As a seasoned crypto investor with a decade of experience navigating the volatile and unpredictable digital asset market, I’ve learned to weather the storms and ride the waves that come my way. Over the years, I’ve witnessed Bitcoin‘s meteoric rise from pennies to tens of thousands of dollars, as well as its tumultuous dips and corrections along the way.

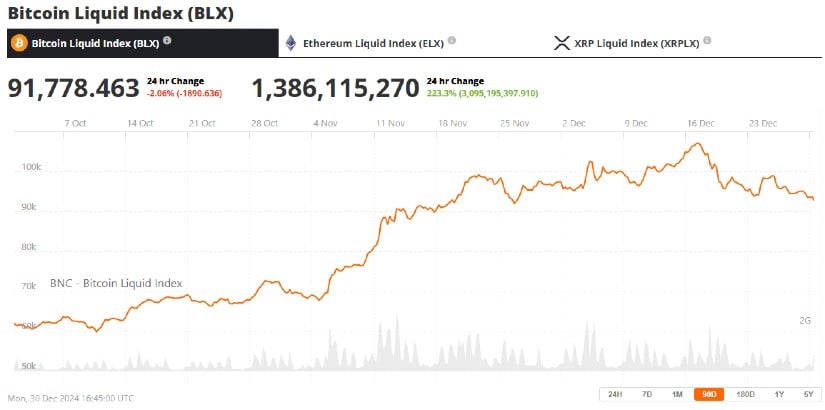

The recent correction, with Bitcoin plummeting to $94,830, has certainly been a bump in the road, but it’s nothing new for me. I’ve seen this movie before, and I know that the market can be unforgiving during holiday seasons when trading activity slows down. However, I remain cautiously optimistic, as the long-term outlook for Bitcoin remains promising.

The Federal Reserve’s monetary policy decision has certainly played a role in the recent decline, as investors have grown wary of risk assets such as cryptocurrencies. The less aggressive than expected easing cycle has kept many on the sidelines, repositioning themselves amidst soft and gradual monetary loosening. I can’t help but chuckle at the irony of a currency that was once seen as a hedge against inflation now being affected by the very same forces it was meant to protect against.

I also find it intriguing how Bitcoin’s history has been marred by waning institutional interest through exchange-traded funds (ETFs). The lackluster inflows and doubts over the creation of a Strategic Bitcoin Reserve have certainly weighed on bullish sentiment. But as someone who has been in this game for a while, I know that the institutional interest will eventually return when they see the potential that lies within this revolutionary technology.

Historically, December has been a strong month for Bitcoin, but alas, the “Santa Claus rally” never showed up this year. However, I’m not one to lose hope easily, and I’m pinning my hopes on the “January effect.” I’ve seen it work its magic in the past, and I believe that it could do so again.

In terms of technical analysis, Bitcoin is resting around a key support near its 50-day simple moving average. If history repeats itself, we may see a bounce back from here. However, I’m keeping an eye on the rising broadening wedge pattern, as it could signal further downside if Bitcoin pierces through the low of the pattern.

Overall, 2025 is shaping up to be an interesting year for Bitcoin. The interplay between macroeconomic developments, investor sentiment, and regulatory changes will determine whether Bitcoin can regain upward momentum or face continued consolidation. I’m optimistic that we’ll see a bright future ahead for this revolutionary technology, but as always, it’s important to remain cautious and vigilant in these turbulent times.

And to lighten the mood, let me leave you with a little joke: Why did Bitcoin cross the road? To get to the other blockchain!

In simpler terms, the value of Bitcoin, which is currently the biggest type of digital currency, saw a substantial decrease. It fell to approximately $94,830, representing a decline of more than 12% compared to its highest point within the past month.

As a crypto investor myself, I’ve noticed that, according to CoinGecko, trading activity has significantly slowed down during the holiday season. The daily trading volume dropped from around $41 billion on December 28 to only $22 billion on December 29. Typically, Bitcoin sees volumes surpassing $100 billion, but this year, investor cautiousness and decreased participation due to the festive period have noticeably dampened momentum.

Market Factors Weighing on Bitcoin

The fall in prices can be linked to several reasons, including broader economic changes and investor attitudes. The Federal Reserve’s latest monetary policy choice has played a significant role. In early December, the Fed reduced interest rates by 0.25%, which suggests a less intense easing cycle than anticipated, predicting two rather than four cuts in 2025. This more hawkish stance has caused investors to tread cautiously with riskier assets like cryptocurrencies, as they adjust their positions during the slow and gradual loosening of monetary policy.

Additionally, institutional investment in Bitcoin through exchange-traded funds (ETFs) has been dwindling. Although total accumulation from these ETFs is projected to reach $35.6 billion by 2024, the rate of inflows has slowed down. This indicates that large investors are hesitant to invest more in a market that appears unclear. Furthermore, uncertainty surrounding the creation of the highly anticipated Strategic Bitcoin Reserve has also dampened optimism among investors.

The Absence of a Santa Claus Rally

Historically, December has been a robust period for Bitcoin, with the so-called “Santa Claus rally” – an increase in asset prices during the holiday season. However, this year’s rally didn’t materialize, leaving investors disheartened. Presently, market participants are looking forward to what is known as the “January effect,” a trend where financial assets usually surge in January due to portfolio adjustments made by investors.

Although the January Effect has consistently benefited certain asset classes over time, Bitcoin’s performance in January has shown some variation. In the past ten years, six Januaries have seen an increase, including a 0.62% rise last year. However, it’s worth noting that historically, February has been a more favorable month for Bitcoin, with fewer instances of negative returns compared to January.

Technical Analysis Points to Key Levels

From a technical perspective, Bitcoin is currently hovering close to a significant support point which aligns with its 50-day moving average – a level that has often served as a crucial turning point for its price fluctuations in the cryptocurrency market. Additionally, Bitcoin’s cost remains above an upward trendline traced from mid-November, suggesting it may maintain some strength even amid recent price instability.

This bearish technical indicator forms a rising broadening wedge shape, suggesting potential instability for further declines in Bitcoin’s price. If Bitcoin breaks below the pattern’s low, it might fall to the support level at $73,777, last seen in March. However, if Bitcoin rebounds from its current position, it could potentially reach the $110,000 mark, testing the upper limit of this wedge pattern.

Outlook for 2025

Over the remainder of the year, Bitcoin’s immediate direction will be influenced significantly by broader economic events, investor opinions, and institutional investments. Important regulatory updates, especially those related to Europe and the implementation of the Markets in Crypto-Assets (MiCA) framework, could significantly impact market behavior as well.

The balance among these elements will decide if Bitcoin can resume its upward trend in early 2025 or persist in a period of stability instead. Given that investors are closely monitoring the January effect, the upcoming weeks might shape Bitcoin’s behavior in the coming year. Let’s wait and see what my Bitcoin price forecast for 2025 will be!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-31 15:12