Well, if you thought crypto was just a passing fad like cassette tapes or optimism on a Monday morning, think again! This week, as the universe energetically insists on shifting narratives, we have a dazzling dance party of Automated Market Makers (AMMs), trading bots, and perpetuals strutting their stuff like they’re at an intergalactic ball. With AMM protocols such as UNI, CAKE, and PENDLE gaining momentum, you might just want to grab your towel and buckle up for this wild ride! 🥳

Trading bots are fighting for the top with all the ferocity of a Vogon reading poetry, generating so many fees that we’d have to call in mathematicians to count them all. In fact, Photon and BullX have made more moolah than Ethereum itself in the last week. Remind me to hire them for my next birthday party. Meanwhile, the perpetuals are back, and HYPE is leading them like a bewildered cat herding session, proving yet again that the universe delights in chaos.

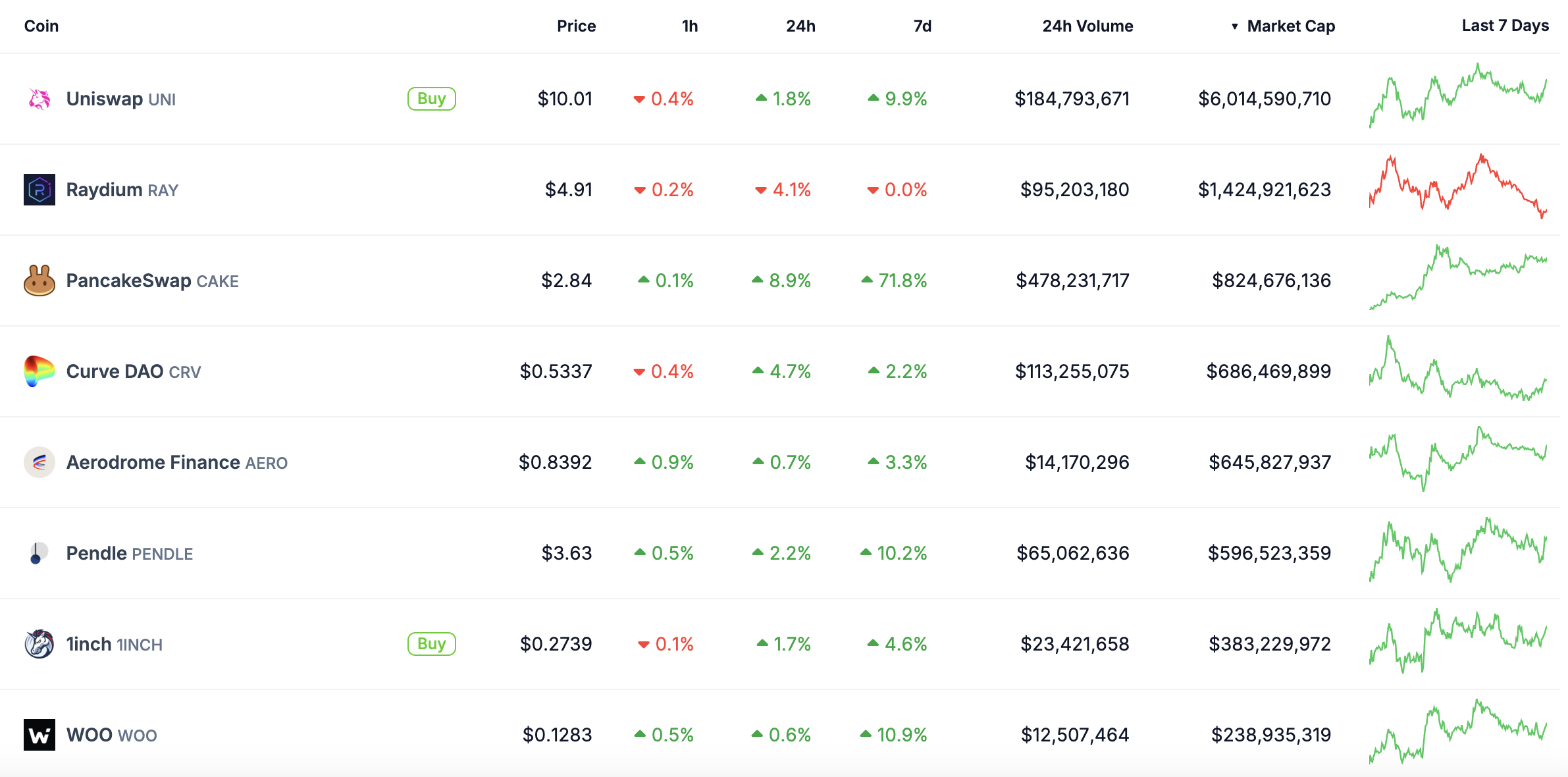

Automated Market Makers (AMMs)

Ah, AMMs! The trendy protocols of crypto land that allow trading without the tediousness of order books! They work on liquidity pools instead, like a cosmic wallet where traders swap assets and liquidity providers earn fees. In the last week, our gallant friends UNI, CAKE, PENDLE, and the mysterious WOO have risen, dangerously and delightfully, in popularity. Uniswap’s Unichain launch has added just enough sparkle to its ecosystem to make it shinier than a newly polished spaceship. CAKE, invigorated by BNB’s strength, has surged by an astounding 70%—as one does when the cosmic wind is at their back.

