed tariffs on Canada and Mexico. 🍁🇨🇳🇲🇽

Analysts emphasize that the Bitcoin price must hold the $90,000-$91,000 range to avoid a potential nosedive to $70,000. Currently, Bitcoin trades at around $98,000, up 0.61% in the past 24 hours. While the market mirrors the downturn of 2018, the burgeoning institutional demand from ETFs and declining exchange balances suggest Bitcoin may have a few tricks left in its bag. However, with billions in BTC on the move and ongoing trade tensions, Bitcoin still faces a critical test. 🔍

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-07 11:27