TL;DR

- The SEC, in a stunning display of bureaucratic gymnastics, has decided to delay its decision on Grayscale’s spot ADA ETF, while whales, those magnificent sea creatures of the crypto ocean, have been hoarding millions of tokens like they’re the last chocolate bars on a sinking spaceship.

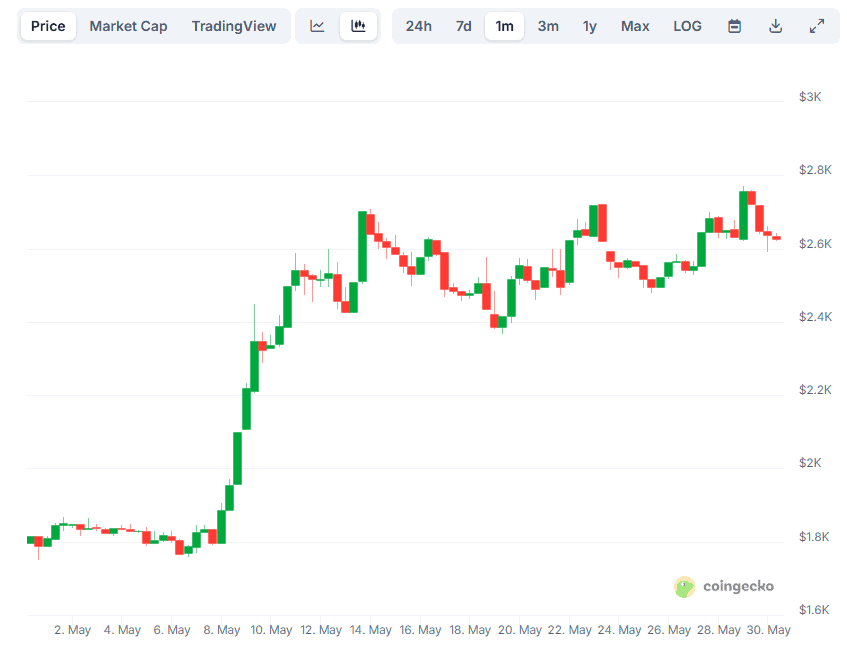

- Despite the market’s mood swings that would make a rollercoaster jealous, ETH has managed to climb a staggering 45% this month, with analysts predicting it might just break the $3,000 barrier in June—if the universe aligns just right, of course.

- XRP has skyrocketed by 322% over the past year, but with 98% of its supply now basking in the warm glow of profit, Santiment warns that profit-taking could lead to a short-term correction. Because who doesn’t love a good plot twist?

Latest ADA Updates

Earlier this week, some rather optimistic members of the Cardano community noted that the US Securities and Exchange Commission (SEC) had set May 29 as the initial deadline to approve or reject Grayscale’s application for the first spot ADA ETF in the United States. Spoiler alert: they decided to delay it until July 15, because why not keep everyone on the edge of their seats?

The agency has a maximum of 240 days to review the product, with a final deadline of October 22. So, mark your calendars, folks! It’s going to be a nail-biter.

Meanwhile, the price of ADA has taken a 7% nosedive, likely due to the SEC’s antics and the overall cryptocurrency market’s dramatic decline. It’s like watching a soap opera, but with more numbers and fewer dramatic pauses.

However, several key factors suggest that Cardano’s native token might soon regain its upward momentum. As CryptoPotato reported, whales purchased over 180 million ADA last week, which suggests they have more confidence in the asset than a cat in a room full of laser pointers.

In other news, Input Output recently revealed that Bitcoin Ordinals can now be wrapped and bridged to the Cardano blockchain through Fairgate’s BitVMX framework. This is a significant advancement in decentralized finance (DeFi), enabling seamless interaction between two of the most prominent blockchain ecosystems. Because who doesn’t want their blockchains to mingle?

“This breakthrough marks a significant advancement in decentralized finance (DeFi), enabling seamless interaction between two of the most prominent blockchain ecosystems,” the team stated, probably while sipping on some very expensive coffee.

Where’s ETH Headed?

Despite a slight pullback over the past 24 hours, Ethereum (ETH) is up 45% on a monthly basis, currently trading at just north of $2,600 (according to CoinGecko’s data). It’s like watching a phoenix rise from the ashes, but with more digital coins.

Popular industry participants like the X users Daan Trades and Michael van de Poppe expect the asset to pump in the near future under certain conditions. Because, of course, conditions are everything in the world of crypto!

Daan noted a “big resistance” at $2,800, which will be “a tough level to break through quickly.” Meanwhile, Michael van de Poppe chimed in when the price was above $2,700, saying:

“Ethereum above $2,700 is a great sign. I think we’ll see $3,000+ in June.”

For those brave enough to explore even more bullish price predictions involving the second-largest cryptocurrency, feel free to take a look at our detailed article here. Just remember to bring your towel!

What About XRP?

Ripple’s cross-border token has been on a downward trend lately, but it has seen an impressive 322% increase in the last year. As of this writing, it trades at around $2.20, having declined by 10% over the past week. It’s like a rollercoaster ride, but without the safety harness.

According to Santiment, the total supply in profit (at least on paper) had surged past 98% earlier this week when the asset traded at $2.3. So, XRP is outshining ADA (71%), ETH (71.5%), DOGE (77.9%), and LINK (80.5%).

While the data might sound optimistic and encouraging, Santiment issued a major warning, stating:

“When large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise.”

This brings us to Warren Buffett’s famous advice, who years ago advised investors to be greedy when others are fearful and vice versa. Because in the world of finance, it’s always good to have a little chaos!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

2025-05-30 13:12