If the United States formally joins the Israel–Iran war, Bitcoin and the broader crypto market might plummet faster than a rock thrown off a cliff.

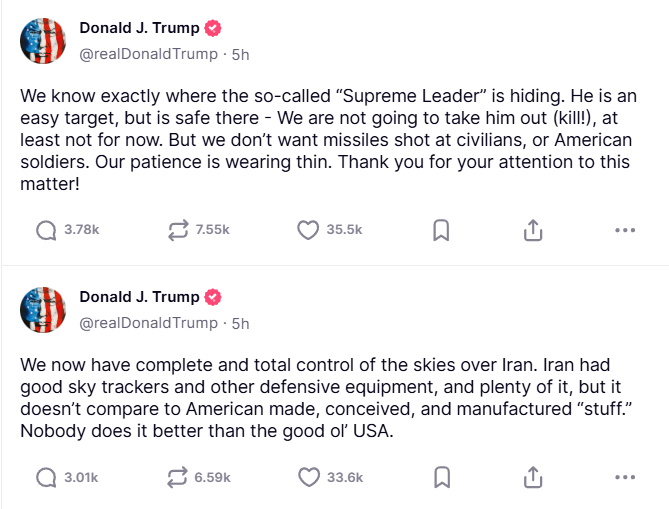

Based on President Trump’s recent posts (oh, how we love his tweets) and geopolitical rumors, the US might take the plunge into this conflict. Market analysts are predicting that risk-off sentiment will dominate global assets, which means all those risky cryptocurrencies could lose liquidity faster than a speeding bullet.

Bitcoin’s Immediate Fate: The Great Crash (if US Joins the Party)

Currently, Bitcoin is hovering around $104,500, but if history is any guide (and we all know it usually is), it could drop 10-20% faster than you can say “geopolitical instability.” Talk about a rollercoaster ride!

In the early stages of large-scale conflicts, investors traditionally scramble to traditional safe havens—like US Treasuries, the dollar, and gold. Crypto? Not so much. It’s like that cousin who says they have their life together, but we all know better.

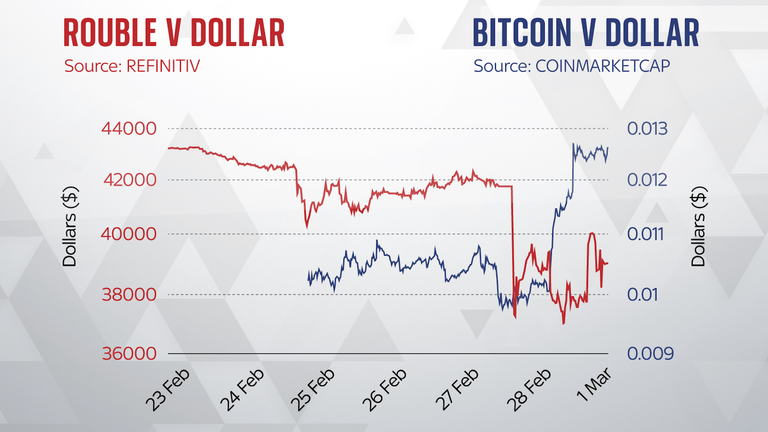

Crypto, despite some romanticized claims of being a “hedge,” has always danced like a high-risk asset during times of geopolitical stress. Remember the Russia–Ukraine war in 2022? Bitcoin dropped over 12% within a week. Fun times.

On-chain activity, as always, reflects this mood swing. Leverage drops, exchange inflows rise, and trading volumes stumble like a drunk at a wedding.

These metrics scream: “Get out of here!”

Macro Mess: Crypto Volatility Gets a Whole New Level

If the US decides to give the whole Iran thing a go and it triggers a wider regional conflict, we can expect oil prices to skyrocket and inflation to rear its ugly head. The Fed might have to postpone rate cuts or even think about tightening things up again. Oh joy, more fun for crypto!

Higher oil prices could push consumer inflation back above the Fed’s beloved 2% target—especially since WTI crude is already twitching at Middle East headlines like a cat hearing a can opener.

War-driven supply shocks could mess up shipping routes and jack up costs everywhere. Fantastic.

This is interesting:

Israel and Iran are battling it out, Trump claims he knows where Iran’s Supreme Leader is hiding, and the US is sending fighter jets. Yet, oil prices are still 10% below last week’s highs.

What’s going on with the market here?

— The Kobeissi Letter (@KobeissiLetter) June 17, 2025

In this scenario, the Fed will be stuck between trying to control inflation and keeping the economy stable—good luck with that. A hawkish stance could push real yields up, which will definitely kill the vibe for crypto valuations.

US Treasury yields are already near 4.4% on the 10-year note, and they could climb even more if war spending escalates the fiscal deficit. Meanwhile, the national debt is north of $36 trillion. That’s a whole lot of interest to pay, friends.

Meanwhile, the US Dollar Index (DXY) is hanging around 98.3, and it might surge even more as global investors go running into the dollar like it’s the last lifeboat on the Titanic.

And, as always, a rising dollar spells trouble for Bitcoin and altcoins, especially in emerging markets where capital outflows follow dollar surges like a dog chasing a car.

How did we arrive at a point where 25% of all tax revenue goes just to paying interest on $37 trillion of govt debt?

Annually:

US govt total revenue = about $5 trillion

US govt interest on debt = about $1.2 trillionUS govt spending = about $7 trillion

— Wall Street Mav (@WallStreetMav) June 16, 2025

Crypto markets don’t like it when traditional equities are acting like they’ve been through a blender. Volatility spikes, margin calls happen, and suddenly everyone’s scrambling for cover.

The VIX, our favorite “fear gauge,” climbs during these times—tightening the risk budget and triggering panic button pushes all over crypto exchanges.

Long-Term Outlook: Will War End Soon? Spoiler: Probably Not

If the US intervention is brief and we somehow achieve a ceasefire, markets could bounce back, and Bitcoin could recover within 4-6 weeks. Sounds optimistic, but hey, it happened before!

But if the war drags on (because that’s what wars do), crypto will be in for a bumpy ride. Expect a longer stretch of volatility, thinning liquidity, and prices being suppressed like your favorite reality TV show on a network no one watches.

Investor appetite for risk will likely remain low until the dust settles and geopolitical tensions chill out.

That said, if inflation from war-related disruptions hangs around, the whole “Bitcoin as a hedge” story might make a comeback. But, spoiler alert, tighter monetary policy will make sure Bitcoin’s price doesn’t go too far up.

Institutional inflows could take a nap, and all eyes will be on things like CME futures and stablecoin supply to gauge sentiment shifts.

Keep an eye on Bitcoin’s $100,000 support level and Ethereum’s $2,000 zone. If they break, it’s going to be a wild ride downhill.

What to Watch Now (and Why You Should Care)

Investors should keep an eye on:

- Oil price movements (because we all know that’s important).

- Fed statements on inflation and rate policies (yawn, but crucial).

- Treasury auction results and bond yield spreads (get your calculators ready).

- Exchange outflows and leverage usage in crypto (don’t forget to hold your breath).

- VIX and global risk indicators (fear never looked so good).

If the US joins the war, Bitcoin’s fate will be more about macro conditions than anything crypto-related. So, buckle up, folks. Volatility is coming, and it’s going to be a wild ride.

Traders, prepare for chaos, stay hedged, and, above all, watch the geopolitical soap opera unfold in real time. Who knows what’s next? Stay tuned.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-06-18 01:15