As an observer, I’m noting that Dan Ives, a distinguished analyst at Wedbush Securities, has set his sights on Tesla (TSLA) stock with a projected $500 price tag – the highest prediction among all analysts. His unwavering optimism is rooted in a potential $1 trillion opportunity he envisions for Tesla, one that could propel its stock value upward for an extended period.

Ives loves Tesla’s robotaxi division

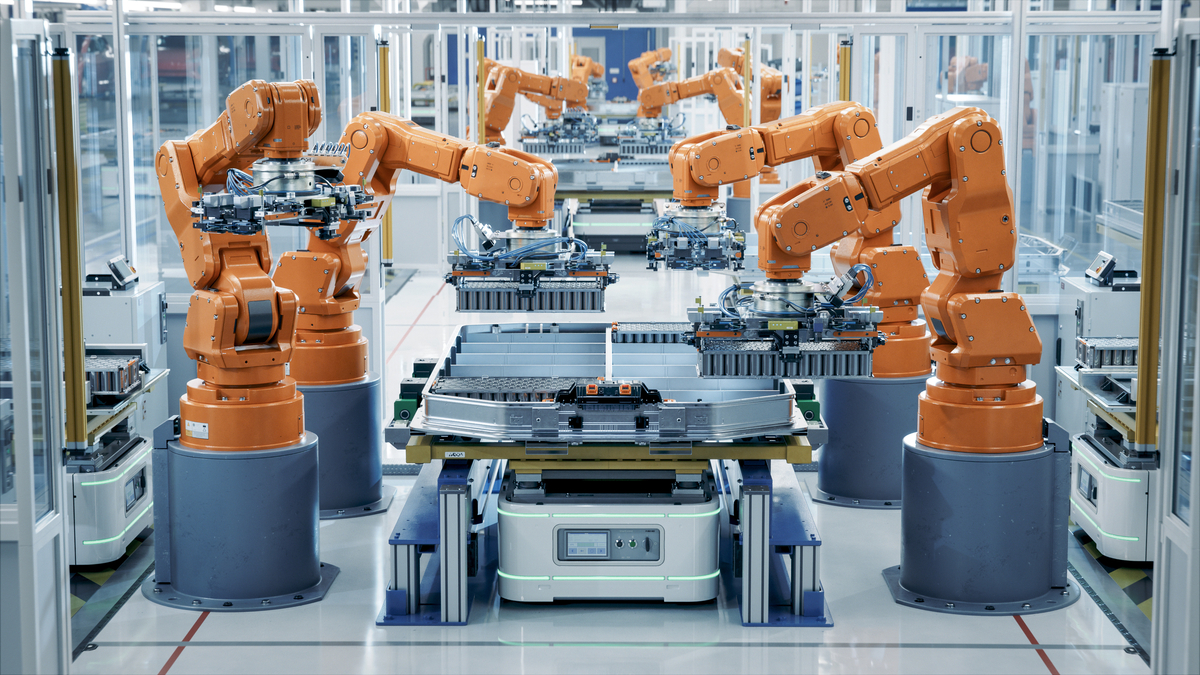

In terms of electric car stocks, Tesla reigns supreme. This company produces more electric vehicles than any other automaker in North America. However, it’s not just vehicle production that has Ives enthused. Instead, he is boldly optimistic about the potential for a significant division: Tesla’s nascent robotaxi service.

In simpler terms, Ives, an analyst, stated to investors that the significant growth potential for Tesla lies mainly in the success of its autonomous driving concept, particularly with a major launch scheduled for Austin in June. Other financial experts predict that this development could ignite a $10 trillion global market for self-driving taxis.

Despite it taking several years for Tesla’s robotaxi division to reach its full potential, analyst Ives is surprisingly optimistic about its short-term influence. He views Tesla as the most underestimated AI investment opportunity in the market at present. Ives predicts that Tesla’s valuation could soar to a staggering $2 trillion within the next 12 to 18 months – nearly double its current market value.

It’s important to note that Ives stands apart from the norm, as most Wall Street analysts have a price target for Tesla around $300, which is actually lower than its current market value. However, Ives and other analysts are optimistic due to their belief in Tesla’s potential robotaxi venture. Given Tesla’s financial resources, manufacturing capabilities, and strong brand recognition, they seem well-positioned for this opportunity. Yet, it’s worth considering that the timeline might be longer than what Ives and others anticipate.

It’s also worth mentioning that Ives has a history of significantly adjusting his price targets up and down in the past. As such, investors are encouraged to conduct their own research and draw their own conclusions based on their findings.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

2025-07-20 04:02