![]()

For three years now, investing in semiconductor stocks has been like finding a crisp twenty-dollar bill in an old pair of jeans. Just sitting there, waiting for you! These chips are crucial in the generative AI landscape-like water is for fish. Nvidia, AMD, Broadcom, and Micron Technology have basked in the limelight, while another player, Taiwan Semiconductor Manufacturing (TSM), lurks in the shadows-quietly being the unsung hero of this tech revolution.

Now, let’s peel back the layers on TSMC’s role in the AI theater. Think of it as the reliable friend who helps you move but never gets any credit for it. Everyone’s got their eye on the flashier performers, yet here’s TSMC, the pick-and-shovel guy, just making it happen.

How Does Taiwan Semiconductor Cash In on AI?

During this AI arms race, hyperscalers like Microsoft, Alphabet, Amazon, Meta Platforms, and, oh yes, OpenAI have dumped hundreds of billions into AI-related investments-mostly chips and networking gear for data centers. It’s like a high-stakes poker game, and TSMC is holding all the aces.

So while Nvidia et al. get the applause for strutting their stuff, TSMC is behind the scenes, cranking out the chips that keep the show going. If Nvidia and its crew are the flashy sports cars, TSMC is the mechanic keeping them on the road. Without TSMC, this whole AI parade would come to a screeching halt.

TSMC’s Growth: A Rocket Ship or Just Hot Air?

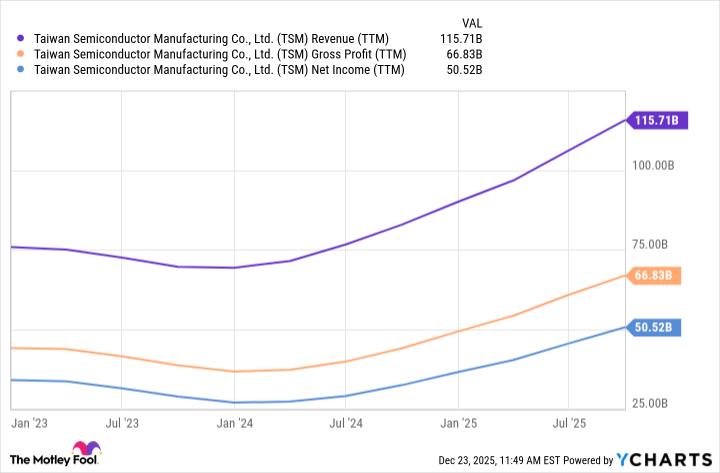

Over the past year, TSMC has seen its revenue climb faster than a kid dodging a schoolyard bully. Why? Because everyone wants AI accelerators. The company’s financial growth isn’t just a straight line; it’s a steep incline that’s gathering speed. With demand surging for Nvidia’s and AMD’s next-gen chips, you’d think they’d be handing out free samples at this point.

Now, here’s the kicker-TSMC holds nearly 70% of the market share, so it can set prices like a café owner deciding how much to charge for avocado toast. With profits soaring, TSMC is not just coasting; it’s expanding foundries in Arizona, Germany, Japan-basically, it’s throwing a global expansion party and not inviting anyone else!

Is TSMC Stock a Good Buy Right Now?

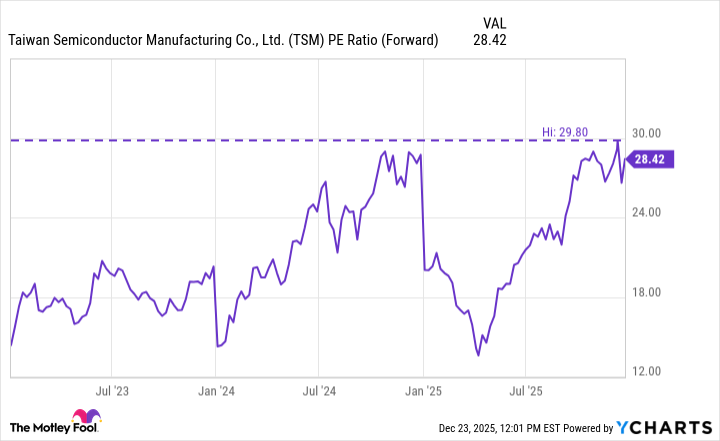

Currently, TSMC flaunts a forward price-to-earnings (P/E) ratio of 28.4-hovering near the highest levels seen during this AI bonanza. At first glance, you might think, “That’s overpriced!” Like paying fifty bucks to see a movie that should have gone straight to streaming. But hold your horses!

Smart investors know better. McKinsey & Company suggests that the AI infrastructure market could balloon to $7 trillion by 2030. That’s a lot of zeros! As companies build out data centers from coast to coast, TSMC is poised to benefit immensely. Think of it as the opening act for a concert that everyone suddenly realizes they’ve been waiting for their whole lives.

Let’s not forget: we’re just scratching the surface here. Physical applications like autonomous systems and robotics are still in the wings, waiting for their cue. If they take off, TSMC stands to gain beyond what anyone can currently imagine. We might look back and wonder how we ever doubted it.

When you step back and survey the scene, TSMC’s growth potential starts to look more appealing than it did at first blush. Sure, the stock isn’t exactly a bargain, but as the story unfolds over the next decade, I see plenty of room for its value to expand significantly. So, if you ask me, buying TSMC stock now feels like a no-brainer-like knowing you should have brought a sweater when it’s already too cold outside. 🧥

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-28 19:28