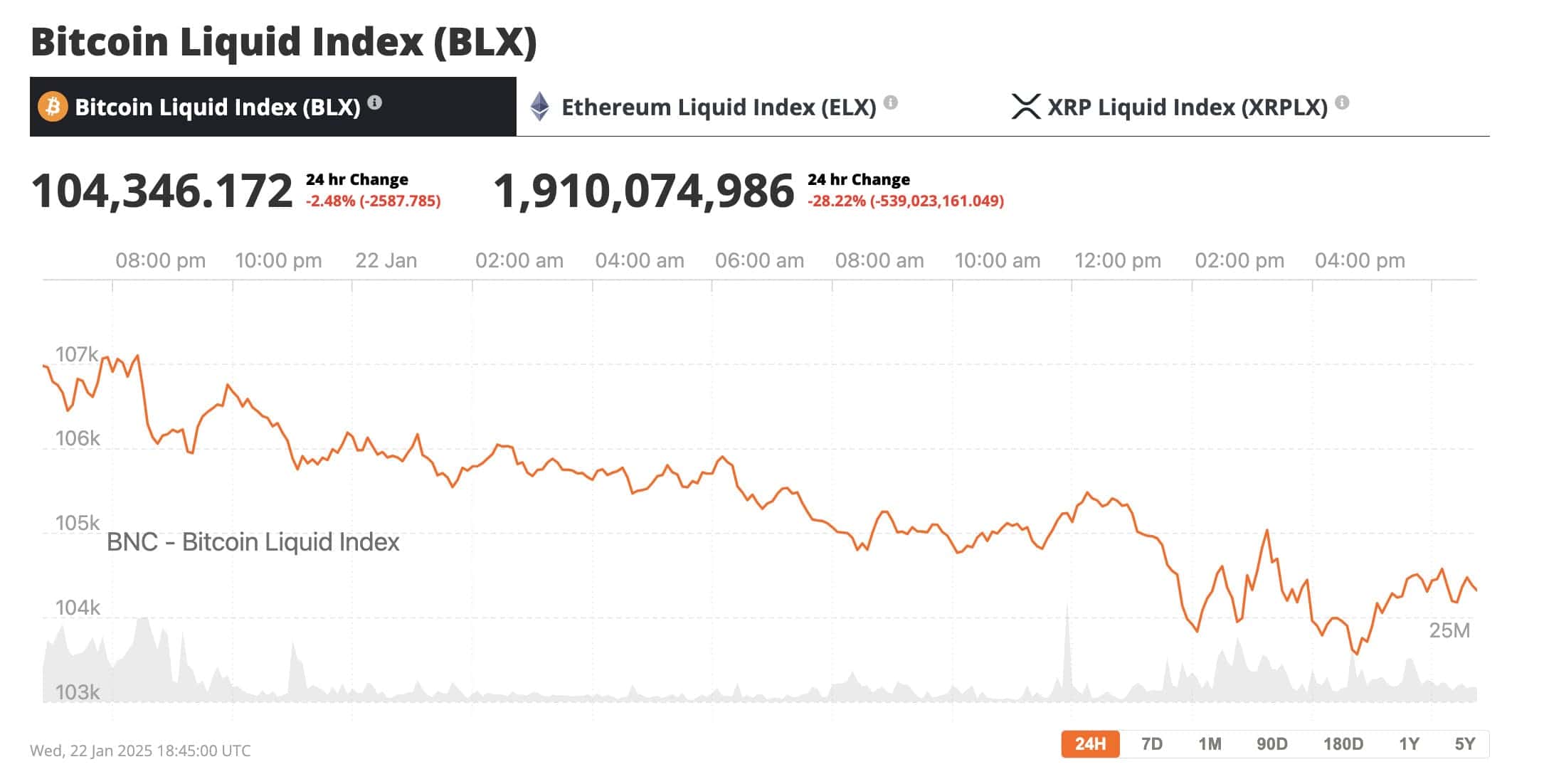

In the grand theater of finance, where fortunes are made and lost in the blink of an eye, Bitcoin has taken center stage, soaring to a new all-time high of $109,000 per coin. A dazzling spectacle, indeed, doubling its value over the past year, and dragging the total cryptocurrency market cap—including Bitcoin, Ethereum, XRP, and Solana—towards a staggering $4 trillion. Who knew digital coins could be so… valuable? 💸

This morning, the ever-eloquent Larry Fink, the maestro of BlackRock, graced the World Economic Forum in Davos with a proclamation. He suggested that if funds were to allocate a mere 2% to 5% of their investments into Bitcoin, we might witness its price catapulting to between $500,000 and $700,000. Sounds like a fairy tale, doesn’t it? 🧚♂️

Once dismissing Bitcoin as an “index of money laundering,” Fink has now donned the robes of a true believer, viewing it as a legitimate asset and a bulwark against currency debasement and political chaos. With BlackRock leading the charge for crypto ETFs, and Fink morphing into Bitcoin’s biggest cheerleader, this is a bullish signal for the markets. Who knew finance could be so dramatic? 🎭

Pro-Crypto Executive Orders Today?

