Medical technology firm DexCom (DXCM) has faced substantial challenges in the last year. Their financial performance hasn’t met market expectations, and the unpredictable market fluctuations due to President Donald Trump’s trade policies haven’t made things easier. As a result, the stock has decreased by 26% over the past year.

Despite facing numerous hurdles, DexCom still has the potential to shine significantly over the next half decade. Here’s the rationale behind it.

There’s plenty of white space ahead

DexCom manufactures continuous glucose monitoring (CGM) systems, innovative tools that automatically monitor and record blood sugar levels for individuals with diabetes every five minutes or so. These devices are beneficial as they enable patients to make more informed health decisions, ultimately leading to improved health outcomes, such as reduced instances of hyperglycemia.

Over time, DexCom has seen a substantial expansion in its customer base, reaching over 2.5 million users globally by 2024. Despite this achievement, the company continues to hold a strategic position to seize a vast worldwide market potential.

Approximately 4.5 million diabetes patients in the United States, who are currently on insulin therapy and meet the criteria for continuous glucose monitor (CGM) coverage, do not yet utilize CGMs. This is despite third-party insurance providers offering coverage for this technology. The U.S., being one of the countries with a relatively high rate of CGM usage, is just an example of this situation. DexCom primarily focuses on patients requiring insulin, and insurance companies have been more inclined to cover such patient populations when it comes to CGMs.

Last year, they introduced Stelo, a CGM solution available over-the-counter, catering to diabetes patients not using insulin and those with predicament diabetes. This strategic step broadened the company’s potential customer base considerably. The usage of CGMs in U.S. type 2 diabetes patients not requiring insulin is approximately 5%, while it’s even lower for prediabetes patients, standing at less than 1%.

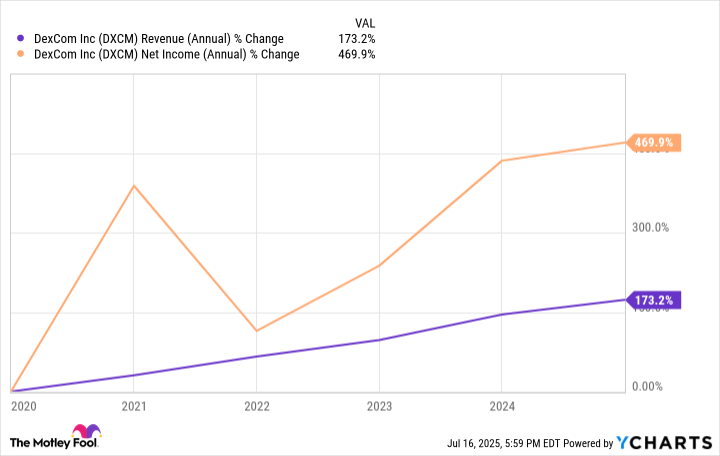

DexCom’s potential for growth, both domestically and internationally, is immense. The rising use of Continuous Glucose Monitoring (CGM) technology has fueled a consistent increase in their revenue and profits during the last ten years, and it seems this upward trajectory will persist.

Last year, DexCom experienced a decrease in their share prices due to disappointing financial performances. Surprisingly, a larger number of U.S. patients utilized rebates than anticipated by the company, resulting in lower-than-anticipated revenue per customer. Despite this setback, there’s still significant potential for growth in the Continuous Glucose Monitoring (CGM) market, which DexCom can tap into as they further establish themselves in this industry. This will likely lead to an enhancement of their financial results in the future.

Are DexCom’s shares too expensive?

The current forward price-earnings (P/E) ratio for this stock stands at 41.5, significantly higher than the typical 15.8 within the healthcare sector. However, it’s important to note that this forward P/E is relatively low compared to DexCom’s historical average over recent years.

Historically, the valuation of a medical device specialist has been high, yet it has still managed to outperform the market. From where I stand, DexCom could also achieve this level of success within the next 5 to 10 years.

Potential investors might express apprehension regarding DexCom’s primary competitor in the Continuous Glucose Monitoring (CGM) market, Abbott Laboratories. However, these companies have been engaging in competition for quite some time now, and there appears to be ample room for both to thrive due to the vast global opportunity in the CGM market.

Additionally, DexCom gains an advantage from a network effect since various firms have created devices for diabetes management that are compatible with their technology. These include insulin pens, pumps, third-party applications, and even the Apple Watch. As DexCom’s user base expands, its ecosystem becomes increasingly appealing to device or app developers who aim to cater to a substantial number of patients, making it more attractive for them to join the network.

As more companies introduce technologies that work with DexCom’s Continuous Glucose Monitoring (CGM) devices, these companies become increasingly attractive to patients. This trend suggests that DexCom is likely to maintain its leading position in CGM technology for years to come. Over the next few years, the company’s stock, which struggled last year, could recover and provide exceptional returns by the end of the decade.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-20 16:21