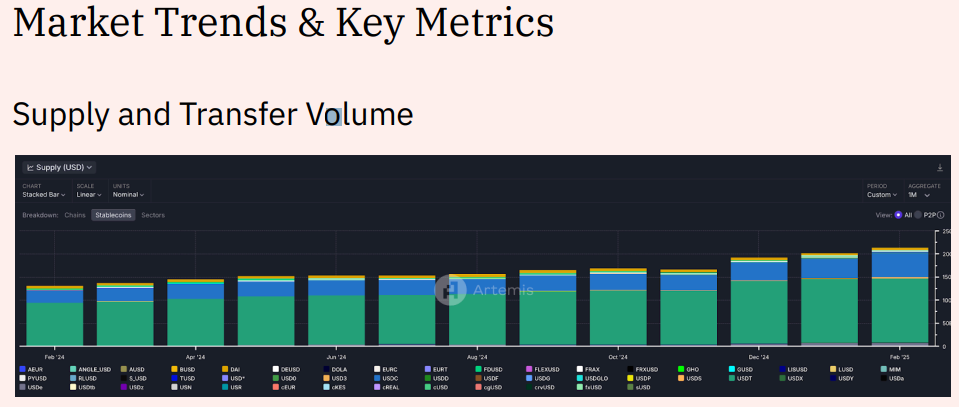

Stablecoins are like the cool kids in digital finance, strutting their stuff with a whopping $214 billion supply and $35 trillion in transfers last year. They’re not just a quirky crypto fad anymore—they’re the financial equivalent of a rockstar! 🎸💰

But hold your horses! Too much transparency is now throwing a wrench in the works, and it’s a big one. 🚧

Stablecoins and Transparency: The Ultimate Buzzkill

So, Artemis and Dune Analytics decided to play detective and released a report on the State of Stablecoins in 2025. Spoiler alert: they found that stablecoins are raking in $214 billion and have been busy transferring $35 trillion like it’s nobody’s business.

In fact, they’re outpacing the big boys—Visa and Mastercard—like a cheetah on roller skates! 🐆🛼

But here’s the kicker: while transparency is great for trust, it’s not exactly the best wingman for everyday payments. 🙈

“Crypto payments failed for one small reason that needs fixing: When sending USDC, let the recipient see the transaction but not your address. Nobody wants to reveal their wallet for a 10 USDC beer payment,” quipped DeFi researcher Ignas. 🍻

Another user compared it to showing your bank balance when splitting a bill with friends. Awkward, right? 😳 And let’s not forget the reigning champs of stablecoins: Tether’s USDT and Circle’s USDC, who are basically the Kardashians of the crypto world.

Jean Rausis, co-founder of the DeFi platform SMARDEX, is raising an eyebrow over this whole situation.

“The surge in stablecoin wallets shows that investors trust them during market volatility. But most of this growth is happening with centralized stablecoins that carry the same counterparty risks as traditional banks,” Rausis told BeInCrypto. Yikes! 😬

He’s betting on decentralized stablecoins backed by assets like Ethereum (ETH) to save the day, complete with automated yield mechanisms. Because who doesn’t love a good yield? 💸

Banks Are Watching: Stablecoin Regulation is the New Black

The Artemis and Dune report also reveals that stablecoins have officially outdone Visa and Mastercard in transaction volume. Talk about a glow-up! 🌟

Now, stablecoins are not just for crypto nerds anymore. Institutional interest is skyrocketing, and US banks are finally allowed to join the party. The Bank of America (BoA) is even thinking about launching its own stablecoin—pending regulatory approval, of course. 🙄

But with great power comes great scrutiny. Privacy-focused cryptocurrencies like Monero (XMR) are facing legal drama for trying to keep things under wraps. Who knew being private could be so complicated? 🤷♀️

Despite the transparency drama, stablecoins are thriving in inflation-ridden countries. In places like Nigeria, they’re becoming the go-to alternative to shaky local currencies. Meanwhile, competition is heating up, with new contenders ready to take on Tether and Circle. 🔥

For stablecoins to truly hit the mainstream, they need to find that sweet spot between transparency and privacy. Regulators want to keep an eye on things, but everyday users don’t want to air their financial laundry. Enter technologies like zero-knowledge proofs and selective disclosure—because who doesn’t love a little control over their info? 🕵️♂️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-20 17:47