On Tuesday, both the overall value of all cryptocurrencies (total crypto market cap) and Bitcoin (BTC) hit record highs. However, they experienced minor drops afterward. Unfortunately, several alternative coins did not perform well as the general market signals became bearish. This bearishness was primarily driven by Hedera Hashgraph (HBAR), which dropped nearly 14% over the last day.

The Crypto Market Is Stabilizing

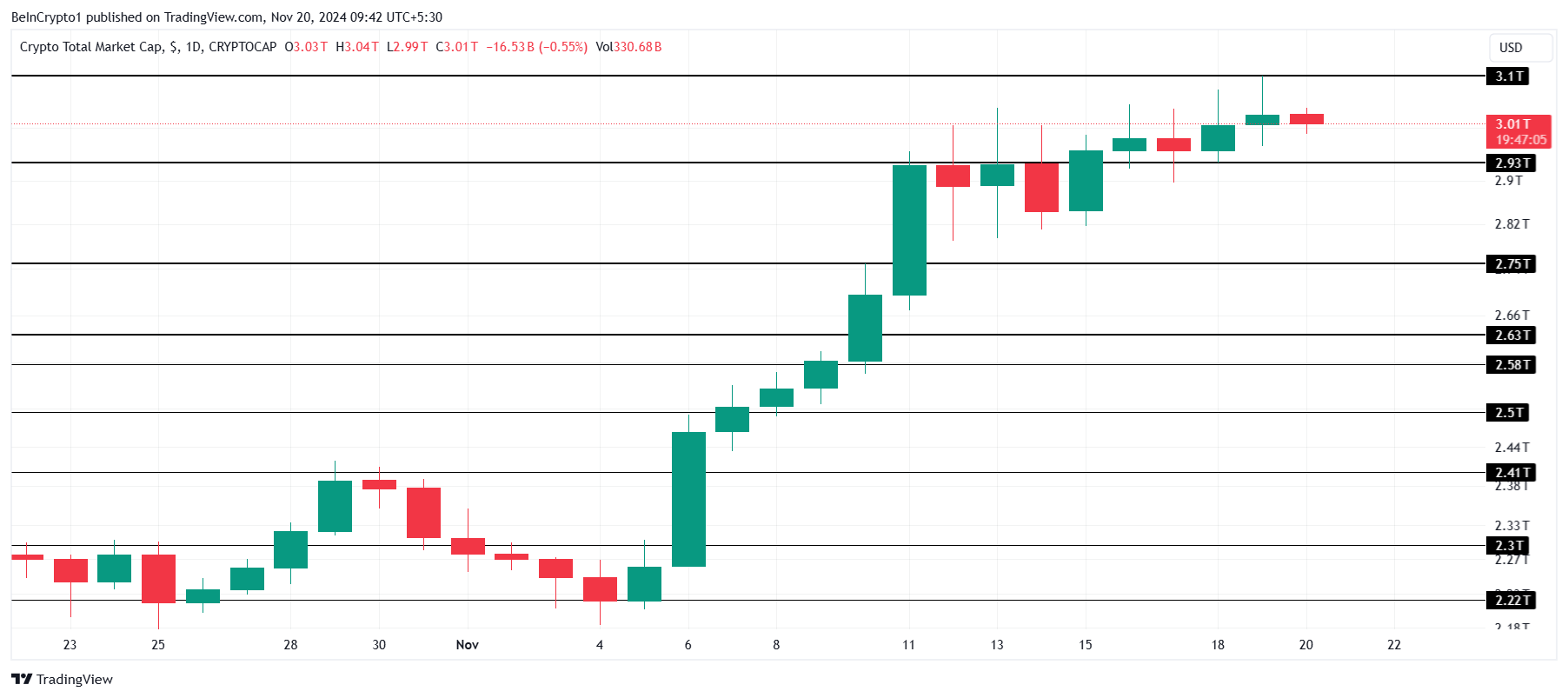

Right now, the combined value of all cryptocurrencies is approximately $3.01 trillion, a slight dip from its highest point of $3.10 trillion hit on Tuesday. Although there are indications that the momentum might be easing off, the market continues to show strength, holding close to record-breaking levels.

Total value remains stable above the crucial support point of approximately 2.93 trillion dollars, suggesting possible ongoing expansion. As long as market circumstances stay advantageous and major drops are avoided, the crypto sector might maintain its positive trend, fostering optimism among investors.

If we fall below the $2.93 trillion mark, it might lead to a decrease towards $2.75 trillion. This point represents the next significant line of defense. Any further declines could potentially threaten the ongoing market recovery efforts.

Bitcoin Formed a New ATH

On Tuesday, Bitcoin hit an unprecedented peak of $93,912, but later softened slightly to its current price of $92,186. Known as the “crypto king,” it’s still hanging in a crucial area, demonstrating persistent investor enthusiasm, even amidst minor shifts.

Bitcoin currently stays strong over the significant support threshold of approximately $89,800, working towards preserving its balance. Dropping beneath this mark might initiate declines, instigating increased vigilance among investors who wish to protect their profits from the latest surge.

As a crypto investor, if Bitcoin were to break its support at $89,800, I foresee a possible drop to around $85,000. This potential decline might lead to some significant delays in recovery. Such a dip could stir up selling pressure among investors who may choose to cash out their profits, thereby adding more challenges to Bitcoin’s continued upward trend.

Hedera Hashgraph Loses a Chunk of Its Profits

In just two weeks, HBAR’s growth has been exceptional, rising more than double (239%) and catching everyone’s attention this month. Yet, a 24-hour drop has slowed its surge, causing worry among investors due to shrinking profits during increased volatility in the digital currency market.

Yesterday, I observed a 13.8% decline in the value of HBAR, which wiped out a substantial chunk of its previous growth. Currently, this altcoin is being traded at $0.123. The level at which it’s trading now could potentially shape its short-term direction. If it manages to establish a solid support base, it might stabilize; however, if selling pressure persists, we could see further downward movement.

Should the downward trend continue, Harmon Coin (HBAR) might reach its next significant support level at $0.099. Dropping to this point could potentially postpone recovery attempts, making it difficult for HBAR to maintain the momentum it gained earlier and temporarily reducing investor enthusiasm.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-11-20 08:20