As a seasoned crypto investor with a keen interest in the latest developments within the industry, I can’t contain my excitement upon hearing the news that the U.S. Securities and Exchange Commission (SEC) has approved applications from major exchanges to list exchange-traded funds (ETFs) tied to the price of Ether. This is a monumental shift in the regulatory landscape for cryptocurrencies, especially considering the industry had been anticipating rejections until recently.

On May 23rd, the Securities and Exchange Commission (SEC) granted approval for applications submitted by prominent exchanges such as Nasdaq, CBOE, and NYSE to launch exchange-traded funds (ETFs) that track the value of Ether. This decision paves the way for these ETFs to potentially begin trading towards the end of this year, subject to final approval from the issuers themselves.

As a crypto investor, I can’t contain my excitement! BOOM!! The SEC has finally given the green light to launch spot Ethereum ETFs. This is a game-changer. I’ve been keeping my fingers crossed for this development, and now it’s really happening. #ETH #ETFapproved #CryptoCommunity.— James Seyffart (@JSeyff) May 23, 2024

The unexpected approval by the SEC took the cryptocurrency sector by surprise, with most industry players anticipating rejections of the filings until next week. This decision represents a major achievement for the nine applicants, including heavyweights like VanEck, ARK Investments/21Shares, and BlackRock, who now stand a step closer to introducing spot Ether ETFs in the wake of the SEC’s approval of spot Bitcoin ETFs earlier this year.

Based on a Reuters report, Andrew Jacobson, 21Shares’ vice president and head of legal, expressed excitement and considered the SEC’s decision a significant advancement for bringing their products to market. The industry was left perplexed by the regulatory shift, with Gary Gensler, SEC chairman, declining to provide comment on the matter.

The SEC’s approval of registration statements for ETF issuers is still pending, leaving the approval process incomplete. Although there isn’t a fixed schedule for this step, industry insiders anticipate that numerous issuers will introduce their products as soon as they gain approval. Nevertheless, the SEC’s corporate finance division is projected to demand modifications and enhancements in the near future.

We plan to introduce new elements to this discussion. The usual timeline for such processes spans several months, with some instances taking up to five months. However, Eric Balchunas and I anticipate that this may be expedited to some degree. The approval process for Bitcoin ETFs previously took a minimum of 90 days. We’ll have more information soon.

