Will Bitcoin and Ethereum‘s Q2 Cycle be a Catastrophic Failure? 🚨💸

- Those dear, darling Bitcoins and Ethereums saw a ghastly decline in retail adoption, a fact as plain as the nose on one’s face, reflected by shrinking network activity.

- Will Q2 signal the onset of a deeper, more dreadful corrective cycle?

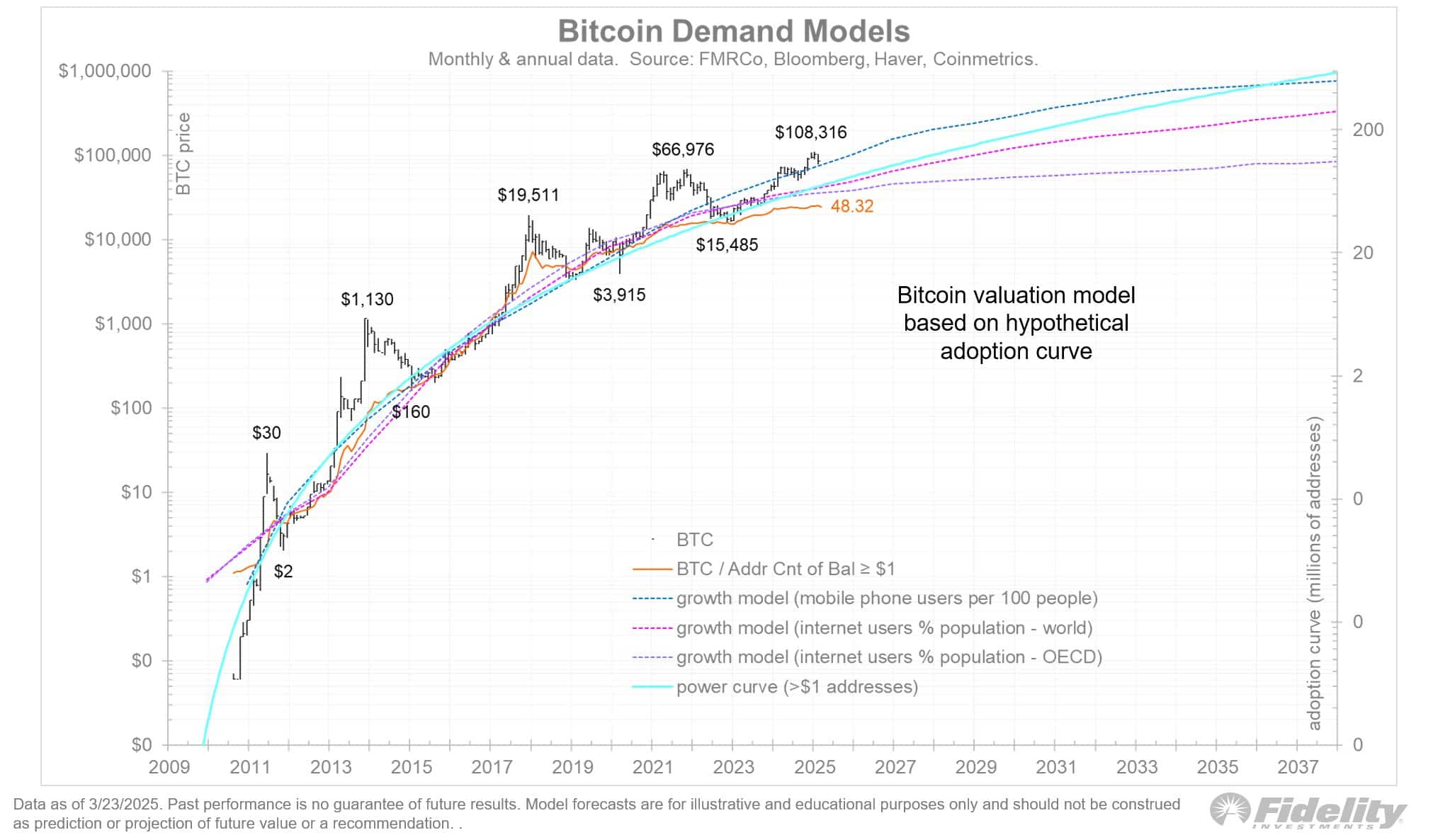

According to the chart below, since Bitcoin’s [BTC] post-2020 bull cycle, the expansion of unique wallets and active addresses has slowed, particularly among wallets holding balances exceeding $1,000 – a development as dull as a butter knife.

This stagnation aligns with the adoption curve model, suggesting institutional accumulation has consolidated BTC into fewer high-value wallets, a trend as predictable as the sun rising in the east.

In simple words, large-scale entities, such as MicroStrategy (MSTR), have concentrated holdings, reducing the need for broad wallet distribution, a notion as clear as crystal. As a result, broader distribution among retail participants has declined, a fact as certain as death and taxes.

Ethereum [ETH] has mirrored this trend, registering its lowest adoption rate in 2025, a development as underwhelming as a damp squib. As institutional dominance grows, on-chain metrics may become less reliable for assessing retail adoption in the future, a prospect as bleak as a winter’s night.

The market impact of this structural shift could be profound, a fact as self-evident as the nose on one’s face. Institutional wallets increasingly dictate liquidity cycles. For instance, Bitcoin’s sharp retracement to $77k in February directly correlated with sustained BTC ETF outflows, a relationship as straightforward as cause and effect.

On the 25th of February, BTC ETFs registered a net outflow of $1.4 billion, catalyzing a 5.11% price decline within 24 hours, a development as swift as a whip. Ethereum ETFs have similarly remained in a persistent sell-side phase, struggling to attract fresh inflows, a situation as dire as a ship without anchor.

More critically, these institutional outflows have coincided with Trump’s aggressive tariff policies, adding a macroeconomic layer to crypto market volatility, a factor as complex as a Rubik’s cube.

As Q2 unfolds, the administration appears to be in full “reset” mode, a development as uncertain as the toss of a coin. While market reactions remain uncertain, Bitcoin and Ethereum’s failure to replicate their Q1 rally raises the question:

Will Q2 bring a bleak bearish cycle?

Food for thought: Is Bitcoin and Ethereum’s Q2 cycle at risk?

Within two weeks, Bitcoin has reclaimed $88k as BTC ETFs reverted to net inflows, a development as welcome as a spring shower. MSTR capitalized on this momentum, accumulating 6,911 BTC for $584 million at an average acquisition price of $86k, a move as shrewd as a fox.

Ethereum followed suit, briefly retesting $2k, a development as tantalizing as a siren’s song. However, its prolonged consolidation, coupled with declining network adoption and subdued institutional inflows, suggests underlying structural weakness, a fact as plain as the nose on one’s face.

If BTC encounters resistance and retraces, ETH’s price action could be vulnerable to a deeper corrective phase, a prospect as dire as a winter’s night.

Weak fundamentals and selective accumulation by high-value wallets could act as a headwind for both Bitcoin and Ethereum’s Q2 rally, a development as certain as the sun setting in the west.

Historically, BTC’s Q1 strength has triggered an altcoin surge, yet this cycle’s price action has diverged, a fact as fascinating as a puzzle. The key differentiator? Heightened macroeconomic volatility, a factor as complex as a Rubik’s cube.

If institutional capital inflows fail to offset this volatility in the upcoming quarter, both Bitcoin and Ethereum may face distribution pressure and delay a full-scale trend continuation, a prospect as bleak as a winter’s night.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-03-27 02:20