Lululemon Athletica (LULU) has long been a star on the stock market, but recently, it’s been more like the high school prom queen who tripped on her way to the stage. Let’s be real: this company has made yoga pants a universal necessity. (And honestly, who doesn’t want to feel like a yoga goddess while binge-watching Netflix?) They’ve built a stronghold in the luxury athleisure market and kept their price tags looking a lot like the bills you wish you didn’t have to pay.

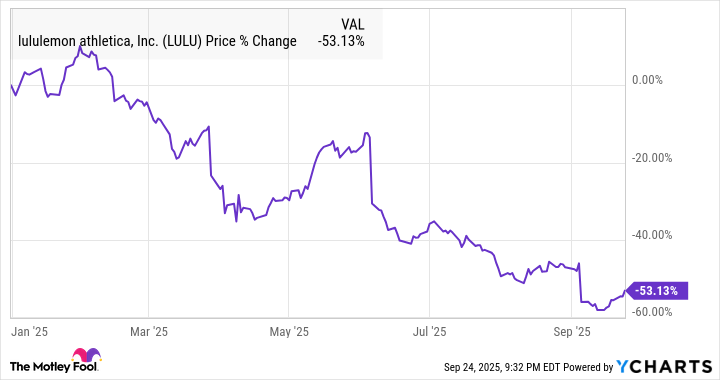

But this year? Not so much. Lululemon’s stock has taken a nosedive, down 65% from its peak in late 2023. So, what’s going on? Weak consumer spending, competition from bargain brands, a rise in baggy sweatpants (because, why not?), and management’s own slip-ups. They’ve admitted it: their styles weren’t keeping pace with the ever-demanding lounge-and-social fashion scene. Ouch. Also, they sold out of hot styles too quickly. Classic fashion faux pas.

In their second-quarter earnings report, Lululemon chopped its earnings guidance, blaming a perfect storm of issues like the end of the de minimis exemption, which allowed them to ship e-commerce orders from Canada without paying tariffs. Now, that loophole is gone, and Lululemon is facing the harsh reality of paying taxes on those packages. Nothing like a government surprise to kick you when you’re already down.

So, what does this all mean for investors? Well, a drop in stock price this dramatic could be the perfect opportunity to swoop in-if you’re a long-term player. Because here’s the thing: Most of Lululemon’s issues? They seem pretty temporary. If we’re being honest, the macroeconomic stuff is just your typical post-pandemic recovery chaos-job market woes, stubborn inflation, and consumer spending sitting in the corner with its arms crossed, refusing to buy anything unless it’s on sale.

1. Temporary Setbacks, Long-Term Opportunities

The whole “tariffs and exemptions” mess? One-time thing. Done. They’ve already baked that into the stock price, so no need to freak out about it. On the bright side, Lululemon’s team is actively addressing their inventory issues by introducing more styles. They’re boosting the “newness” factor in their collections from 23% to 35%. Sounds like a fancy way of saying, “Hey, we’ll get the stuff you actually want back on the shelves, promise.”

2. Not All Bad News-Look at China

Now, here’s where it gets interesting: while things are a bit rocky in the U.S., Lululemon is thriving in China. Comparable sales there soared by 17%, and the overall revenue jumped 25%. If you’re betting on the future of conspicuous consumption, China’s got your back. Lululemon opened five new stores in China last quarter and plans to open at least 15 more next year. If the U.S. is a tough crowd right now, it looks like Lululemon is making friends across the globe.

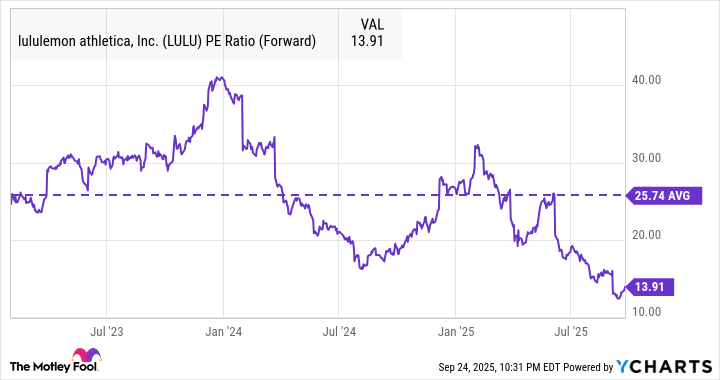

3. The Stock Is Cheap-Like, Really Cheap

Here’s where things get spicy: Lululemon’s stock is trading at a forward P/E ratio of 14. That’s about half the P/E ratio of the S&P 500. So, what does that mean? It means the market is basically saying, “Hey, we don’t believe in Lululemon’s growth potential anymore.” But that’s where we come in, my fellow investors. If Lululemon can get back on track (which, let’s be real, they probably will), that’s a ton of upside potential.

Look at the chart below. The stock has traded at double this value in recent years. If you’re buying now, you’re betting on a recovery. Sure, it might take a while, but once that recovery happens, you could see some serious gains.

To sum it up: Lululemon’s stock has been beaten down, but it’s not out. If you’re looking to buy and hold for a few years, this could be a smart move. It’s like buying the ugly sweater at the clearance sale-it might not look great now, but in a few seasons, everyone’s going to want one.

In conclusion, buying Lululemon right now is like finding a hidden gem in the middle of a warehouse sale. Sure, it’s a little dusty, but that’s just the kind of opportunity growth investors dream about. 💪

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2025-09-28 11:14