I bought stock in Starbucks (SBUX), a company I really like, back in June 2020. However, over the last five years, it hasn’t performed as well as the overall stock market (the S&P 500), so I’m now thinking about whether it still makes sense to keep it in my investment portfolio.

I invested in Starbucks hoping for both growth and regular income. I was particularly hopeful that their business in China would recover quickly after the pandemic and significantly boost profits, but that hasn’t materialized. Now that Starbucks is considering options for its China operations, I’m admitting that my investment didn’t work out as planned and I’m selling my stock.

Starbucks has consistently delivered strong income for me as an investor. They’ve raised their dividend payout every year I’ve owned the stock – a streak that now lasts 14 years. Currently, the dividend yield is almost 3%, which is near its all-time high.

I’m happy with the dividends I receive from Starbucks stock, but the company’s growth has been slow. Looking at the period right before the pandemic, Starbucks’ revenue has grown at a single-digit annual rate, which usually isn’t enough for the stock to significantly outperform the market. This leads me to wonder if I can find another dividend stock with better growth potential. Luckily, there are a few possibilities.

1. Academy Sports & Outdoors

Although Academy Sports (ASO) currently has a relatively small footprint with just 300 stores, the company believes it has the potential to grow its revenue faster than Starbucks in the future.

Academy Sports is primarily growing its sales by opening new stores. They plan to open up to 25 stores this year, and had already opened eight by the end of the second quarter of 2025. Looking ahead, the company aims to have around 150 new stores open by the end of 2028.

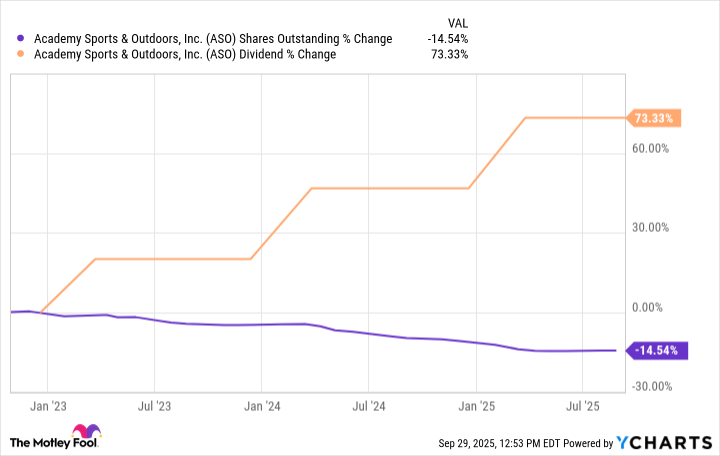

The recent store openings position Academy Sports for strong growth in the years ahead, potentially achieving double-digit increases. The company also consistently returns value to its investors by repurchasing its own stock and steadily increasing its dividend payments each quarter.

Currently, Academy Sports’ 1% dividend yield isn’t very appealing to investors seeking immediate income. However, long-term investors are optimistic that the company’s growth strategy will lead to increased profits and, eventually, a more substantial dividend payout.

2. Arcos Dorados

Arcos Dorados is the biggest independent owner and operator of McDonald’s restaurants in Latin America and the Caribbean. They have the rights to the McDonald’s brand in 21 countries throughout the region and operate over 2,400 locations, both directly and through sub-franchisees.

Arcos Dorados is actually growing much faster than its reported numbers suggest. While the company reported 3% revenue growth for the second quarter of 2025, this figure doesn’t tell the whole story. When accounting for changes in currency exchange rates, revenue actually increased by a strong 15%. This growth comes from both existing restaurants performing better and the addition of new locations.

Arcos Dorados stock currently offers a better income stream than Starbucks, with a dividend yield of 3.5%. Importantly, Arcos Dorados doesn’t pay out a large percentage of its profits as dividends, which suggests it has the potential to increase those payments – and grow its stock value – in the future.

As a portfolio manager, I see a key strength in Arcos Dorados being its real estate holdings. Roughly a third of their restaurants are operated by sub-franchisees, but importantly, Arcos Dorados directly owns the land and buildings for almost 500 locations. This allows them to generate rental income from their franchisees, creating a revenue stream that many other restaurant companies simply don’t have. I believe this real estate component makes them a potentially more stable and attractive investment.

3. Stick with Starbucks?

Throughout my time as an equity researcher, I’ve developed a rule: I never sell a stock without careful consideration. Right now, I’m evaluating whether to sell my Starbucks shares and reinvest in a faster-growing income-generating stock, but it’s still just an evaluation. Honestly, I still see compelling reasons to hold onto Starbucks, so a decision hasn’t been made.

It’s been a little over a year since Brian Niccol became Starbucks’ CEO, and he’s working to make the brand appealing again. A key part of his plan is to create a more welcoming and comfortable atmosphere in stores. To do this, Starbucks recently announced it will be closing hundreds of underperforming locations that don’t align with this new vision.

Niccol’s strategy will cost about $1 billion. However, with lowered expectations, Starbucks is poised to recover as tough choices begin to yield positive results.

I currently think Starbucks stock is unlikely to fall significantly because it remains a popular brand, and its leadership is strong. I’m watching Academy Sports and Arcos Dorados as possible replacements for Starbucks in my investments, but I don’t need to make a change right away, so I’m holding onto my Starbucks stock for now.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-04 04:04