As a seasoned researcher with over two decades of experience in financial markets and a keen interest in cryptocurrencies, I find myself intrigued by the festive anticipation surrounding Bitcoin‘s performance this Christmas. With my fingers crossed for a record-breaking rally, I delve deeper into the historical trends and current data to form an informed opinion on whether we will witness another “Santa Rally” this year.

With the holidays approaching and Christmas just around the corner, there’s an air of excitement in the cryptocurrency market. Traders are eagerly waiting to find out if the holiday cheer will fuel a remarkable surge this season, breaking previous records. In years when Bitcoin (BTC) undergoes halving, it has traditionally shown a “Santa Rally” – a period of optimistic price increases during the week before Christmas.

The question lingers: Will this year’s trend continue as before, or will it take a new direction in the market?

Bitcoin Could Repeat Christmas Performance, Analysts Predict

So far this year, Bitcoin’s price has jumped a substantial 137%, reaching over $108,000 before a brief dip. Some analysts predict that Bitcoin might climb even higher during the upcoming Christmas week, despite a temporary downturn.

Keep in mind that while Bitcoin’s value doesn’t always increase around Christmas time, it often performs well during bull market periods. On the contrary, bear markets usually lead to substantial drops in Bitcoin’s value during the holiday season.

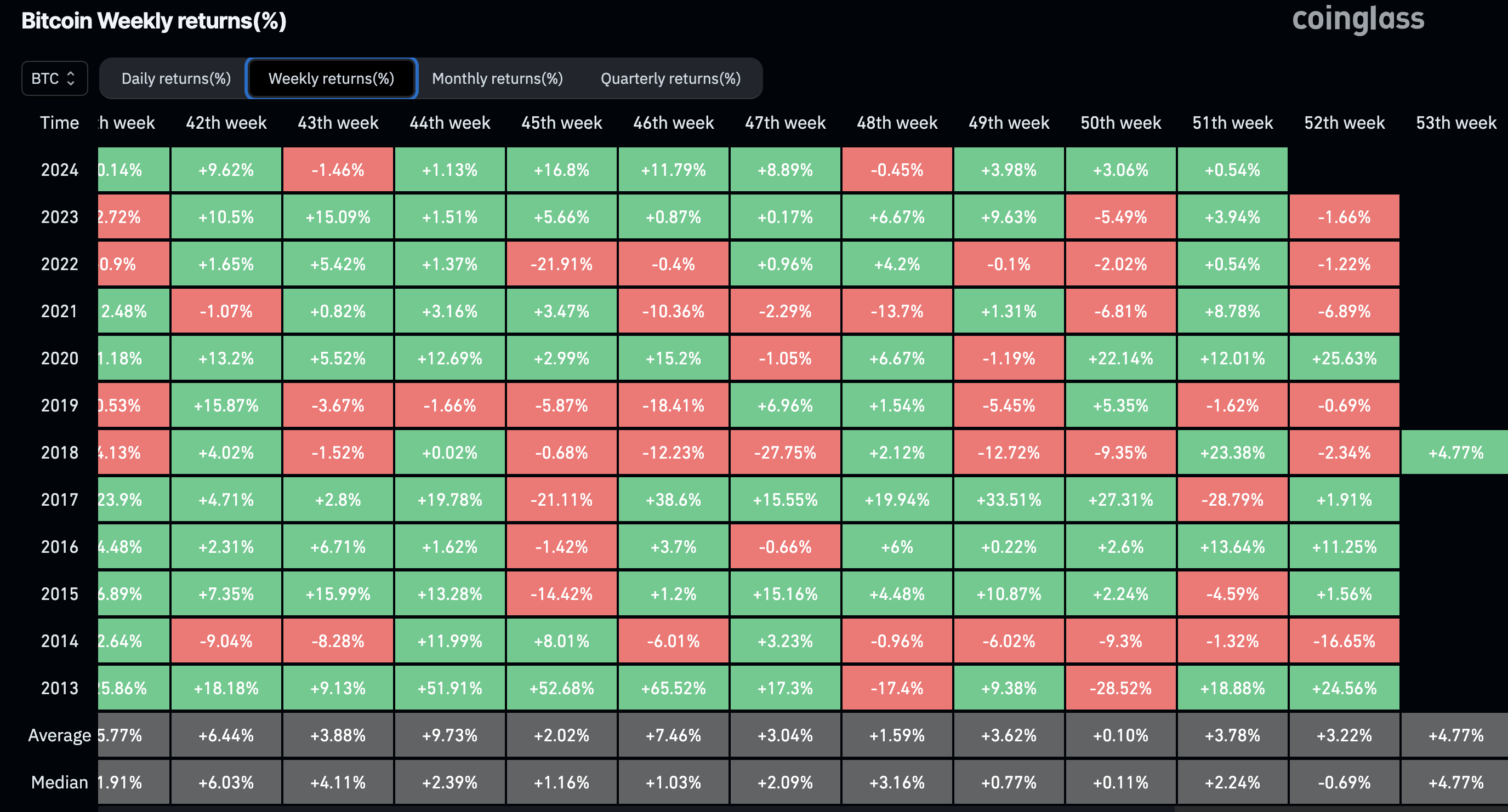

According to Coinglass, Bitcoin experienced a significant increase during the final week of 2020, rising by 25.63%. This trend was also observed in 2016, where Bitcoin saw an increase of 11.25%, and in 2012, it registered another notable growth (approximately 10%).

Additionally, Bitcoin (BTC) has experienced a rise of 8.71% so far in December. Given past patterns, it may continue to grow in the upcoming week, possibly approaching the $120,000 value.

It’s worth noting that certain analysts express optimism that something comparable could happen this year. Among them is Mister Crypto, who is an investor in Bitcoin and other cryptocurrencies, sharing this positive outlook.

According to Mister Crypto’s recent post on X (previously known as Twitter), it has been tradition for Bitcoin to experience a significant surge, or “parabolic” rise, around the Christmas season in years when there is a halving event. He predicts that this trend won’t break in 2021.

Similar to what Mister Crypto predicted, another analyst, known as Crypto Rover, has suggested that a “Santa Rally” for Bitcoin might take place in the year 2024.

