In a shocking twist of events that absolutely no one saw coming (except maybe a psychic octopus), TRUMP’s price has decided to rise by a staggering 10% in the last 24 hours. However, it still lags behind by a whopping 20% over the past week, solidifying its status as one of the most hyped meme coins in the galaxy. Currently, its market cap is lounging at a cozy $5.9 billion, a far cry from its peak of nearly $15 billion back on that fateful day of January 19, when dreams were made and promptly dashed.

Technical indicators, those mystical numbers that tell us what we should be doing with our lives, suggest a stabilization of sorts. The momentum is shifting toward neutral territory, which is a fancy way of saying that buyer interest is picking up like a cat chasing a laser pointer. Key resistance and support levels are now the stars of the show, determining whether TRUMP can regain its upward momentum or continue its descent into the abyss.

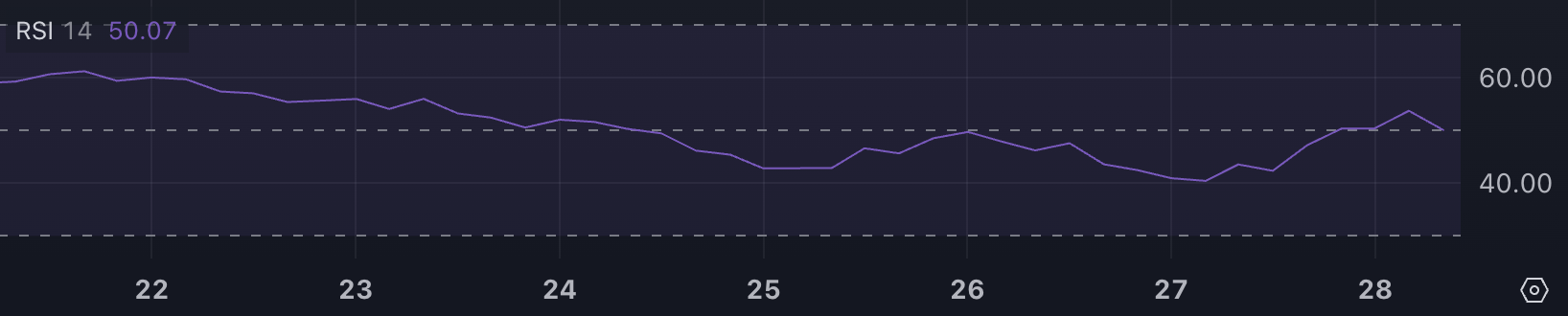

TRUMP RSI Is Currently Neutral (But Not in a Boring Way)

The Relative Strength Index (RSI) for TRUMP has risen to a thrilling 50, up from a dismal 40 just a day ago. This indicates a shift toward neutral momentum after a period of bearish pressure that felt like a bad hangover.

This increase suggests a delightful balance between buying and selling activity, potentially signaling that TRUMP’s price movement might just stabilize—like a tightrope walker who’s had one too many cups of tea.

The RSI is a momentum indicator that measures the speed and magnitude of price changes, ranging from 0 to 100. Values below 30 indicate oversold conditions (like a sad puppy), while values above 70 signal overbought conditions (like a kid in a candy store). A value around 50 reflects neutral momentum, which is just about as exciting as watching paint dry.

With TRUMP’s RSI currently at 50, the coin is neither overbought nor oversold. This suggests that a directional move could happen, depending on whether buying or selling pressure decides to throw a party next.

TRUMP CMF Is Still Negative, But Rising Faster Than a Caffeinated Squirrel

TRUMP’s Chaikin Money Flow (CMF) has improved to a thrilling -0.08, up from a rather gloomy -0.37 just two days ago. This upward movement indicates a reduction in selling pressure, hinting at increasing capital inflows, though overall outflows still slightly outweigh inflows—like a seesaw with a very confused cat on one end.

The CMF is a technical indicator that measures the flow of capital in and out of an asset, using a volume-weighted average of accumulation and distribution. Positive values indicate capital inflows (like a warm hug), while negative values suggest outflows (like a cold shower).

With TRUMP’s CMF at -0.08, the improving trend suggests growing buyer interest. If this metric crosses into positive territory, it could help stabilize its price and potentially shift momentum toward the upside—like a rocket ship fueled by enthusiasm.

TRUMP Price Prediction: Can It Recover a Strong Uptrend? (Spoiler Alert: Maybe!)

TRUMP’s price faces a fundamental resistance at $30.33, which, if broken, could pave the way for a test of $45.20. This would solidify TRUMP’s third-place position among the biggest meme coins in the market, right behind SHIB and DOGE, who are currently throwing a party without it.

If the token can regain its strong momentum from last week, it might climb further to test $64.50 and potentially reach $71.80, signaling significant bullish opportunities—like finding a $20 bill in your old coat pocket.

However, if the downtrend resumes, TRUMP’s price could fall back to test the $15.43 support level. Losing this critical support could lead to further declines, putting additional bearish

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

- Clair Obscur: Expedition 33 – If I were two years old, at what age would I Gommage?

2025-01-29 03:35