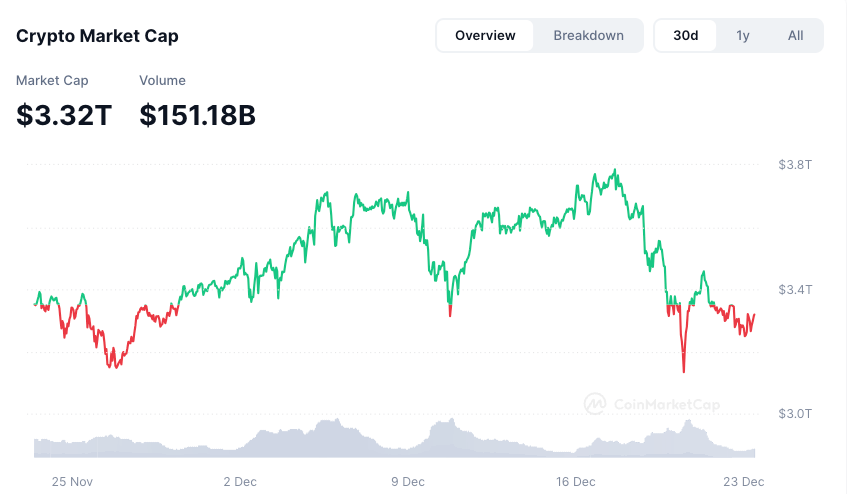

As a seasoned analyst with over two decades of experience in the financial markets, I find myself both intrigued and cautious regarding the current state of the cryptocurrency market. The recent drop in total market capitalization by around $42 billion is certainly noteworthy, particularly given the rapid recovery we’ve witnessed in the last few days.

Over the past day, the overall value of the cryptocurrency market has decreased by approximately $42 billion due to a drop in prices for significant cryptos like Bitcoin, Ether from Ethereum, and XRP. These cryptos have experienced declines ranging from 1% to 2.7%.

Although it dipped, Bitcoin is currently being traded at approximately $96,000, following an increase of over 2.6% since the December low around $92,500 that followed the Federal Reserve’s reduction of interest rates by 25 basis points. However, remarks from Jerome Powell, the Fed chair, hinted at a more aggressive stance, indicating fewer interest rate cuts might be implemented in the upcoming year.

As a researcher, I observed that Powell’s comments significantly influenced investor confidence and led to a downturn in risk assets throughout various markets. Notably, the benchmark index of the stock market, the S&P 500, experienced a steep drop exceeding 3.5%, although it later recuperated somewhat. However, the weekly loss remains at 2.2%.

Although the cryptocurrency market has shown some improvement in recent days, Bitcoin dropped by over 8% for the week, while Ether experienced a 15% decrease in value during the same timeframe. Notable altcoins like Dogecoin, Solana, Ripple, and Cardano also saw losses between 21% and 10% for the past seven days.

As a researcher examining the crypto market, I’ve noticed that recent drawdowns have caused the crypto space to undo its gains made over the past month. This trend seems to have subdued investor enthusiasm and possibly instigated profit-taking among investors who reaped benefits from the market surge post-U.S. elections.

Additionally, as per CoinGlass’s data, approximately $14 billion in bitcoin options are due to expire on Deribit, whereas $1.7 billion will expire on Binance on the same day. Similarly, around $3.8 billion in ETH options are due to expire on Deribit and about $400,000 on Binance by December 27th.

The maximum pain point for bitcoin options — the price at which most options contracts would expire worthless — is currently at $84,000. Ether options’ maximum pain point is at $3,400.

The impending expiration of these choices might lead to considerable market turbulence, as traders may choose to reposition themselves beforehand in response to this event.

It’s possible that the digital currency market could be experiencing a minor dip. Over the weekend, the creator of both Hex and PulseChain, Richard Heart, found himself on Interpol’s wanted list due to allegations of fraud and violence.

Hex and PulseChain founder Richard Heart wanted by Interpol on charges of tax evasion and assault.

— cryptothedoggy (@cryptothedoggy) December 22, 2024

It’s also worth noting that U.S. President-elect Donald Trump has appointed Bo Hines, a former college football player, as the Executive Director of the Presidential Council of Advisers for Digital Assets, which is also known as the “Crypto Council.”

Recently, Donald Trump designated David Sacks, previously the COO of PayPal, as the new AI and Digital Currencies Advisor for the White House. In a TruthSocial post, Trump stated that Sacks would be responsible for shaping the Administration’s policies related to Artificial Intelligence (AI) and Cryptocurrency, two sectors vital to America’s future competitive edge.

In contrast to recent declines, Japanese investment firm Metaplanet made its biggest ever Bitcoin acquisition, purchasing an extra 619.7 Bitcoins in one transaction following a dip below the $100,000 price mark. The deal was worth approximately $60 million at the time when Bitcoin was trading at $96,000 per coin.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-23 18:13