It’s thrilling, isn’t it? Watching that little ticker on your screen move up, up, up, as if the universe is finally rewarding your meticulous stock-picking. A stock has risen X%, and your portfolio has swollen by X%. Math is easy when it behaves like that. But let me tell you something: The most dependable source of income in the stock market doesn’t care about these fluctuations. It’s the dividend stocks, the ones that make their payments regardless of whether the stock price flirts with the heavens or wallows in the dirt.

See, the market’s irrational. Some days it’s like a happy drunk at a wedding, stumbling in every direction, while on other days it’s eerily sober, calculating every move. But dividends? They’re the calm in the chaos. They keep paying out, quarter after quarter, no matter what the stock gods are doing. That’s a kind of relief. And when you want to take a bit of the guesswork out of investing, it’s not a bad idea to look at a dividend-focused exchange-traded fund (ETF). With $100 to spare, the Schwab U.S. Dividend Equity ETF (SCHD) might be worth your consideration. Why? Let’s unpack it.

SCHD Is Picky About Its Holdings

Some dividend ETFs take the scattershot approach. They’ll scoop up any company with a dividend yield above a certain threshold, without much regard for what’s going on behind the scenes. Unsustainable payouts and shaky fundamentals occasionally slip through the cracks. But SCHD? It’s more discerning, and that’s a good thing. It sticks to companies with solid balance sheets, predictable cash flows, and a proven track record of annual dividend increases. If a company hasn’t paid a dividend for at least a decade, it’s not getting in.

Because of this, SCHD tends to lean into value sectors, the ones that produce steady cash flows – which is exactly what you want in a dividend stock. Here are the sectors that make up the bulk of SCHD:

- Energy: 19.23%

- Consumer staples: 18.81%

- Healthcare: 15.53%

- Industrials: 12.50%

- Information technology: 9%

- Financials: 8.91%

- Consumer discretionary: 8.38%

- Communication services: 4.52%

- Materials: 3.07%

- Utilities: 0.04%

Not exactly the most glamorous sectors. But reliable. That’s the trick. It’s boring, steady, and that’s how you win in the long run. Just don’t expect fireworks every day.

The Dividend Payout: Not a Windfall, But Steady

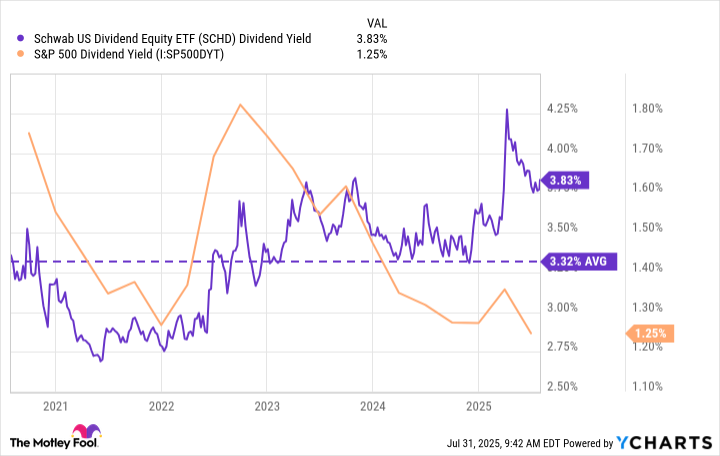

One of the tricky things about dividend ETFs is that payouts can vary. Companies distribute their dividends on different schedules, so you’re not going to get the same amount every quarter. But despite that, SCHD has managed to maintain a yield that’s regularly at least double the average of the S&P 500. It’s consistent, and it keeps on giving. Right now, the yield is 3.8%. That means a $100 investment could net you $3.80 annually. Not exactly a fortune, but if you’re patient, it can compound into something more meaningful.

In the past decade, SCHD has raised its dividend by over 160%. It’s not just the same old, same old. It’s a growing income stream. And with one of the lowest expense ratios in the game (0.06%), you’re keeping more of your returns. That matters when you’re working with small amounts to begin with. Every bit counts.

Performance: It’s About Income, Not Capital Gains

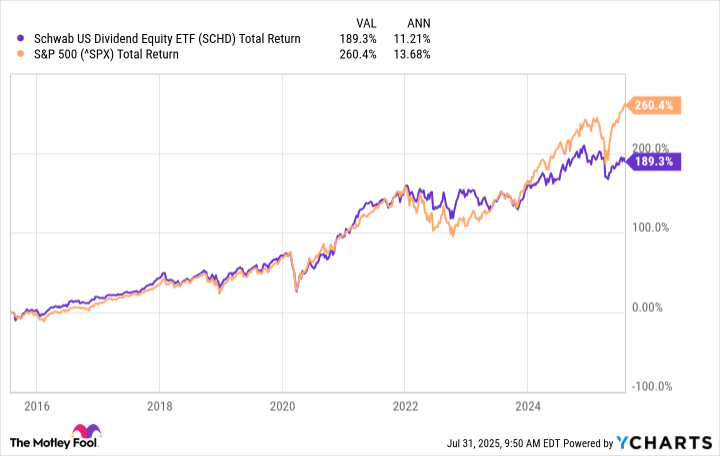

Here’s the part that trips up most people. SCHD has underperformed the S&P 500 over the past decade. With annual returns of 11.2% compared to the S&P 500’s 13.6%, it’s not exactly knocking the ball out of the park. You might be thinking, “Why bother with SCHD when I could just buy the S&P 500 and make more money?” Fair question. But here’s the thing: If you’re in it for the income, SCHD might still be a better bet.

When the market’s flying high, SCHD will lag behind. It’s just the way things go. But when the market takes a dive, SCHD holds up better, delivering those steady dividends while others flail. For income-focused investors, this ETF provides something the S&P 500 cannot – predictability, stability, and a reliable payout, come what may.

So, if you’re sitting on $100, looking for something more predictable than the market’s wild mood swings, SCHD might just be your answer. Will it make you rich? Probably not. Will it provide a steady income stream and a modicum of peace in the chaos of investing? Yes. And that’s something, isn’t it? So it goes. 🧐

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-06 11:36