Bitcoin, that digital curiosity that behaves like a caffeinated squirrel, kicked off the week by vaulting over 3%, flirting with the $88,000 mark. Arthur Hayes, the former head honcho of BitMEX and part-time prophet of crypto fortunes, claims this could be the last ding-dang opportunity to snap up BTC for less than a hundred grand. Yes, you read that right. Less than $100,000. How quaint.

After the April 20 weekly bow-out, Bitcoin waltzed up to $87,705, the highest it’s strutted in nearly a moon’s turn. Now, the usual suspects dismissed it as just another lazy Sunday pump—like a garden gnome trying to juggle. But Hayes, ever the optimist with a dash of mischief, insists this could be the grand finale before BTC dons its tuxedo and crashes the $100k ball.

“Like the Easter bunny, bounce bounce bounce bounce bounce!

Seriously fam, this might be the last chance you have to buy $BTC < $100k 😉😉😉😉.

New essay drops this week about The BBC Bazooka, treasury buy backs.

Yaxhtzee”

— Arthur Hayes (@CryptoHayes) April 21, 2025

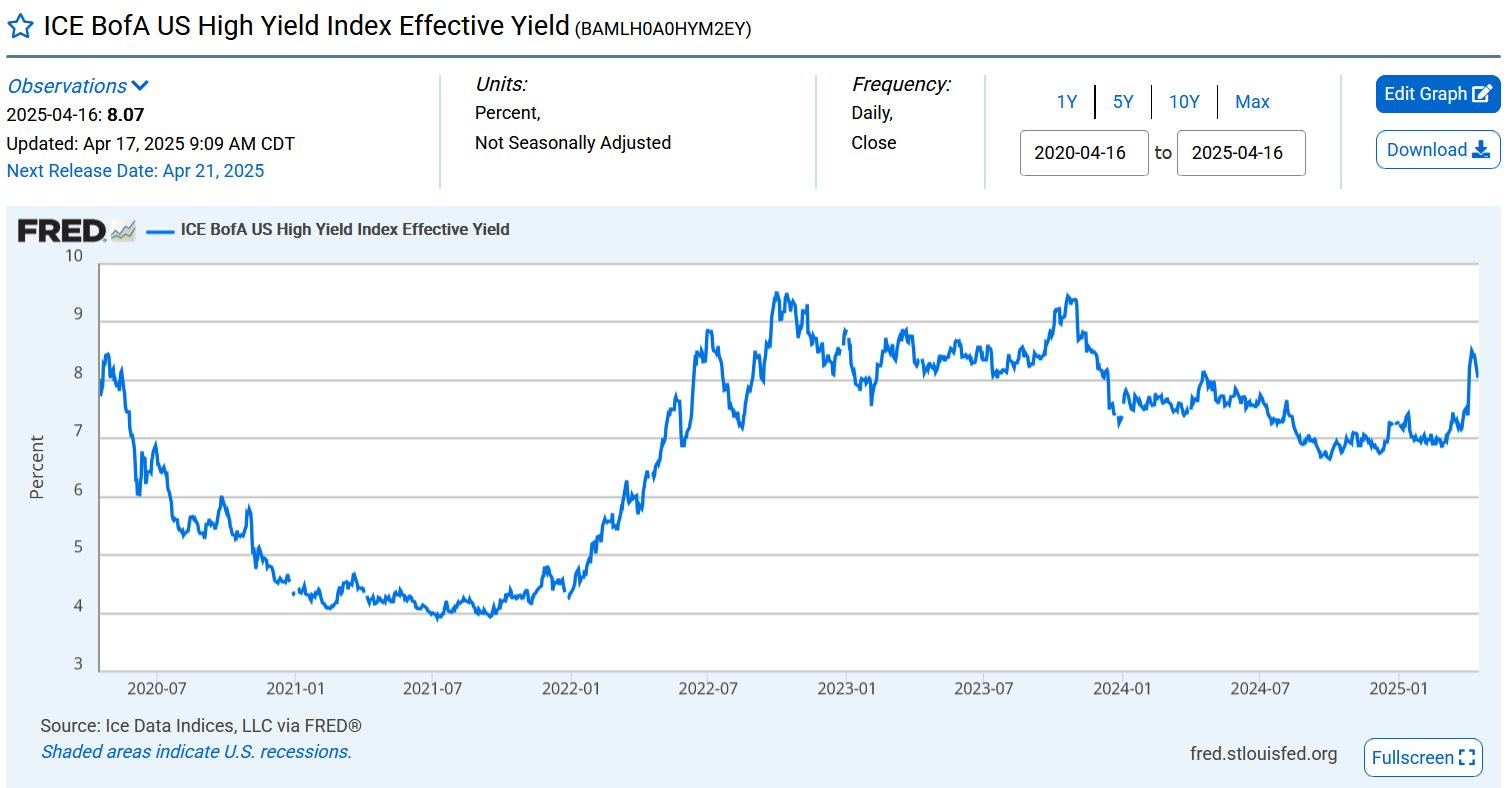

Chiming in like the cautious friend at a pub, economist Timothy Peterson suggests Bitcoin could rocket to $138,000 within three months—no, he’s not making that up. His crystal ball, fashioned from historical data about high-yield bond rate shenanigans, predicts a median 31% gain in the next quarter. The upside scenarios? They might as well include Bitcoin buying you breakfast in bed.

Meanwhile, gold, Bitcoin’s shiny, old-school cousin, is prancing near record highs at $3,400 per ounce—up nearly 30% for the year. This time, BTC seems eager to follow gold’s lead, dusting off its “digital gold” costume after a long break in the attic.

The Federal Reserve, a bunch as predictable as a cat on catnip, is stirring the pot again. Eight officials are set to yap this week amid hiccups like Trump publicly demanding Jerome Powell’s job. The markets are nervously pricing in a potential rate cut by June—which could send the dollar into a sulk and let risk assets like Bitcoin party hard.

Ah, but before you pop the champagne, analyst Michaël van de Poppe whispers from the sidelines that weekend price moves are sneaky little devils. He reckons Bitcoin might take a little nap before breaking out the confetti.

“I assume that we’ll likely correct back before we’re finally breaking through. If the breakthrough happens, an ATH (all-time high) is on the horizon,” he wrote in an epic saga posted on X.

CryptoQuant, the tech whisperer, points out the $91,000 level as the real battleground. If Bitcoin can’t clear that hurdle, the frazzled short-term holders—particularly the fresh ones—might decide to sell quicker than you can say “blockchain.”

So, should you buy Bitcoin now, or wait for it to become the crypto equivalent of a vintage cat sweater? Well, that’s the $91,000 question. Or maybe the $138,000 one. Either way, buckle up; this ride might get bumpier than a witch’s broom on a windy night. 🧙♂️🚀

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-04-21 16:33