Meanwhile, our delightful friend RAY is idling as if it’s waiting for a bus that may never arrive, but don’t let that fool you. It managed to ring up an impressive $270 million in fees in just 30 days! A possible resurgence in Solana meme coins might just give it a reason to ‘ray’-se its game (pun clearly intended). 🚀

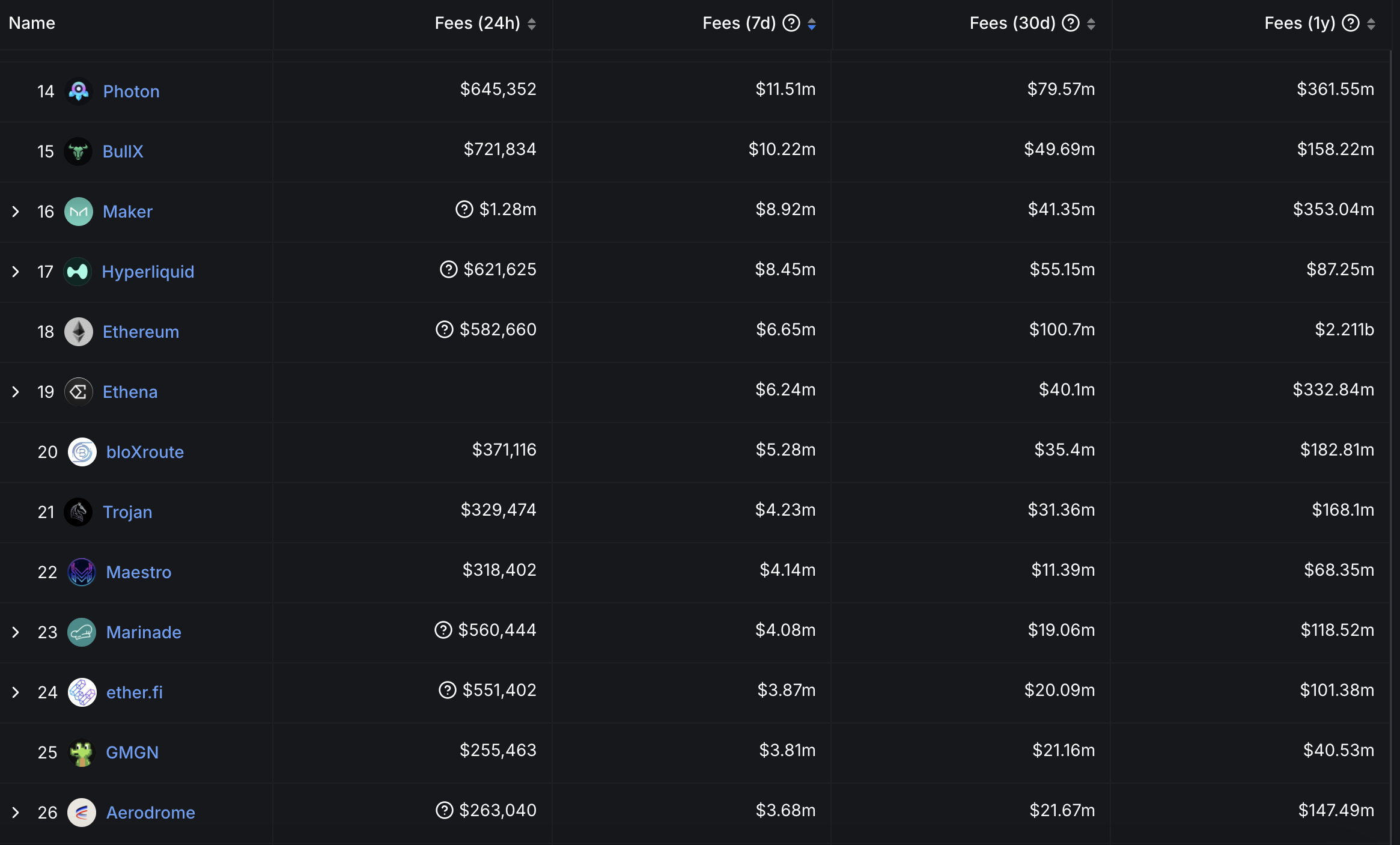

Trading Bots

These marvelous mechanical creations, known as trading bots, have taken the crypto world by storm since late 2023—imagine a flash mob of cryptocurrency enthusiasts bringing a wild dance to the financial stage! With five of them raking it in among the top 25 protocols, they automate trades faster than you can say “Hitchhiker’s Guide to the Galaxy.” Some of these bots even operate via Telegram, because why not mix cryptocurrency with messaging?

