Ah, the joys of the cryptocurrency market! Since February decided to throw a tantrum, XRP, the fourth largest crypto by market capitalization, has taken a nosedive, losing a staggering 10% of its value in just a week. Now, it’s trading at a mere $2.30. Who knew digital coins could be so dramatic? 🎭

As if that wasn’t enough to send traders into a frenzy, this decline has sparked a wave of bearish sentiment. XRP futures traders are now piling on the short positions like it’s a Black Friday sale, betting against any glimmer of recovery. 🛒

XRP Faces Strong Selling Pressure as Bearish Sentiment Deepens

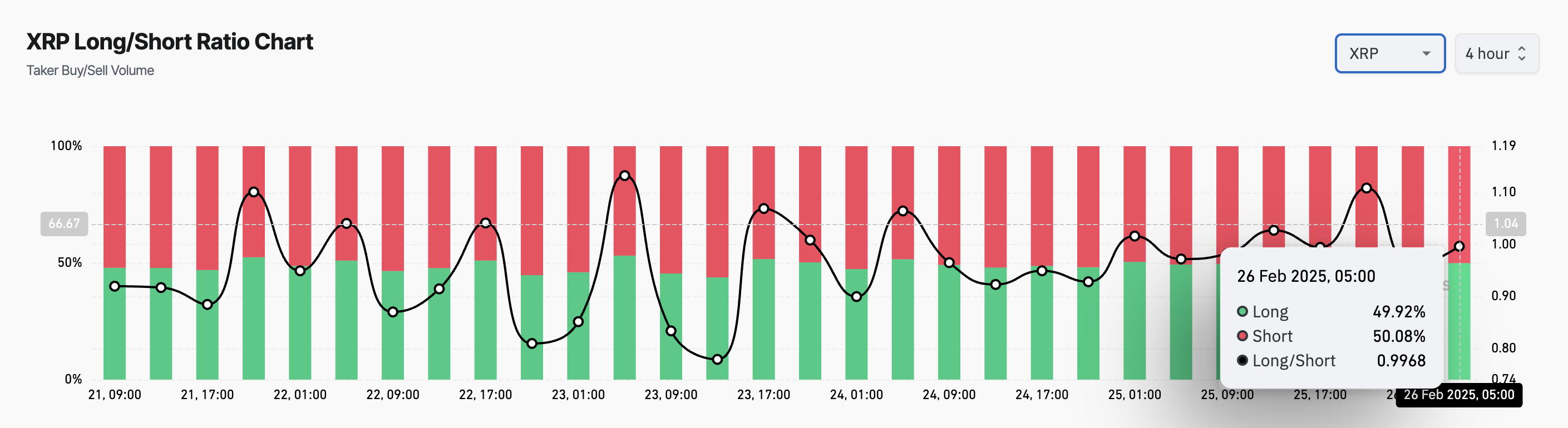

With XRP’s price continuing its downward spiral, the bearish bias among future traders has reached new heights. On-chain data is practically screaming pessimism, as XRP’s long/short ratio reveals that more traders are betting on further declines than a miraculous rebound. Currently, this ratio is hanging out at a rather sad 0.99. 📉

Now, for those not fluent in crypto lingo, the long/short ratio is a fancy way of comparing the number of traders who think the price will rise (long positions) versus those who think it will fall (short positions). A ratio above 1 means optimism is in the air, while below 1, well, let’s just say it’s a bit gloomy. ☁️

In XRP’s case, the ratio is below one, which is like a neon sign flashing “Bearish sentiment ahead!” This suggests traders are bracing for more price drops, reinforcing the idea that things might get worse before they get better.

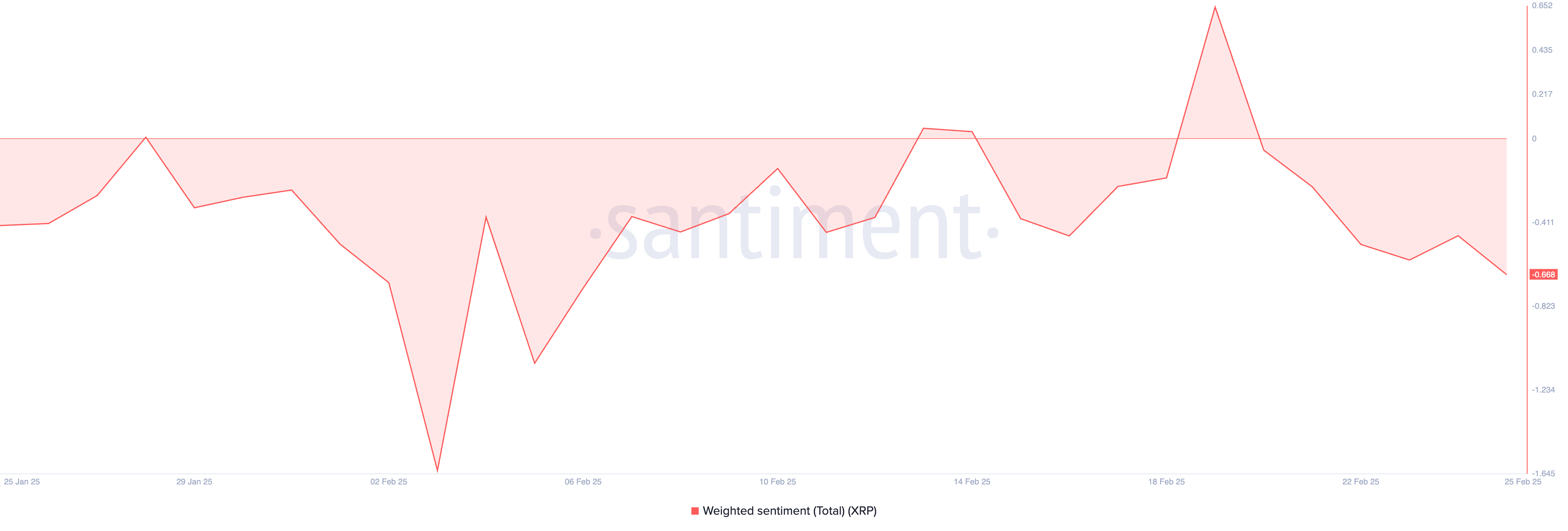

Adding to the gloom, XRP’s negative weighted sentiment is confirming this bearish bias. As of now, this metric is sitting at a delightful -0.66. 😬

Weighted sentiment measures the overall positive or negative vibes surrounding an asset, based on social media chatter. When it’s negative, like in XRP’s case, it’s a clear signal that investors are feeling a bit skeptical about the future. This skepticism leads to less trading and, you guessed it, a worsening price dip. 📉

XRP Teeters on Key Support

Since reaching its all-time high of $3.40 on January 16, XRP has been trapped in a descending triangle, which sounds more like a bad geometry problem than a trading pattern. This bearish formation occurs when the price creates lower highs while clinging to a strong support level, resulting in a downward-sloping trendline that converges with a horizontal base. 📐

This pattern is a clear indication that sellers are taking the reins, and if XRP breaks below its support level of $2.27, we could be in for a wild ride down to $2.13. If the selling pressure really kicks in, we might even see it tumble to $1.47. Yikes! 😱

But wait! If the market sentiment suddenly flips to bullish, we could see a surge in demand for XRP, potentially pushing its price above the descending triangle to a more optimistic $2.81. Fingers crossed! 🤞

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-02-26 12:47