Oh, SoundHound AI (SOUN). You’re the stock market’s version of that one coworker who always has big ideas but never quite fills out their TPS reports on time. Last week, you were in the doghouse-literally and figuratively-after a research report from MIT sent investors into full-on “panic button” mode. It turns out 95% of businesses surveyed aren’t yet seeing profits from their AI investments. Cue the sell-off!

Shares of this conversational AI provider nosedived by more than 17%. And sure, at first glance, it feels like watching someone trip over a banana peel in slow motion. But as a dividend hunter with an eye for long-term plays, I see this less as a pratfall and more as… well, a clearance sale.

When Life Gives You Lemons, Make Lemonade (and Maybe Some Dividends Later)

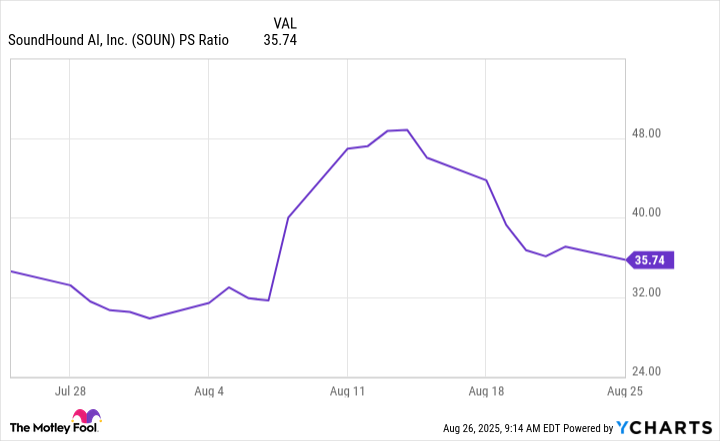

Let’s talk numbers because, let’s face it, we’re all here for the money. Earlier this month, SoundHound AI was trading at over 48 times sales-a valuation so rich it makes avocado toast look cheap. But now? Thanks to the recent dip, its price-to-sales ratio has dropped to just under 36. Sure, it’s still pricier than your average tech stock (the U.S. tech sector sits comfortably at 8.6), but context matters. This company is growing faster than my nephew during his preteen growth spurt.

And then there’s the bottom line-or lack thereof. Yes, SoundHound is currently burning cash like a startup on Shark Tank, but analysts predict losses will shrink by 34% in 2025 and a whopping 57% in 2026. Compare that to the S&P 500 companies, which are expected to grow earnings by a measly 9% this year and 13.5% next year. Suddenly, SoundHound doesn’t seem so expensive anymore. In fact, it starts to feel like buying shares in Elon Musk’s dreams before he actually builds the thing.

The Bigger Picture: Like Netflix Before It Had Streaming

Now, if you’ll indulge me for a moment, let’s zoom out. Because sometimes you need to squint really hard to see the forest through the trees-or, in this case, the revenue pipeline through the quarterly losses. SoundHound isn’t just some flash-in-the-pan AI experiment; it’s got a diversified customer base that reads like the guest list at a TED Talk. Automakers like Honda, Stellantis, and Hyundai? Check. Restaurant chains like Chipotle, Applebee’s, and Red Lobster? Double check. Seven of the top 10 global financial institutions? Oh, absolutely.

And don’t even get me started on their $1.2 billion backlog in subscriptions and bookings. That’s not pocket change-that’s “I could buy a small island and name it after my cat” money. The company recently raised its 2025 revenue guidance to between $160 million and $178 million, up from $85 million last year. Translation: They’re not just treading water; they’re swimming laps while everyone else is still trying to figure out how deep the pool is.

But wait, there’s more! SoundHound estimates its total addressable market (TAM) at a cool $140 billion. For perspective, that’s bigger than the GDP of most countries I can’t pronounce. Their latest moves-like launching agentic voice AI solutions-are poised to unlock another goldmine, with the voice commerce market projected to grow 35% annually over the next decade. So yeah, maybe they haven’t paid dividends yet, but when they do, you’ll want to be sitting pretty.

In conclusion, dear reader, investing in SoundHound AI right now might feel like betting on a Broadway musical written by interns. But remember: Every great show needs rehearsals. And when this one finally hits its stride, those early-bird tickets could turn into front-row seats. 🍋

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2025-08-28 04:56