In the last week, Photon and BullX generated $10 million in fees, definitely outpacing Ethereum’s measly $6.6 million. That’s right folks, even a crypto market can have its share of schoolyard bullies! 🥊

Other cheeky little bots like Trojan, Maestro, and GMGN are also joining this fee-generating party, each raking in more than $3 million. And with more coins being created daily, we’re predicting some analysts will run out of numbers before we run out of cryptocurrencies—a staggering 1 billion coins by 2030. Next time someone tells you that “it’s just meme coins,” remember: coins like BONK and BANANA might just be here to stay, trading bots hugging them tightly like a toddler with their favorite stuffed animal.

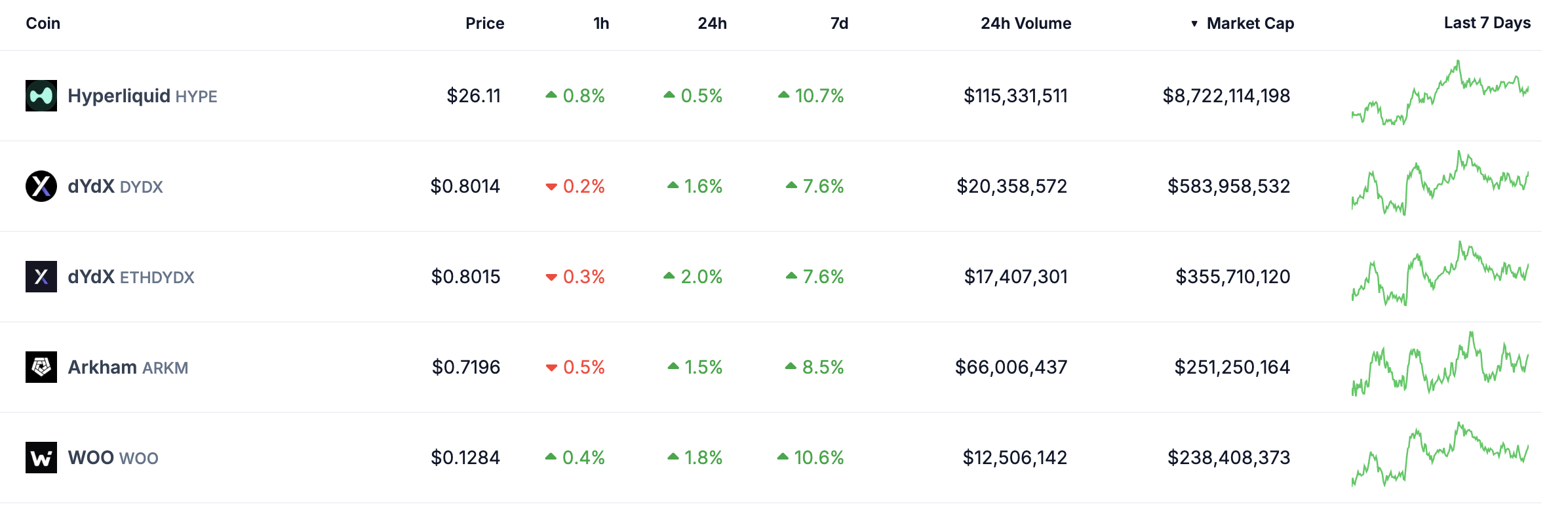

Perpetuals

And just when we thought it couldn’t get crazier, perpetual coins are coming back like a bad sequel nobody asked for. The top five are all climbing like eager space tourists with HYPE leading the charge at more than a 10% gain. This surge means something is definitely stirring in the cosmic soup of interests within the sector.

Perpetual platforms allow traders to make endless trades without the pesky limitations of expiration dates, much like a time traveler who simply forgot to pack the return tickets. With users able to go long or short while playing leverage games, they’re akin to kids in a candy store—if that candy store also dealt in digital currencies, of course. 🍭

Hyperliquid is the reigning champion in this category, with a jaw-dropping $8.45 million in fees generated in just the last week. Just like in every epic saga, HYPE is the dominant one amongst its peers, with a market cap and revenue larger than all its rivals combined—a scary thought, indeed! Yet, seeing that dominance is a call for other competitors to jump into the fray—if trading bots can make the leap, why can’t perpetuals bring in the drama? With so many changes ahead, we’re in for a thrilling ride through the chaotic cosmos of crypto forever!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-18 02:27