On-Chain Data Suggest the Coin Could Go Higher

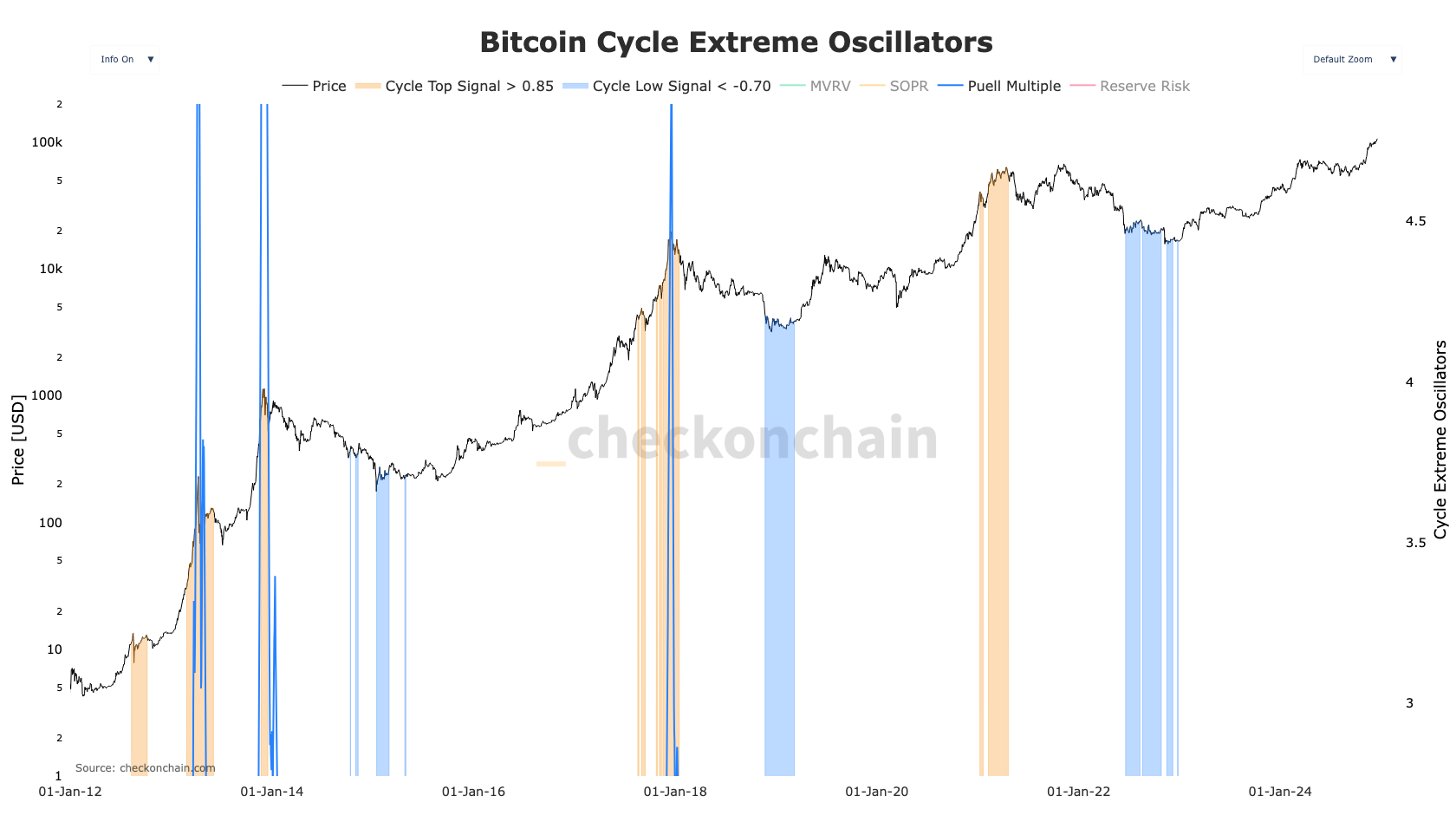

Viewing it from a blockchain standpoint, various extreme Bitcoin cycle oscillators suggest a potential rise in its value. To illustrate this, let’s consider the Cycle Top and Cycle Low signals. According to BeInCypto, Bitcoin reaches its peak when the Cycle Top exceeds 0.85.

Conversely, cryptocurrency experiences a low point when the Cycle Low reading falls below 0.70. However, as you can see from the graph, Bitcoin has already moved past this low point. Yet, it hasn’t reached the cycle’s peak just yet. If there’s a significant increase in buying activity during the Christmas week, Bitcoin might even surpass its previous record high of $108,268.