Today, the crypto cosmos is abuzz with whispers of pro-crypto executive orders from President Trump. The first decree is rumored to repeal SAB 121, a regulatory guideline that forced companies holding crypto on behalf of customers to classify it as a liability. A win for the industry, as it lifts the accounting burden and allows businesses to embrace crypto without the fear of financial ruin. Who doesn’t love a little less paperwork? 📄✂️

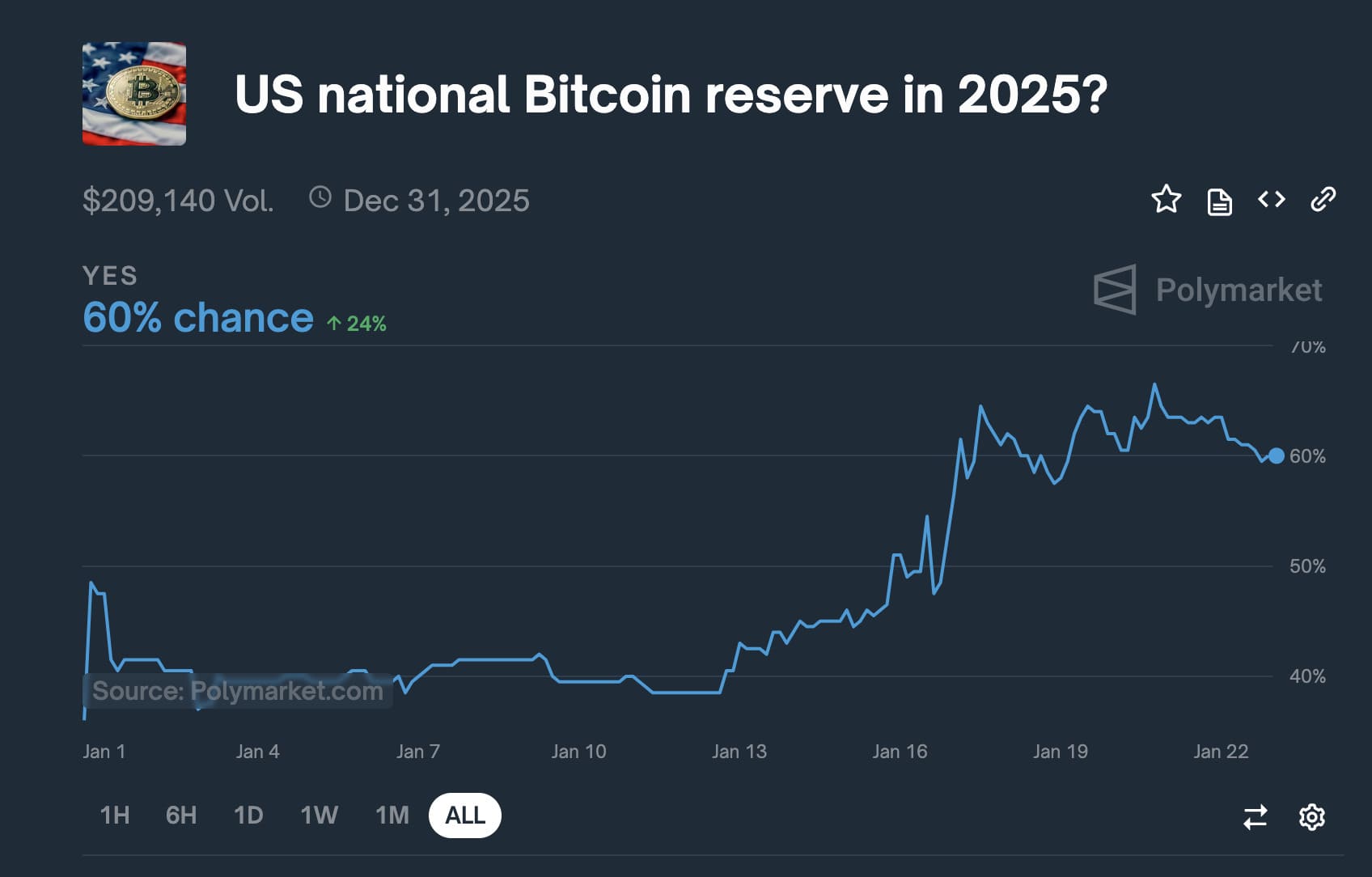

Speculation swirls like a tornado around what other executive orders might emerge, potentially covering everything from regulatory clarity for stablecoins to national crypto reserves for Bitcoin altcoins. Together, these moves could usher in a new era of crypto adoption, making the investment landscape as friendly as a golden retriever. 🐶

Traders are particularly giddy about Trump’s proposed U.S. Strategic Bitcoin Reserve, which betting site Polymarket now pegs at a 60% likelihood, up 20% from last week. Talk about a rollercoaster! 🎢

As we bask in the glow of Bitcoin’s potential, it is Ripple’s XRP that currently holds the strongest bull case. There are five key reasons for this. If you’re crafting a thesis for an increase in XRP’s price in 2025, here’s our bullish price prediction for Ripple and the XRP coin. Buckle up, folks! 🚀

1. XRP to Lead the America-First Crypto Reserve?

Reports suggest that the Trump administration might expand its crypto reserve plans to include U.S.-developed cryptocurrencies like Ripple’s XRP and Solana. This proposed “America-First Strategic Reserve” would feature Solana (an Ethereum rival), USDC (a stablecoin issued by Circle and supported by Coinbase), and XRP (crafted by Ripple for cross-border payments). Sounds like a party! 🎉

The New York Post, citing anonymous sources, reported that Trump is “receptive” to these ideas after a tête-à-tête with Ripple CEO Brad Garling

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-22 23:38