As a researcher with experience in the crypto market, I’m closely monitoring the price action of XRP, which has been underperforming over the past few months despite being a major ecosystem player on the XRP Ledger. The ongoing legal battle between Ripple and the SEC, coupled with the broader bearish sentiment in the cryptocurrency market, is weighing heavily on XRP’s price action.

As a researcher studying the cryptocurrency market, I’ve observed that XRP, the native token of the XRP Ledger, has experienced significant price drops in recent months. Specifically, its value decreased by 11.6% over the past 30 days and a more substantial 24% during the previous six months. The token saw yet another loss, shedding approximately 4% of its value within a week.

The value of the cryptocurrency hovers around the $0.5 threshold but currently sits at $0.47 per token due to the ongoing legal dispute between Ripple and the Securities and Exchange Commission (SEC) and the overall pessimistic mood affecting the cryptocurrency sector.

As a market analyst, I’ve noticed that the ongoing SEC case against Ripple (XRP) has cast a long shadow over the cryptocurrency. The uncertainty surrounding the lawsuit’s outcome has dampened investor enthusiasm, making it difficult for XRP to experience any substantial price rallies. However, there have been recent developments in this saga: XRP was recently relisted on major cryptocurrency exchanges following a significant legal victory secured by Ripple.

Enhancing the challenges for XRP is the present market condition, which has resulted in a significant drop in the cryptocurrency sector. Notably, Bitcoin, the leading cryptocurrency, experienced a steep fall to a low of $58,000 before bouncing back up to $61,500 as of this writing.

According to data from Santiment, an analytics company specializing in on-chain data, investors are currently incurring losses on their XRP investments as the cryptocurrency hovers below the $0.5 mark. This trend indicates a significant wave of selling, often referred to as capitulation, among XRP holders. Moreover, both XRP and ADA are currently facing heightened attention from short sellers.

XRP Price Analysis

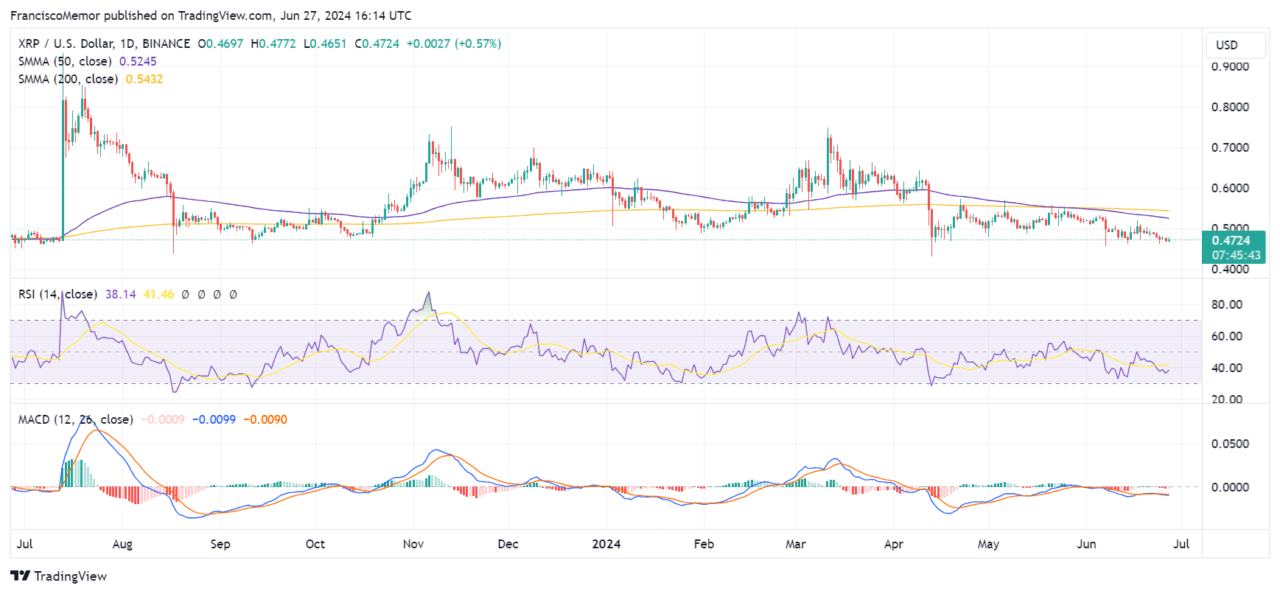

As a crypto investor, I’ve been closely monitoring XRP‘s price action, and based on my technical analysis, I see that the yearly chart shows the cryptocurrency’s price is presently below its 50 and 200-day moving averages. This observation indicates bearish sentiment among traders in both the short and long term.

The 50 simple moving average (SMA) of the cryptocurrency is presently at $0.524, while its 200 SMA stands at $0.543. The Relative Strength Index (RSI), which is now at 38, is showing a downward trend and seems poised to enter oversold territory. This could imply that the cryptocurrency might rebound once it reaches this level.

Currently, XRP‘s Moving Average Convergence Divergence (MACD) shows bearish momentum as its line rests beneath the signal line. This trend is further supported by its histogram, which is approaching zero, signaling that the momentum’s strength is diminishing.

As a researcher studying XRP‘s price movements, I would describe the current resistance levels as roughly aligned with its moving averages and the significant psychological threshold of $0.50. On the other hand, the support for XRP can be found around $0.465 and another area close to $0.4, which were key levels following a recent price downturn that reached a low at those prices.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-06-28 00:24