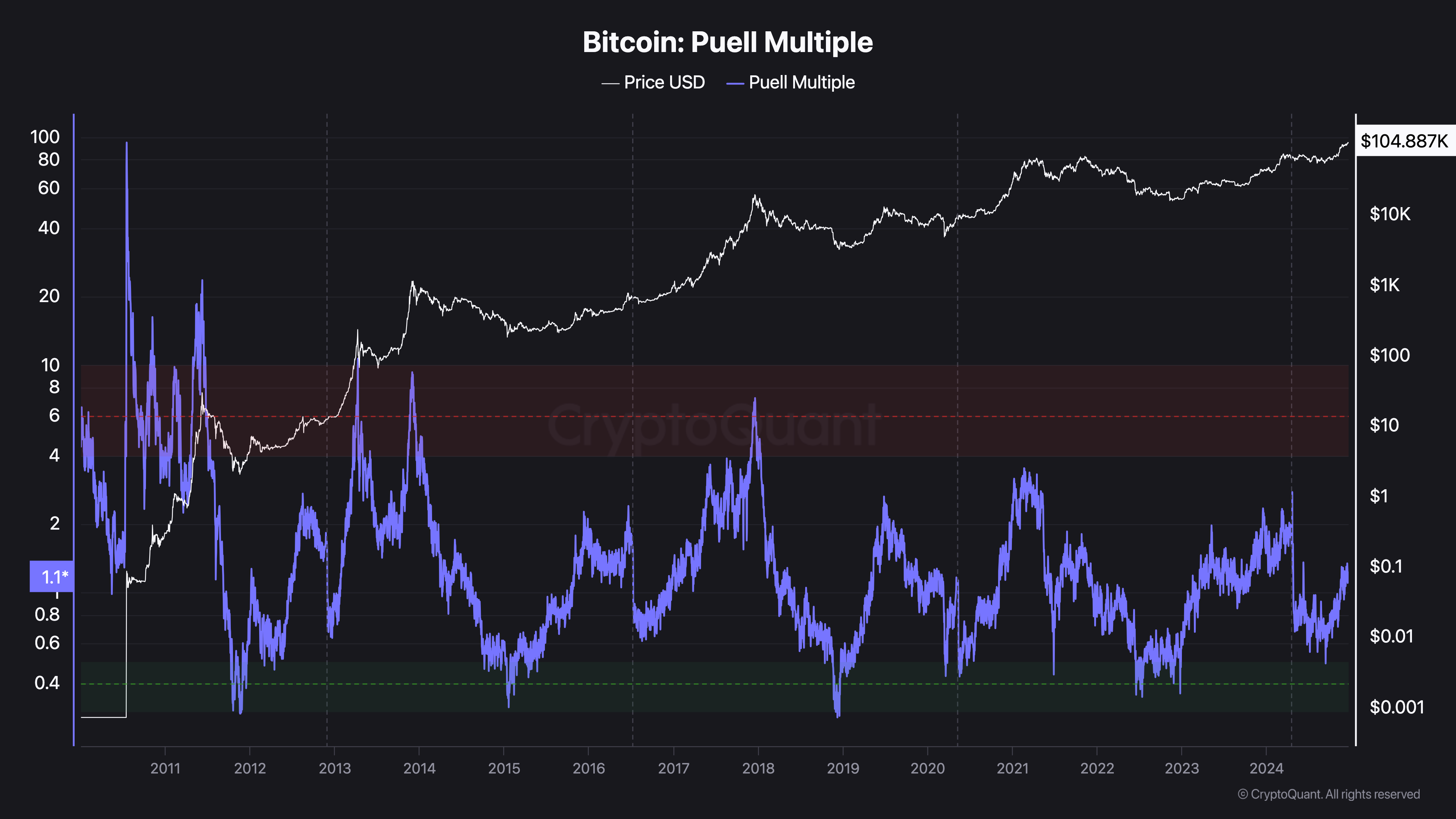

Additionally, the Puell Multiple mirrors the prevailing bias. This metric uses the current price of Bitcoin to offer a comparable viewpoint. Essentially, it assists in determining if the price of Bitcoin is comparatively higher or lower than its past patterns.

The current reading of Bitcoin’s Puell Multiple, which is at 1.15 according to CryptoQuant, suggests that we are currently above the market bottom but there’s still potential for growth, as this value is significantly lower than the point that would indicate a market top.

BTC Price Prediction: Possible Run to $116,000?

From my analysis, it appears that Bitcoin’s price trajectory is reminiscent of its March surge past $73,750. During that brief span of approximately three months, Bitcoin soared by an impressive 81.95%. As of November 5 and up to the current moment, Bitcoin has shown a significant increase of 56.58%.

Examining the Accumulation/Distribution (A/D) line reveals an uptick in readings, suggesting significant accumulation over distribution. Furthermore, the Money Flow Index (MFI), a measure of capital inflow, has surged as well.

If these trends persist, Bitcoin’s price may surge past $116,000 and close to $120,000 by Christmas week. But if Bitcoin encounters significant selling activity before December 25, it might not reach those levels and could instead dip below $100,000.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-18 22:05