— James Seyffart (@JSeyff) May 23, 2024

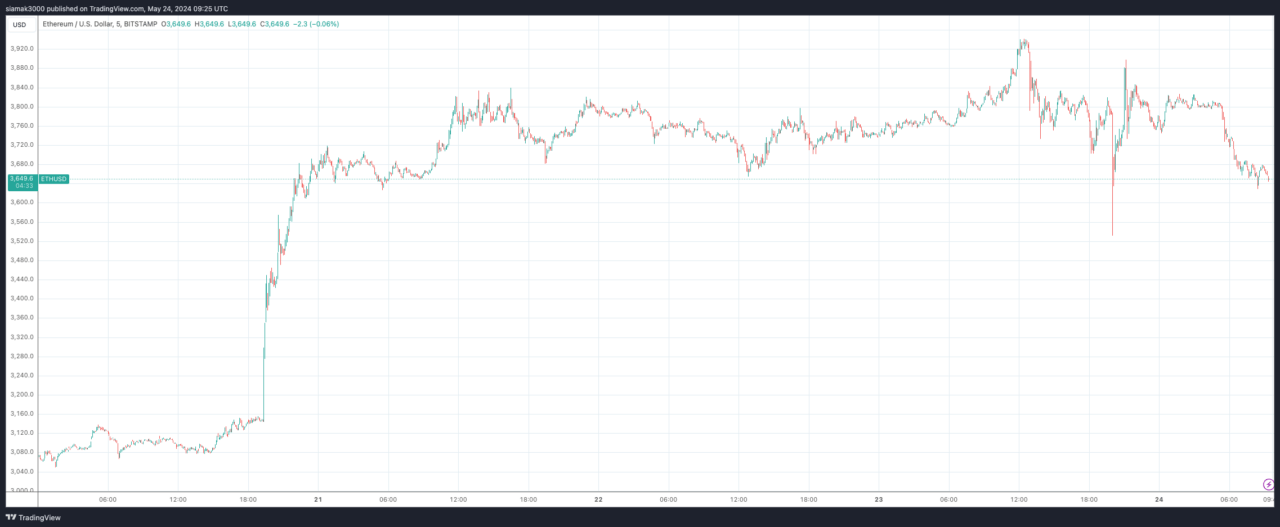

As I analyze the current market situation (at 9:23 a.m. UTC on May 24), ETH is priced approximately at $3,655, representing a decrease of 4.6% over the previous 24 hours.

As a cryptocurrency analyst, I’ve observed that the approval of 19b-4 filings for spot Ether ETFs by the SEC didn’t result in an immediate price surge for Ether. The market had already factored in this possibility, as many investors were anticipating that these ETFs would begin trading this week or next. However, when it became clear that the launch could still be several months in the future, a sense of disappointment set in among some crypto enthusiasts, leading to selling pressure on the Ether market.

Primary question:

Why is the market not moving for #Ethereum?

Well, the approval was already priced in due to the strong 20% move.

It’s a waiting time until the listing takes place, and then the inflow will provide whether there’s a strong continuation upwards.

— Michaël van de Poppe (@CryptoMichNL) May 24, 2024

The green light given to US-traded Ether Exchange Traded Funds (ETFs) marks another encouraging advancement for the burgeoning crypto sector, which has been making great strides towards integration into traditional finance. This development follows closely on the heels of a groundbreaking bill passed in the U.S. House of Representatives aimed at providing regulatory certainty for cryptocurrencies, as well as the UK’s approval of listed digital asset products. Taken together, these events underscore the increasing recognition and legitimacy of cryptocurrencies within the financial landscape.

As a researcher studying the digital asset market, I’ve come across an intriguing development from CCData, a prominent market data provider for institutional investors. In a recent blog post, they discussed the implications of a significant decision made by the Securities and Exchange Commission (SEC). The SEC has decided to bar staking in the initial Ethereum-based exchange-traded funds (ETFs), meaning entities managing potential ETH ETFs will forego the annual yield from Ethereum staking.

In spite of Ethereum experiencing reduced trading volume on exchanges and lower on-chain activity compared to other cryptocurrencies and Layer 2 solutions lately, the approval of Ethereum-backed Spot ETFs holds the potential to rejuvenate the Ethereum ecosystem. According to CCData’s analysis, heightened network usage and Ethereum’s deflationary monetary policy may generate favorable supply conditions and contribute positively to Ethereum’s price movement.

The CCData Research team conducted an analysis on the possible inflows for Ethereum Exchange-Traded Funds (ETFs), estimating substantial investment if they draw some of the funds currently in Bitcoin ETFs. According to their regression analysis, Ethereum’s price could experience a 30% rise over the next hundred days with considerable fund transfer. However, the team cautions that Ethereum might encounter temporary challenges due to outflows from the Grayscale Ethereum Trust, as observed following the approval of Bitcoin ETFs.

The CCData Research team delved into distinct elements influencing the direction of ETH ETF trading volumes and prices. These elements encompassed order book liquidity, Ethereum’s deflationary mechanism, staked supply, and Grayscale’s tactical oversight. These factors could intensify price fluctuations, alleviate selling pressure, and possibly result in increased inflows and price consistency for Ethereum.

Read More

- Does Oblivion Remastered have mod support?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Elder Scrolls Oblivion: Best Bow Build

- 30 Best Couple/Wife Swap Movies You Need to See

- Elder Scrolls Oblivion: Best Healer Build

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Everything We Know About DOCTOR WHO Season 2

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2024-05-24 12:50